Ethereum’s daily futures trading volume exceeded Bitcoin for the first time on July 10th. This is a groundbreaking development that matches the price of assets testing the $3,000 level.

The technical flips in the derivatives market show potential changes in trader sentiment and capital allocation, giving credit to the narrative of changing market structure.

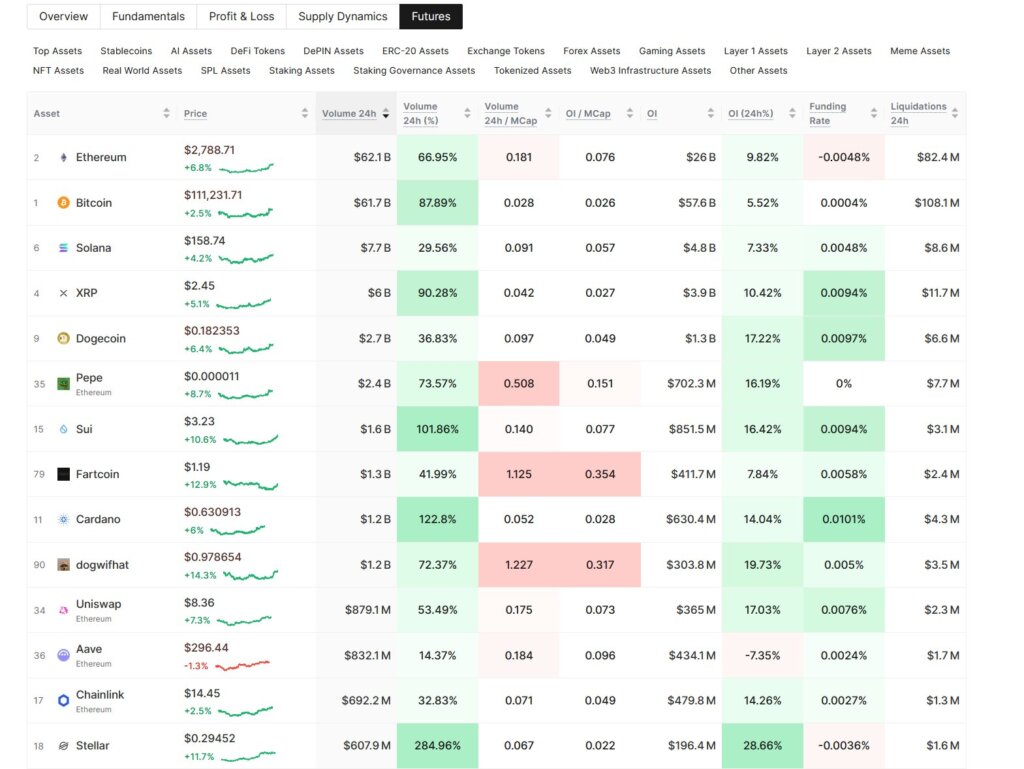

Data from GlassNode shows that 24-hour Ethereum futures volume reached $62.1 billion, surpassing Bitcoin’s $61.7 billion. The ratio of BTC futures volume to ETH has skyrocketed past parity, indicating that traders are for the first time guessing and hedging on Ethereum on a scale comparable to Bitcoin.

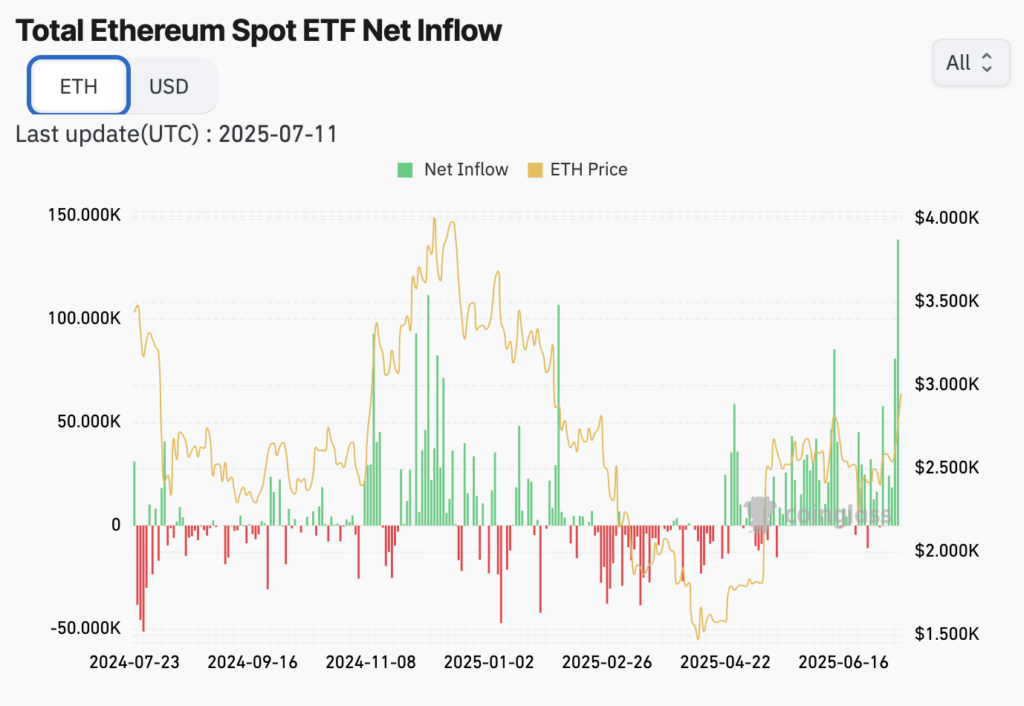

The US Spot Ethereum ETF, which offers a more traditional route for exposure to ETH, is partially fueled. I was able to see it on July 10th 138,000 ETH record-breaking influx, $381 million on the second largest dollar condition.

But there are important distinctions between them. Currently approved ETFs do not allow staking of underlying assets. This means investors missed the yields generated through network verification, the core components of Ethereum’s economic model, and the ability to position it as an asset with potential yields.

Up to this point, the SEC has delayed its decision to allow staking within these products. However, the Solanas Staking ETF is currently live, indicating that the tide is changing.

Beyond the impact of ETFs, there is an increase in other forms of institutional adoption. The move by several Corporate Treasury Departments to acquire Ethereum shows serious belief in the long-term value of assets. This month, blockchain technology company BTCS Inc. announced its strategy to raise $100 million for the acquisition of strategic Ethereum..

In a statement reported by NASDAQ, BTCS CEO Charles Allen framed Pivot as evidence of his belief that Ethereum “has significant growth potential and is central to future digital financial infrastructure” and as a prediction of its critical assessment. This trend supports analytics from companies such as Grayscale. This argues that Ethereum’s vast developer community and network effectiveness is durable despite competition with the new blockchain.

The combination of strong derivatives markets and new institutional influx promotes the narrative of revolving trade. This could lead to capital flowing from Bitcoin to Ethereum, causing other digital assets or broader market gatherings for the ALT season.

The current market power appears to follow this historical pattern, leading to an increase in speculation that Ethereum’s strength could lift the wider altcoin market. From flips in the futures market and price surges to launching new financial products, the culmination of these events marks a clear revival of Ethereum’s position within the current digital asset economy.