In the historic milestone of the cryptocurrency market, all Bitcoin (BTC) holders are achieving profitability (or at least broken).

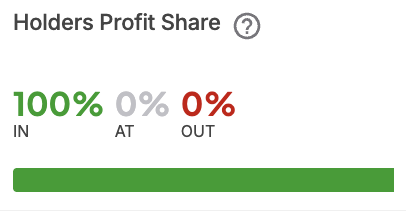

Specifically, the latest on-chain data from the Crypto On-Chain Analytics platform Intotheblock It makes clear that 100% of Bitcoin holders are either profitable.

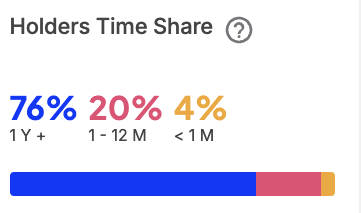

This data further reveals the holder-based composition of Bitcoin, showing that 76% of wallets remained in position for more than a year, 20% of owners for 1-12 months and just 4% representing recent market participants.

This indicates that the majority of current holders have taken positions at low prices, particularly those accumulating Bitcoin below the $50,000 level between 2023 and early 2024.

Bitcoin price analysis

As of press time, Bitcoin was trading at $117,688, an increase of 1.55% over the past 24 hours. Notably, the flagship cryptocurrency touched on an all-time high of $118,661 early in the day, temporarily claiming the position of the global fifth largest asset, leaving Amazon (NASDAQ: AMZN), Silver and Google (NASDAQ: GOOG) in the dust.

Bitcoin averaged 30-day daily trading volume at around $61.666 billion, significantly outpacing traditional stock markets. In the context, Finbold’s analysis showed that this volume was 88.75% higher than Nvidia (NASDAQ: NVDA) over the same period.

Bitcoin is currently located for its third consecutive weekly profit, so the assets remain bullish towards the weekend, supported by robust trading volumes and ongoing institutional participation.

Special images via ShutterStock.