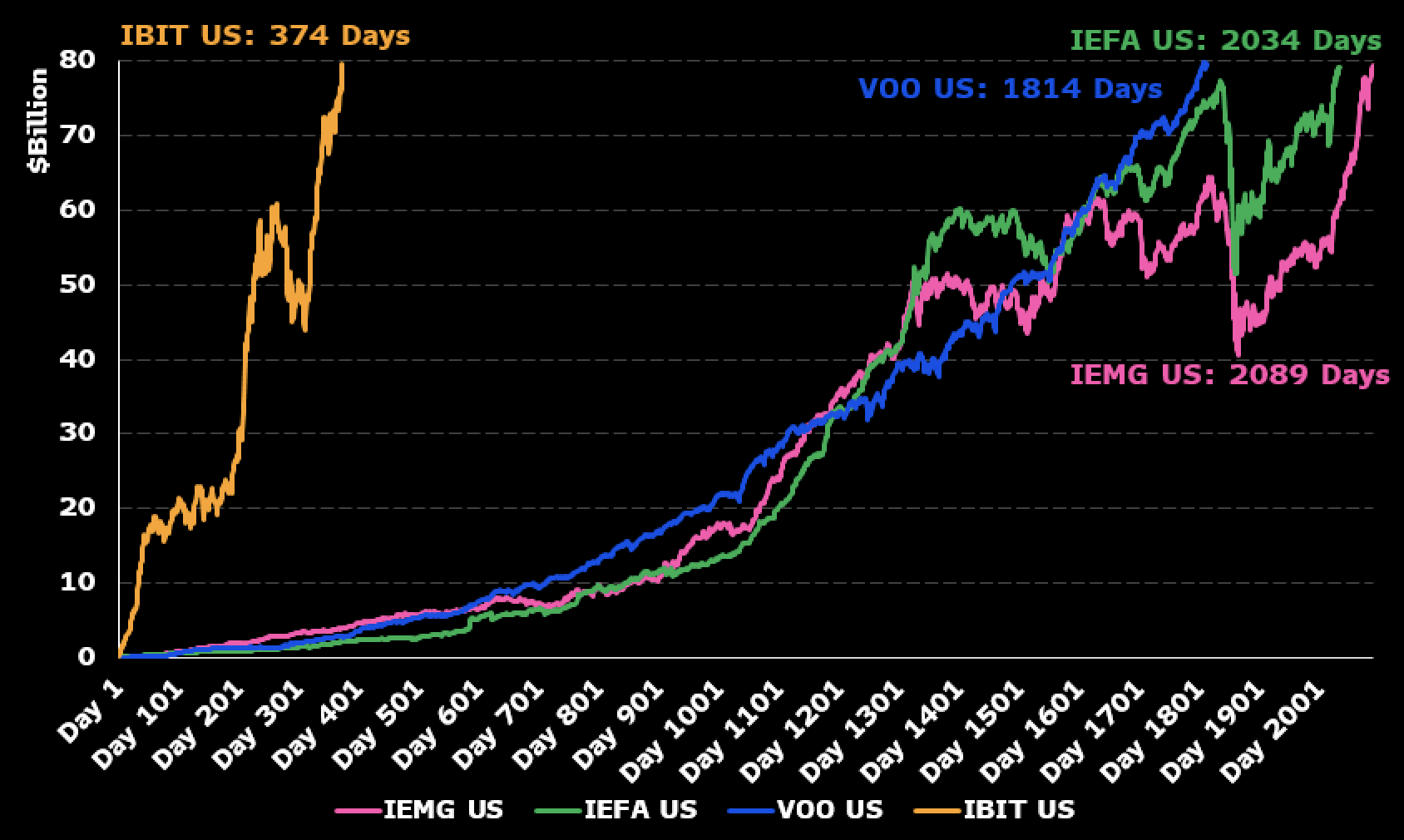

BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest growing ETF to date, officially gaining $80 billion in managed assets just 374 days after its launch. This milestone is a new record for the ETF industry, says Bloomberg’s Eric Balknas.

To put it into view, it took Vanguard’s $VOO to reach the same level, almost five times more than 1,814 days. Not only did ibit beat that pace, it also completely rewritten the script. As of July 10th, IBIT’s cumulative net inflow had a net worth of $81.1 billion, four times the closest competitor in the Bitcoin ETF space.

Also, the daily flow gives us good photos of what’s going on. ibit made $448.49 million in just one day, far ahead of all other Spot Bitcoin ETFs. Fidelity’s FBTC has a daily influx of $324.34 million, with Ark 21Shares’ ARKB bringing $268.7 million.

Looking at the big picture, all US-registered spot Bitcoin ETFs have reached $140 billion for the first time. ibit is the only one that accounts for more than half of that number.

The big list includes funds from Fidelity ($235 billion), Grayscale’s secondary BTC Trust ($5.13 billion), Bitwise ($4.62 billion), and Vaneck ($1.8 billion).

IBIT is surged thanks to a mix of solid Bitcoin price performance and a steady inflow from both institutional and retail investors. It’s not just the product. This is a sign of where you’re big money to make your Bitcoin bets more comfortable.

From $80 billion over a year since its launch, the presence of BlackRock’s Bitcoin appears to pay for all the hopes that were there before January 2024. The new $118,000 all-time high reflects that.