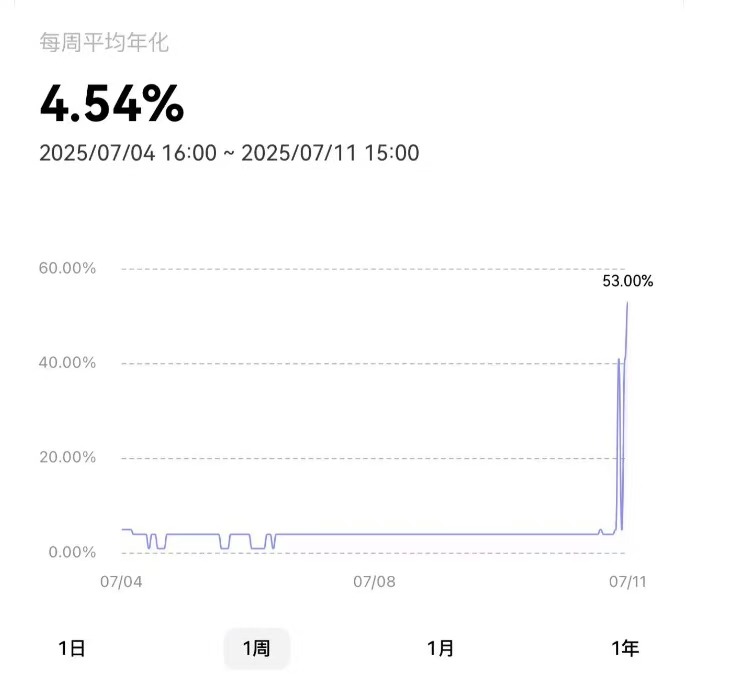

Interest rates on OKX’s USDT’s “Simple Aren” flexible savings products surged from 5% to 53% during midday Asian trading hours on Friday as Bitcoin and Crypto Market first tasted volatility in the third quarter of 2025.

Market analysts say the spike is one of the short-term price highs for products that support the crop in recent months. Historically, similar jumps have coincided with the rise in Bitcoin prices.

OKX USDT Simple earns flexible fees. Source: OKX

On November 10, 2024, Bitcoin opened at $76,677, resulting in savings products reaching 44% rates, while coins reached $90,000 in just a few days. Currently, Bitcoin trading is $118,500, an increase of 6.5% in the day, making investors seem uncertain about profiting on the possibility of continuing market operations.

Bitcoin prices are short sellers

Over the past 24 hours, more than $1.14 billion short positions have been settled, according to Coinglass data. The liquidation came from the background, with Bitcoin rising above $118,000. The Crypto Fear & Greed Index is 67. In other words, the market is in an excessive state of purchase.

When the largest coin of market capitalization reached $113,000 during trading in the US market, Bitcoin rose to 3,900 coins in exchange.

Miners hold coins unless prices rise to a level that justifies sales, primarily to cover the costs of mining operations. They could also try to realize profits by the end of “US Crypto Week,” where many expect price adjustments to occur.

Cryptoquant’s UTXO data reveals that only 15% of the market, which consists of holders who have purchased Bitcoin in the past month, has fallen from the previous price altitude of 30%. This decline indicates that the current uptrend is under the control of existing owners rather than fresh capital inflows.

SOPR and exchange activities show caution

Bitcoin uses the short-term holder’s output profit ratio (SOPR).

Data from Santiment revealed that the balance fell 21% since June to 315,830 BTC. This trend is deeper than ever over the past five years. Meanwhile, 1.88 million Bitcoins, or 61% of exchange-owned coins, have moved to independent wallets.

Long-term holders are used to placing assets outside the exchange to reduce the likelihood of large-scale divestitures.

In terms of the derivatives market, Open Interest (OI) is up to $4.1177 billion, up 5.67%. Higher OI means attracting more liquidity and attention in the futures market and working together to improve volatility.

GlassNode: More Growing Market Activities

Late Thursday, GlassNode shared the X chart. This marked a $4.4 billion jump in the Bitcoin realisation cap after the price exceeded $113,000. This is a metric that tracks the value of a coin based on the last movement.

Unlike market capitalization, the realised cap reflects actual capital inflows. It only increases if the coin moves at a higher price. The $4.4 billion jump when $BTC beats a new ATH above $112K confirms not only speculative markup, but also the real beliefs behind the move, not just https://t.co/2ckvmgtmet pic.twitter.com/xtdarvgcdh.

– GlassNode (@GlassNode) July 10, 2025

According to the market analysis platform, CAP only increases when the coin changes hands at a higher price due to actual capital inflows rather than speculative valuations.

The market value to realised value (MVRV) ratio of Bitcoin is a chart comparison of market capitalization and realised cap, which is 2.2. In previous market tops in March and December 2024, the MVRV ratio exceeded 2.7. Looking at the two numbers, Market Watchers believe that the coin may not have reached its peak of execution yet.

Market analyst Axel Adler Jr. explained that once the MVRV reaches 2.75, the inflection point of sales occurs.