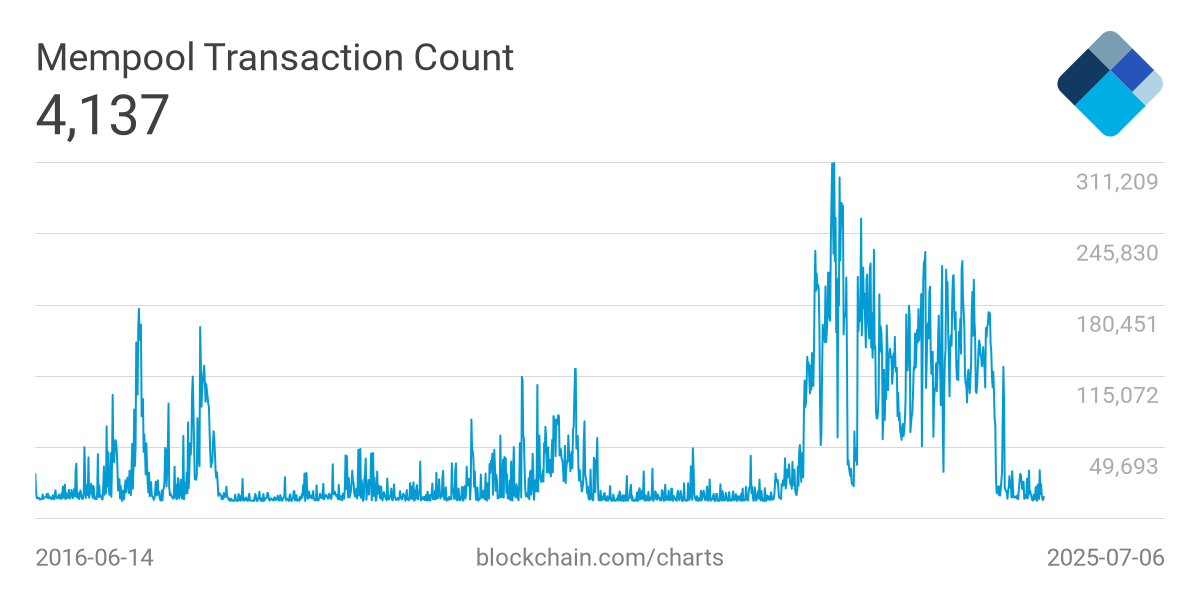

Bitcoin’s memory activity has hit an all-time low, miners’ fee revenues have fallen, and some people in the crypto community have warned about the long-term sustainability of the world’s most valuable blockchain.

According to data from BlockChain.com, only thousands of unconfirmed transactions remain in Bitcoin’s memory as of press time. Fee revenues currently account for less than 0.5% of mining income, far below the level seen in previous bull markets.

“Simply put, almost all of the actual users of Bitcoin have left, too, at the highest price ever,” wrote Joel Valenzuela, Dash’s business development leader, in the X-Post. “We are facing a major crisis. The Bitcoin network has gone bankrupt, and there has been a huge change, and assets become fully detained assets run by governments and agencies.”

BTC pending transactions

Mempool – a queue of pending Bitcoin transactions – acts as a buffer when transaction demand exceeds block capacity. Users attach fees to encourage miners to include transactions in the next block. So does prices when activities surge. But once Mempool becomes clear, Blockspace competition disappears, and miners’ incomes are also from fees.

Miners face a decline in revenue

When Mempool is empty, the miner is already feeling the squeeze. Ethan Bela, chief operating officer of Bitcoin mining infrastructure provider Luxor Technologies, told Defiant that Bitcoin’s long-term security model depends on either price growth or sustainable price viewing.

“We believe that the ongoing investment in infrastructure and hashrate production is a key component of Bitcoin’s security,” Bella said, adding, “It is important that Bitcoin prices rise and trading fees rise as block rewards decrease…”

“So, low trading fees are not a source of concern in the short term, but they are really important in the medium to long term, and miners need to encourage more projects to consume block space and trade in L1,” Vera explained.

Others point to changes in patterns in both user behavior and protocol use. For example, as Doggfather, CEO of Doggfather Analytics, as explained in the Defiant commentary, retail investors “are investing in ETFs and similar indirect vehicles because they don’t exist yet or have not come at all during this cycle (such as notes exchanged by other laws).

Network security is at risk

Another factor behind Mempool’s emptiness is the lack of non-financial trading activities. Doggfather says that ordinal numbers like the BRC-20 and runes and casting of reliable tokens have caused demand for block space to plummet as they are now mostly dormant.

“The memory was busy and the fees were high when there was “hot” ordinances and rune mint. The most famous block was after the fourth half at block 840,000. The fee was 37.626 BTC ($2,402,245) for this one block.

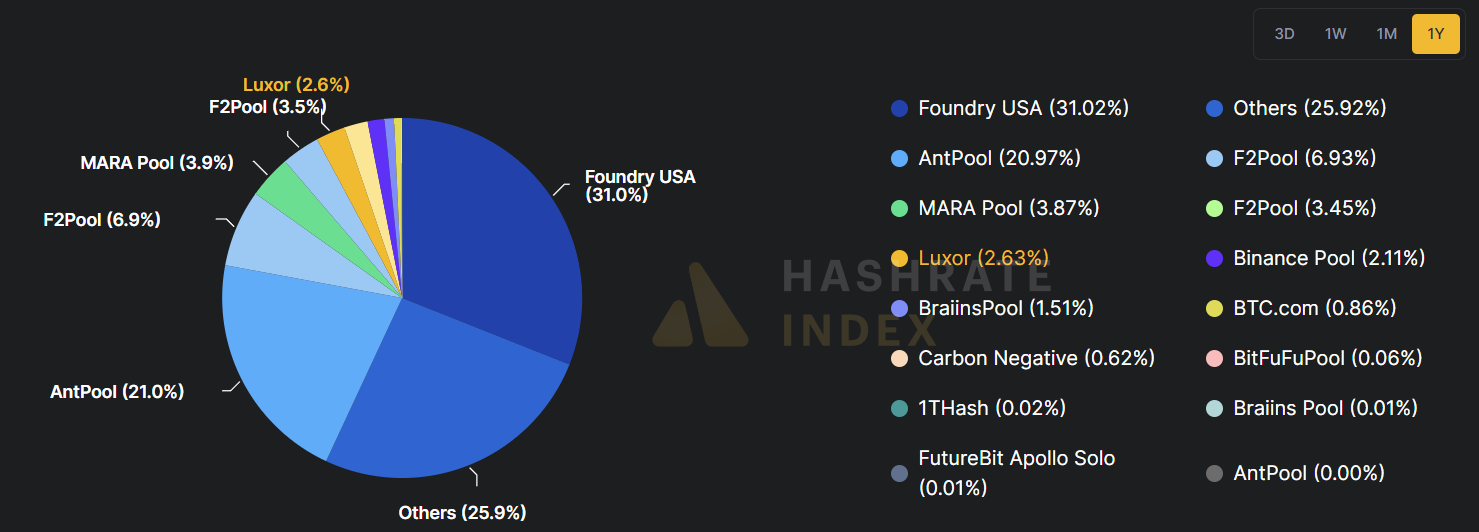

BTC Minor Market Share

But concerns run deeper than use. “Right now, miners’ fee revenues are a pathetic rate at risk, and they put security at risk,” said Nishant Sharma, head of developer ecosystems at Doma Protocol. “What’s worse, Mining is centralized, with the top five pools, including Foundry and Antpool, controlling over 60% of the block.”

Sharma highlighted grassroots mining efforts as a potential way to challenge centralization. He describes a new mining pool model that doesn’t charge participating miners, offers Lightning Network Payouts, and is designed to allow small-scale telecommuters to compete with the dominant pool.