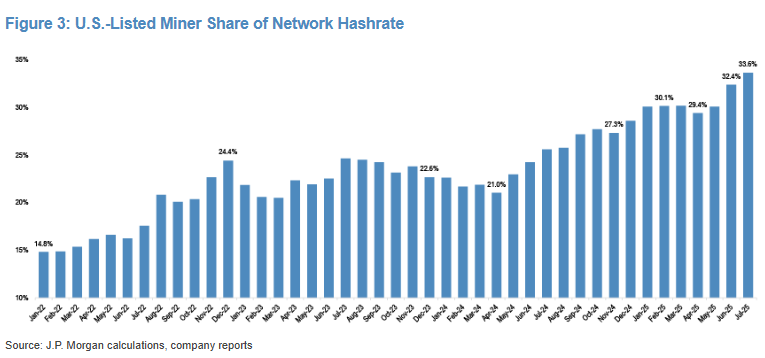

The share of Bitcoin’s total network hashrate, due to miners publicly listed by US miners, has skyrocketed to nearly 34%, according to recent data shared by analysts at Banking Giant Jpmorgan.

In particular, their hashrate advantage has more than doubled since January 2022 (when it reached about 15%).

However, this growth was rather uneven. The global hashrate share continued to fluctuate between 20% and 23%.

They eventually reached a 30% milestone by November, and this growth continues steadily throughout 2025.

“Access to US capital markets is a meaningful differentiator for miners,” said Matthew Sigel, head of digital assets at Vaneck, commenting on the latest milestones.

Last month, JPMorgan analysts revealed that publicly listed miners had won one of the highest quarters ever, earning gross profits worth around $2 billion.

Mara Holdings (formerly Marathon Digital) remains the leading US Bitcoin miner. In last month alone, the company produced 950 BTC. Its total holdings are now approaching above the 50,000 BTC milestone.

US share of global hashrate

According to Hashrate indexthe US currently accounts for a total of 36% of the global hashrate. The estimate is based on mining pool data and ASIC trading flow.

China, once enjoyed absolute control in the Bitcoin mining sector at nearly 75% of the world’s hashrate for cheap coal and hydroelectric power, lost its lead after the government launched a full-scale mining ban in 2021.

Despite the ban, China still accounts for 17% of the world’s hashrate, making it third place.