The data shows that the volume of Ethereum futures has reversed that of Bitcoin. This indicates that strong speculative interest is full of assets.

Ethereum Futures volume shot alongside Price Rally

According to data from Analytics Firm GlassNode, Ethereum was able to beat Bitcoin again in terms of futures trading volume. The volume of trading here is, of course, the volume of trading that a particular asset has seen in various historical central exchanges. In the context of the current topic, the amounts associated with the futures market are of particular interest.

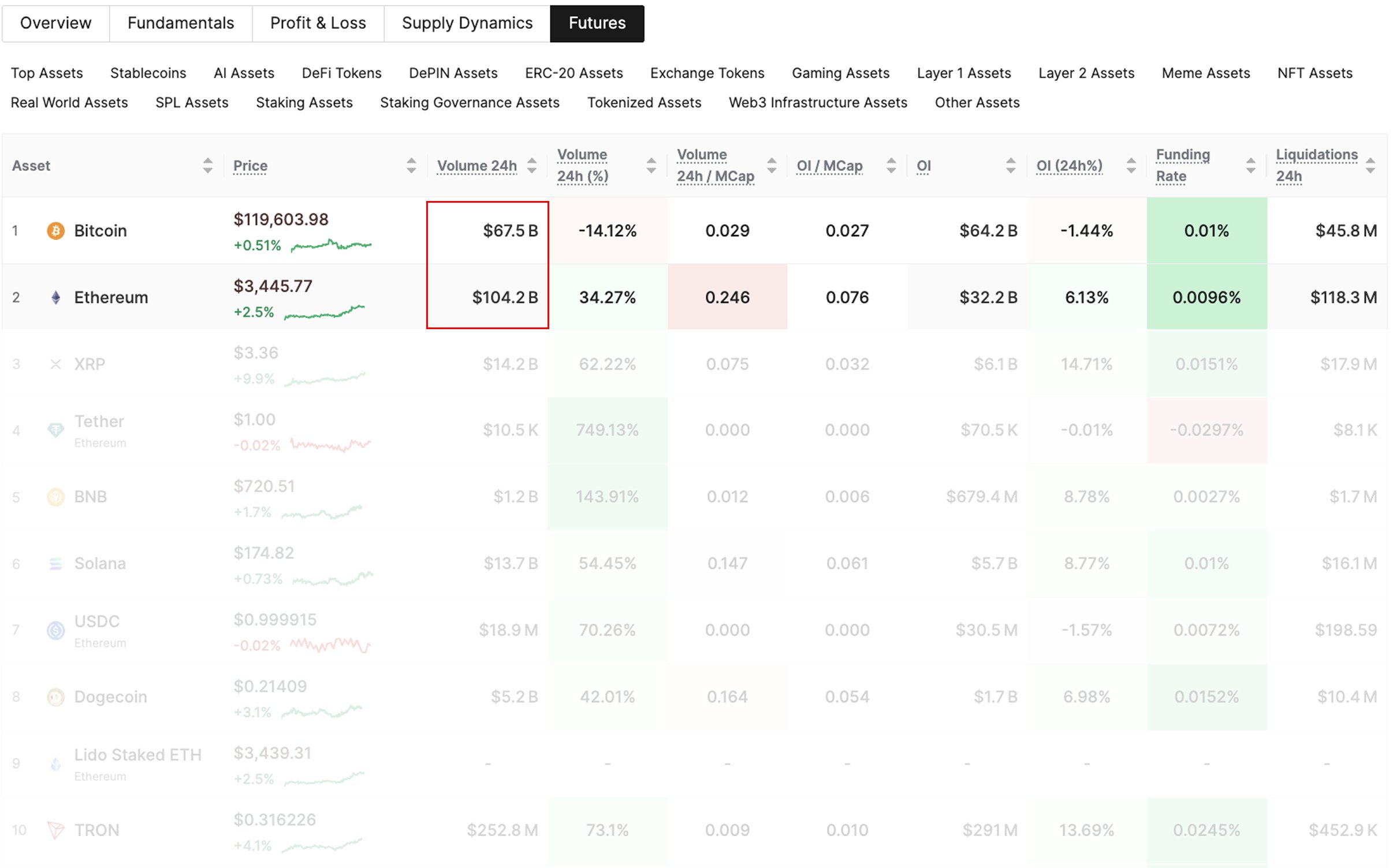

Below is a table showing how Bitcoin and Ethereum were compared when posting GlassNode.

Looks like the ETH futures volume far outweighs the BTC one | Source: Glassnode on X

As visible, Bitcoin has registered a futures trading volume of $67.5 billion. It’s particularly below the $104.2 billion figure that Ethereum witnessed. This is not something that usually happens, as number one cryptocurrency typically observes more speculative demand than ETH and Altcoins.

The same table also provides data for several other futures-related indicators. BTC was sitting at $64.2 billion at the time of post, a metric that tracks the total amount of futures positions currently open on all derivative platforms.

The same indicator for ETH was $32.2 billion. This shows that the original digital assets were still far ahead of the total market positioning. That said, the 24-hour change in metrics was a positive 6.1% for Ethereum, while Bitcoin saw a 1.4% decline

Fresh demand for ETH is accompanied by a strong wave of influx into spot exchange sales funds (ETFs) as their prices are separated from the market.

Interestingly, all this attention has come towards cryptocurrency, but its average funding rate has still not been too positive. Funding rates are metrics that track the amount of regular charges traders in the futures market are exchanging with each other.

If this metric is green, it means that the longest investors are paying a premium to the shortest investors to hold their position. This trend means the existence of bullish mentality among traders.

From the table, it is clear that Ethereum’s funding rate has reached 0.0096%, even after the surge in futures trading volume. This was less than the Bitcoin value of 0.01%. So, new positioning has arisen due to ETH, but investors still don’t seem to be optimistic.

“This setup is bullish. There are no signs of strong speculative interest, rising OI, and overheating yet,” the analytics company said.

ETH Price

At the time of writing, Ethereum traded around $3,600, up almost 21% last week.

The price of the coin has surged during the past few days | Source: ETHUSDT on TradingView

Dall-E, Glassnode.com featured images, tradingView.com charts

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.