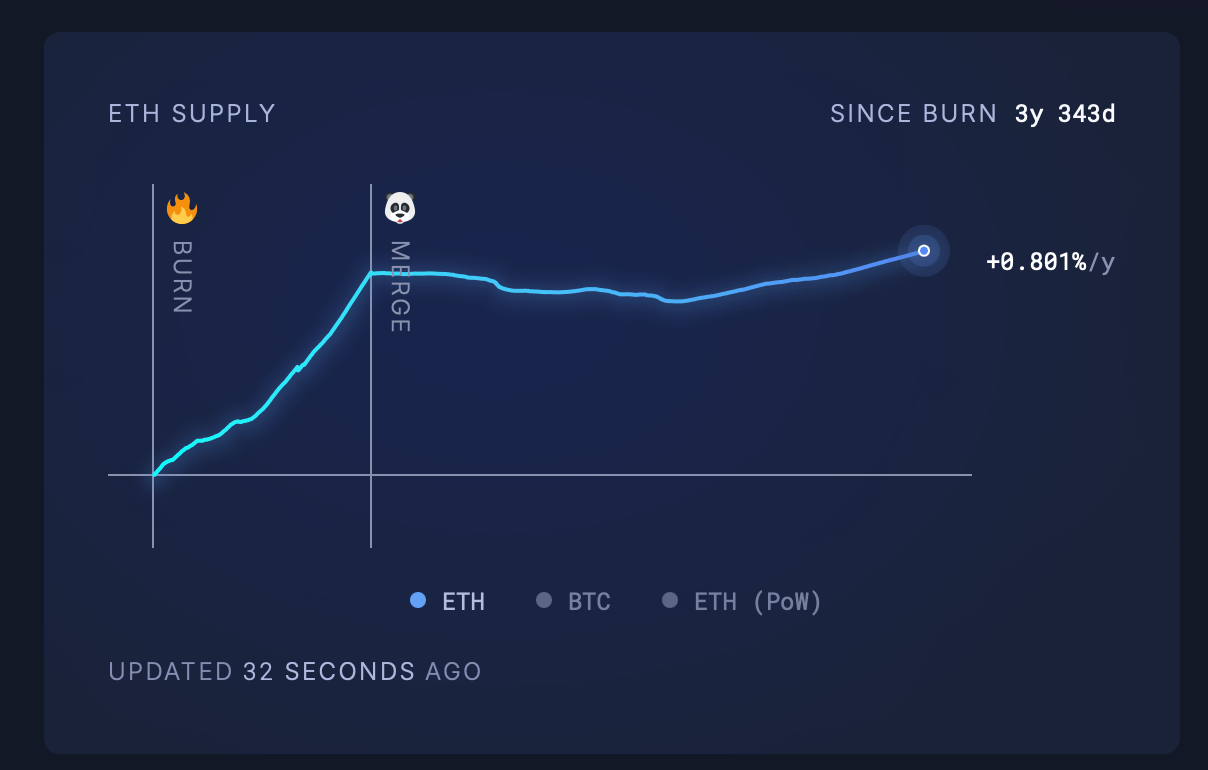

Over a 1,438 days, the Ethereum Network torched over 4.6 million ether and wiped out $13.57 billion worth of digital assets. But even after all that codes have fallen into smoke, the supply of ether continues to grow, with an annual inflation rate of 0.801%.

Ethereum destroyed 4.6 million ETH

It has been almost three years and 11 months since the Ethereum blockchain deployed its London Hard Fork on August 5, 2021 at a block height of 12,965,000. This upgrade introduced key adjustments. Part of the transaction fee, or gas, was burned, and ether was permanently removed from the circulation.

Data drawn from UltrAsound.Money this week reveals that Ethereum Network has torched more than 4.6 million ether since its upgrade. At today’s ETH/USD rate, the burns will be around $13.57 billion at evaporation prices. Over a period of 1,438 days, it rose with a flames of 2.22 ETH per minute, with ETH transactions doing most heavy lifts.

So far, ETH transactions have been burned through 375,959 ETH, and taken over by NFT Marketplace Opensea, sending 230,051.12 ETH to a digital bonfire. Decentralized Exchange (DEX) UNISWAP version 2 torched 227,044.95 ETH alone, but transactions involving Stablecoin Tether (USDT) earned a total of 210,070.05 ETH, rather than moving around the Fiat Pegged Token.

Source: ultrasound.money

Even if 4.6 million ETHs were burned, the network remains inflationary, recording a median issuance rate of 0.801% since the London Hard Fork. According to Santiment data, this is almost a lockstep at Bitcoin’s current rate of 0.809%. Interestingly, Ultrasound.Money’s seven-day figures show that Ethereum’s rate is immersed in 0.723%, with 16,745.66 ETH being newly minted last week.

As the economic model of London Hard Fork and Ethereum continues to evolve, the balance between publication and byrne remains analysts’ focus. Whether or not this tightrope walk will ultimately benefit the etheric assessment, the monetary policy dynamics of the network are clearly different from other areas of the crypto field. Also, the 0.801% rate is technically inflation, which is far from what we’d seen if 3.394% Ethereum stuck to Proof of Work (POW).

In the context, Bitcoin’s current issuance rate is 0.809%, but the average average over the past 1,438 days is 1.476%, which is impossible to achieve since August 5, 2021 than Ethereum’s 0.801%. Meanwhile, over the same 1,438-day span including half of the latest 2024, Bitcoin Miner generates 1,092,150 BTC, which translates to a massive $1299.2 billion of newly issued coins.