The second half of 2025 is only a few weeks, and it is no exaggeration to say that Bitcoin and global financial markets have seen most of this year. From global trade wars to actual conflicts between nations (including serious military action), markets have been affected by a variety of forms of external pressure throughout the year.

As a result, the world has seen a huge amount of correlations and direct relationships between traditional financial and crypto markets. The US stock market and Bitcoin have not been particularly linked in recent months, but they have not denied the existence of relationships between asset classes.

What does traditionally lower volatility mean for BTC?

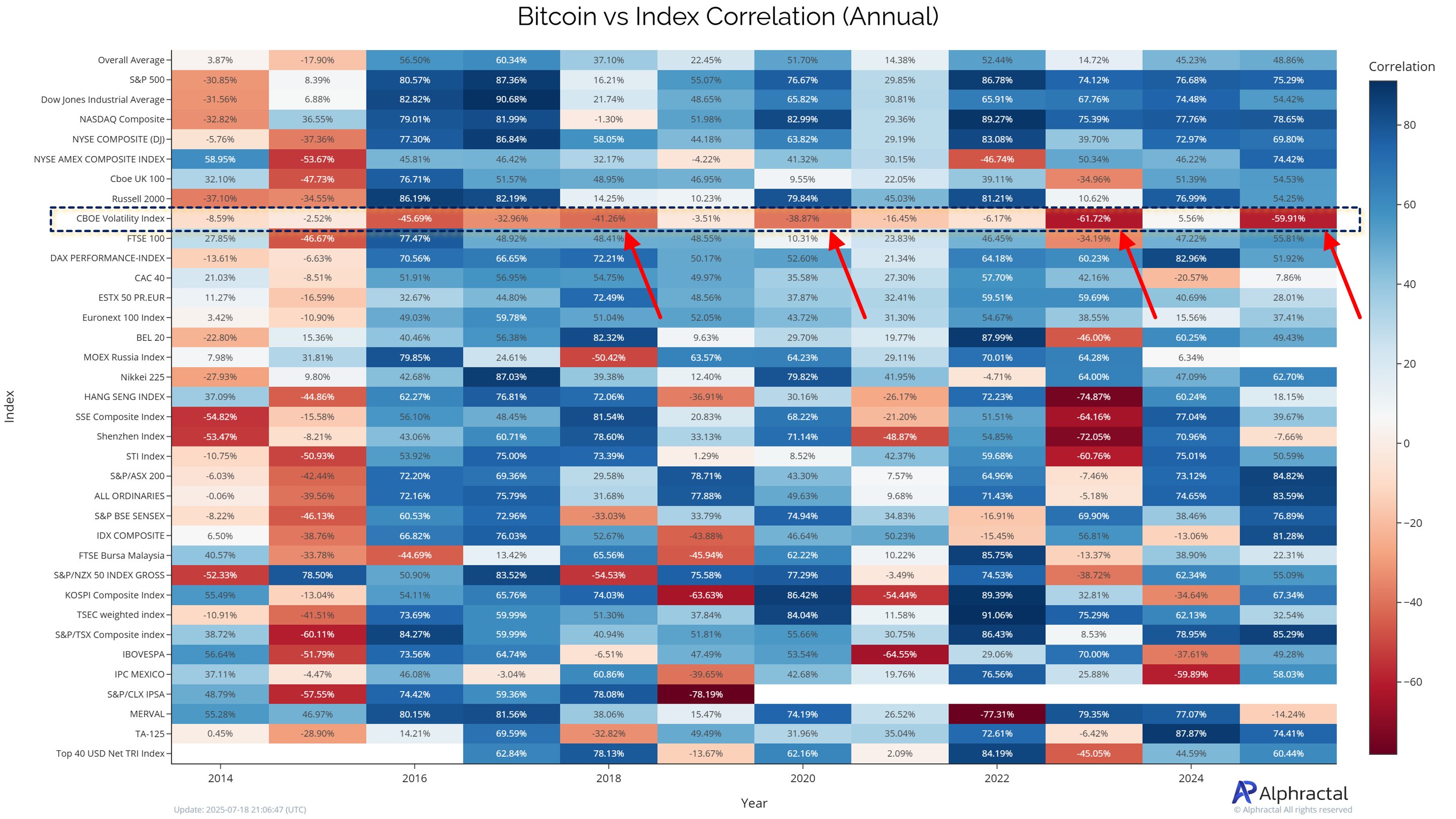

In a new post on social media platform X, Alfractal CEO and founder Joao Wedson delves into the relationship between Bitcoin and the US stock market (through the S&P 500 Index). According to experts at Crypto, the best cryptocurrencies show a low correlation with the CBOE Volatility Index (VIX), which tracks market expectations for S&P 500 Index volatility.

In the context, volatility refers to how quickly prices change in a short period of time, and is often seen as a way of measuring market sentiment. Wedson said the VIX index, also known as the Fear Index, is widely used as a risk thermometer among participants in traditional financial markets.

According to Wedson, Bitcoin prices have historically tended to move more independently and significantly the following year, especially during low VIX, whenever there is a negative correlation with the S&P 500 index. Analysts say this increase in volatility has often resulted in significant price increases in the past.

Wedson said:

In other words, do not waste analysis time on BTC and S&P 500 if the correlation between BTC and BTC and VIX is low or negative. This is usually when BTC is likely to enter the explosion phase.

Source: @joao_wedson on X

On-chain analysts said it’s worth looking at the relationship between Bitcoin and the US stock market when Bix is high. This is because fear in the latter can affect the former behavior. However, Wedson pointed out that with VIX currently declining, the S&P 500 index may not be very useful in analyzing Bitcoin’s next move.

Wedson concluded that the more BTC is dissociated from traditional volatility (VIX), the stronger it becomes as an independent asset. Ultimately, this is a positive indication of Bitcoin prices and could provide fresh opportunities for investors looking to enter the market.

Bitcoin price at a glance

At the time of writing, BTC is valued at around $117,888, as it has not reflected any significant price movements over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.