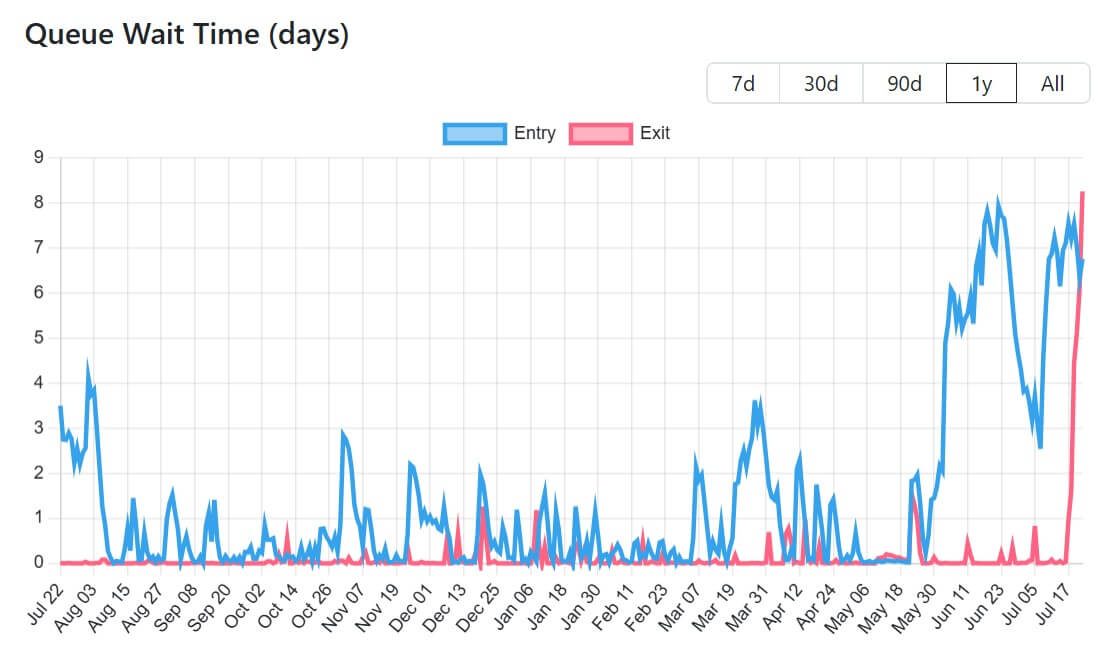

Ethereum Balidators have experienced the longest wait time in more than one year due to increased demand to collide with built-in exit restrictions in the network.

According to data from validatorqueue.com, Validators trying to terminate Ethereum Network will have to wait about 8 days and 6 hours to complete the process, marking the highest delay since early 2023.

At the same time, the queues to join the network as new validators have also skyrocketed, with the longest waiting time of about six days and 10 hours since April 2024.

The widening gap between entry and exit latency reflects more valiters trying to leave the network compared to participants.

As of July 22, the number of ETHs of over 475,700 validators peaked on January 5, 2024 at ETHs above 536,500.

This bottleneck is due to Ethereum’s Validator Churn limit, which limits the number of validators that can enter or close each day. This protection ensures stability of the proof consensus by preventing sudden shifts that can undermine the security of your network.

In particular, Ethereum has previously experienced a similar staking backlog. In January 2024, the validator waited up to six days amid a major withdrawal request from lenders Celsius. However, demand slowed down, and waiting times fell to less than a day by the medium term.

Ethereum staking interest is growing

Despite the growing exit queue, the total volume of ETH continues to rise.

Data from Dune Analytics shows that over 35.5 million ETH are currently trapped in contract staking, accounting for almost a third of Ethereum’s total supply.

This increase coincides with a broader increase in staking activity between institutional and retail investors. According to Staking Rewards data, the influx of pure staining has jumped over the past 30 days alone by 689,000 ETH, valued at around $3 billion.

During this same period, Ethereum prices rose 62.61% in a short time, up from $3,800, at its highest level since December 2024.

However, the value of the digital assets has been raised to just $3,696 at the time of reporting. Encryption data.