Bitcoin’s impulsive bullish leg pauses when it reaches a critical $123,000 level, informing potential profits and distribution.

A fix is expected to move to the $111,000 support zone before the next leg gets high.

Technical Analysis

By Shayan

Daily Charts

After surpassing its previous all-time high at $111K and triggering a notable short filter, BTC surged to set a new ATH at $123,000.

However, the upward momentum temporarily paused at this critical resistance, resulting in a period of lateral integration where the pressure on the seller would likely increase.

A corrective pullback is expected towards the retracement zone of 0.5-0.618 Fibonacci between $107,000 and $111,000 before the next impulsive movement. Until then, a period of integration may be possible.

4-hour chart

In the lower time frame, BTC integration is more pronounced and reflects on continued profit realization. What initially resembles a head-and-shoulder reversal has evolved into a descending wedge, a typically bullish continuation pattern.

Prices continue to trade within this wedge, and are currently supported by a major ascending trendline of around $116,000. This trendline has served as a great support throughout recent gatherings.

As long as the price remains limited between the wedge boundaries and this trend line, the integration range is being revived.

A break below the line could cause a deeper fix to the $111,000 support. Conversely, breakouts above the boundary above the wedge show a continuation of bullish trends, targeting a potential $123,000 ATH.

On-Chain Analysis

By Shayan

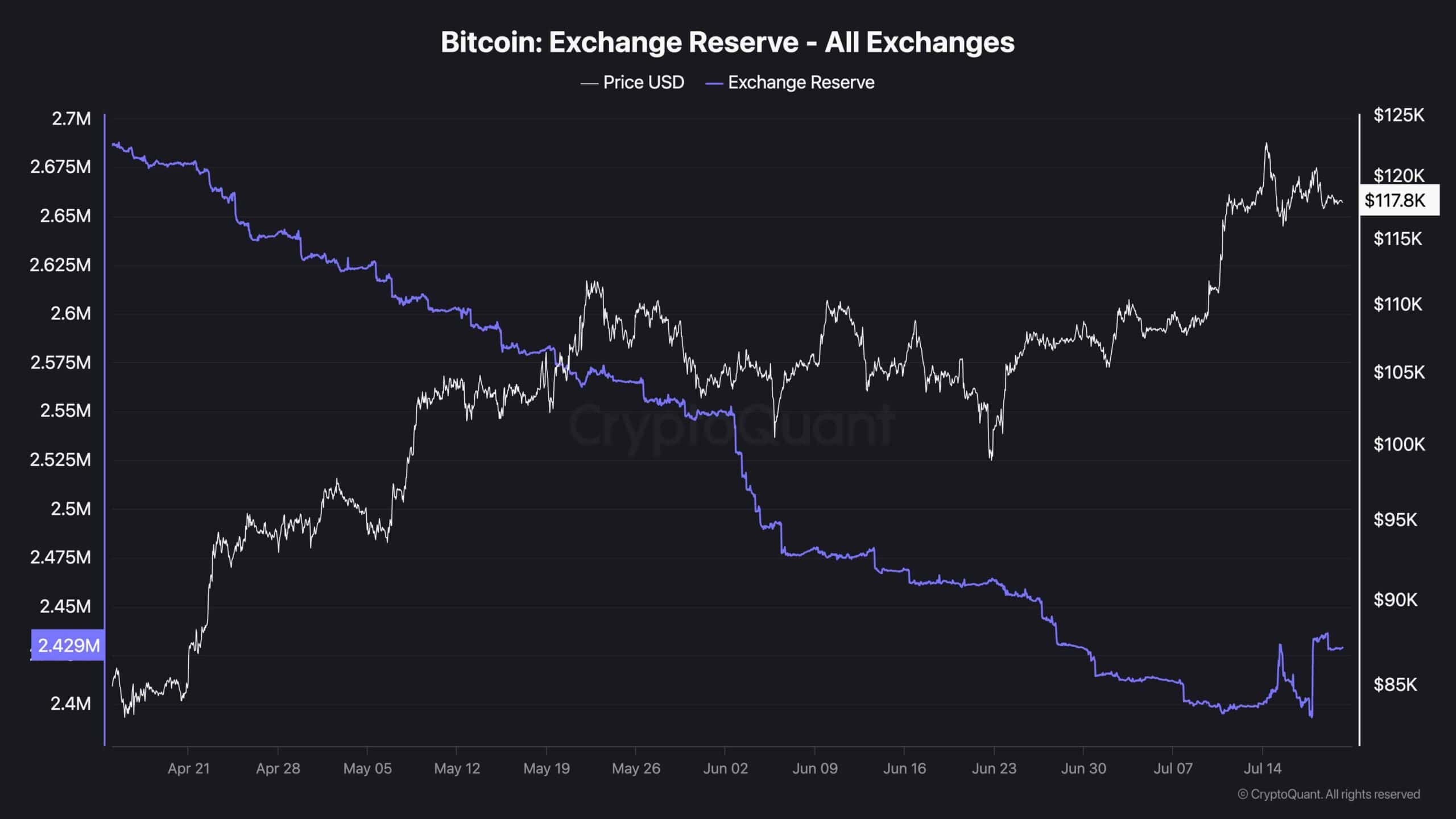

Cryptoquant’s on-chain data shows a noticeable increase in Bitcoin reserves in centralized exchanges, reaching its highest level since June 25th. This sustained inflow reflects the continued profit acquisition and distribution by investors. This is a dynamic that often reduces buy-side pressure and suggests a potential correction stage.

Historically, rising exchange reserves have been associated with the top of the local market as more BTC will be available for potential sales. However, this metric alone should not be considered a critical trigger for an immediate price drop. The liquidity, sentiment and demand dynamics in the broader market are still important.

Essentially, rising replacement reserves could introduce short-term sales pressures, but BTC’s broader market structure remains bullish. Unless macroeconomic or technical conditions change significantly, correction pullbacks still need to be displayed within the context of long-term uptrends.