The Bitcoin trajectory has attracted attention from analysts and investors as the crypto king approaches a vital price level. Market momentum is to build within technical setups that refer to increased liquidity, historical patterns, and potential breakouts. With half the clocks etched and liquidity indicators flashing green, the crypto market may be heading for the most important test in recent memory.

Bitcoin Harving Fuel Predictions

According to documentingBtc, half of the next Bitcoin is 32% complete. The current block is set to 907,251 and half is set to 1,050,000, so only 142,749 blocks remain. This leaves approximately 991 days left until the event. Historically, halving has served as a major catalyst for price surges, reducing block rewards and is often consistent with bullish cycles.

Half progress is more than just a countdown. It plays an important psychological role and encourages holders to remain patient. Long-term investors see this as a roadmap to potential new highs.

Next, cut the progress by half

▓▓▓▓▓▓░░32%

Load…pleaseCurrent block: 907,251

Harving Blocks: 1,050,000

Remaining blocks: 142,749

Remaining days: 991 days– Documentation of “@documentingbtc) on July 26, 2025

Key Retest Zone: Between $110,000 and $117,000

Technical analyst ThescalpingPro highlights the long-term upward wedge pattern on Bitcoin charts, growing Bitcoin’s record high between 2017 and 2021, predicting its future top spot near $300,000. Currently, Bitcoin is approaching a major retest zone of nearly $117,000. This area can cause parabolic gatherings if it is held and confirmed with support.

#bitcoin – This is the biggest retest ever. pic.twitter.com/uivg6hfqox

– Mags (@thescalpingpro) July 26, 2025

Meanwhile, analyst Cryptopatel outlined a potential breakout scenario. With a massive rally ranging from $110,500 to $123,293 and now it’s backwards, Bitcoin bounce could potentially be sent to $150,000 at around $110,000 at the 0.5 Fibonacci level. However, this point below can lead to a sudden revision of less than $100,000. Currently, the $110K level serves as a key line of sand.

Related: Bitcoin domination at the “make or break” level of the Altcoin market

Fluid surge signals a bullish tail

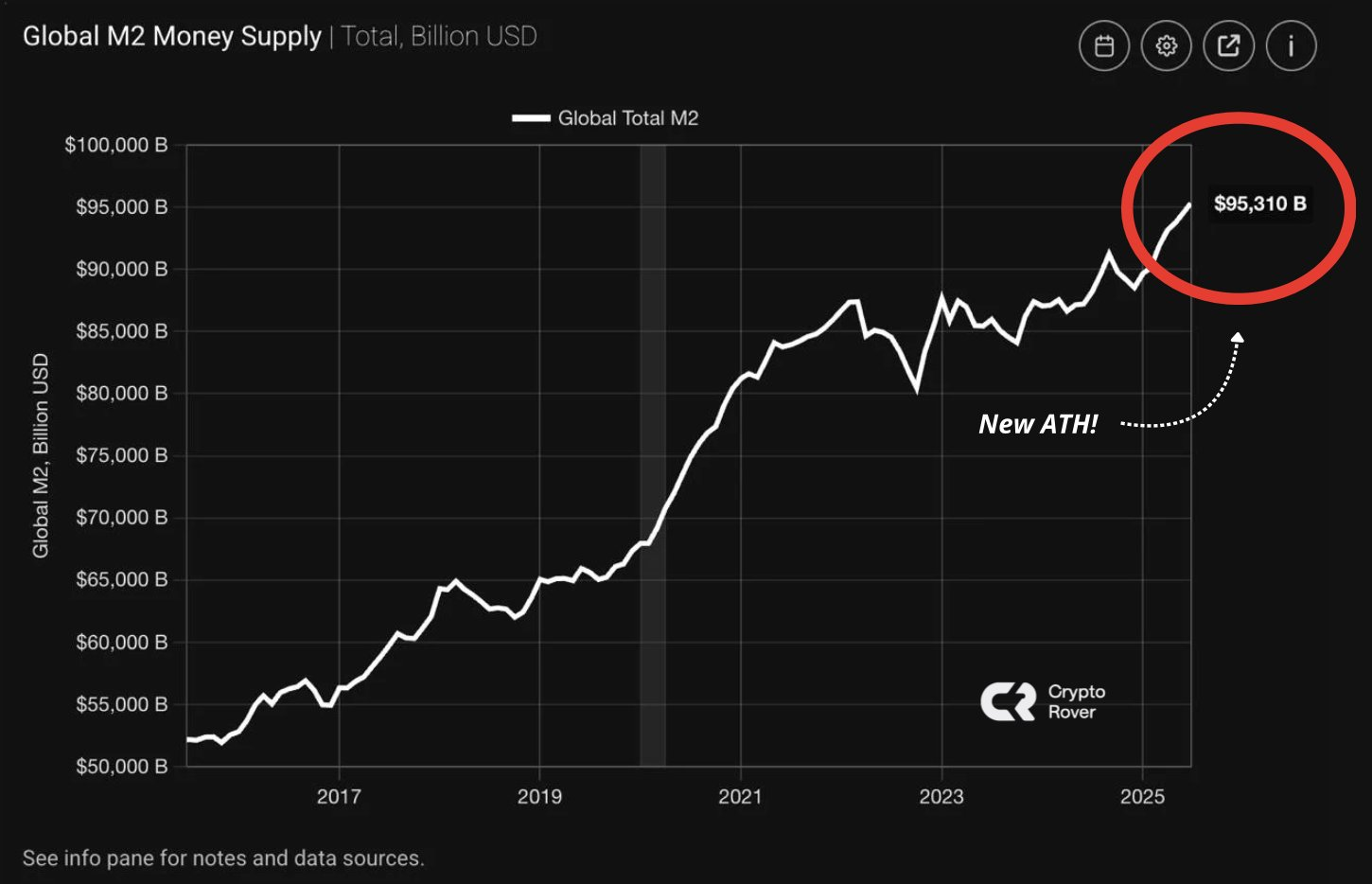

In addition to the bullish story, Crypto Rover refers to a global economic signal, with M2 money supply reaching an all-time high of $95.31 trillion.

sauce: x

More liquidity in the global system often drives capital to risk-on assets like Bitcoin. This trend supports cases of strong upward pressure in the crypto market. As of press time, Bitcoin was trading at $118,079, showing a 1.41% increase over the last 24 hours. Despite slight weekly flooding, its market capitalization remains strong at over $2.34 trillion.

Related: Bitcoin price analysis: BTC faces $120,000 resistance when compression tightens

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.