Bitcoin (BTC) continues to trade within a narrow price range, indicating limited upward movement last week. At the time of writing, the price of major cryptocurrencies was around $117,719, down 1% in the last 24 hours, representing a 4.2% decline, above $123,000, from the recent all-time high.

In this price performance, a recent analysis shared by contributor Borisvest Shed on Cryptoquant’s Quicktake platform highlights the potential for underlying market dynamics affecting the current state of Bitcoin.

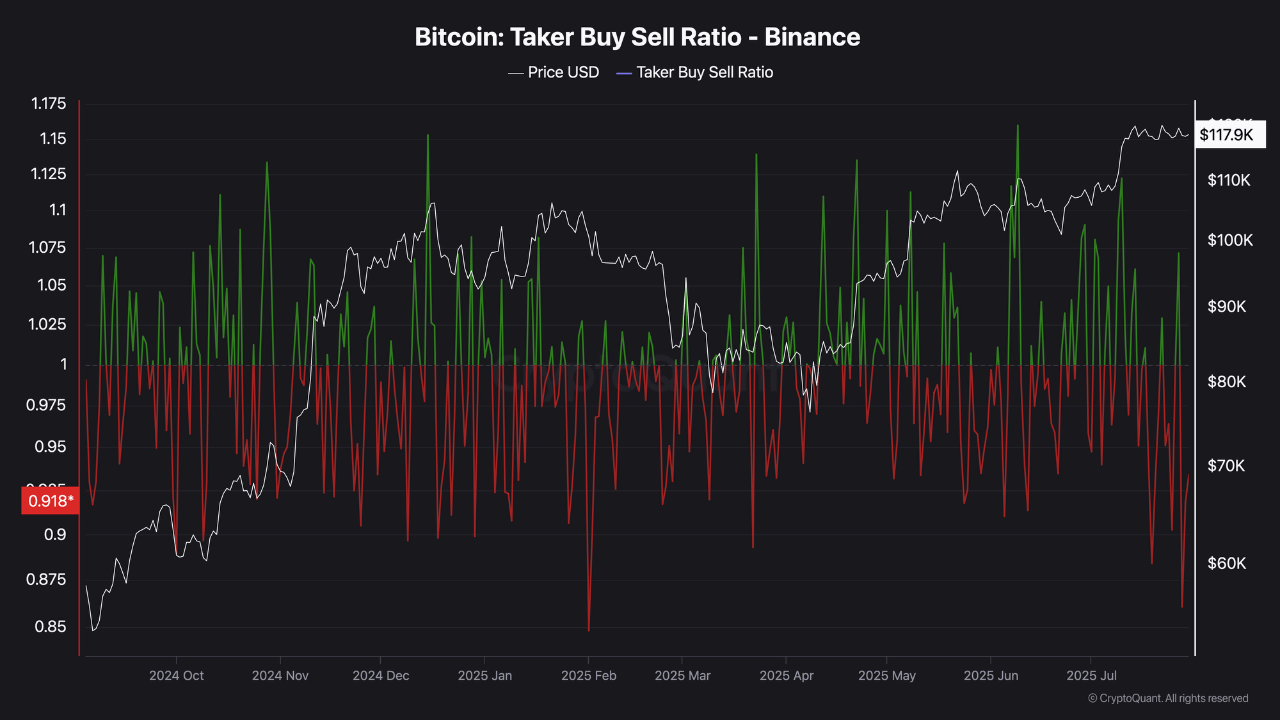

Analysts say Binance Futures data suggests that certain trading patterns could shape the short-term direction of BTC despite volatility settling.

These observations prompted a debate on whether market makers intentionally maintain control before significant price transfers occurred.

Binance data suggests strategic positioning

Borisvest emphasized that open interest in Binance has remained stable between $13 billion and $14 billion over the past 20 days. This stability indicates that new positions are not increasing rapidly, but existing transactions are actively maintained.

“This kind of behavior in a range environment often indicates silent accumulation or strategic stall,” the analyst wrote, suggesting that large players may be managing their exposure carefully during this integration phase.

The taker trading ratio, currently at 0.9, refers to an increase in sales pressure from candidates in the market. However, Bitcoin prices have not experienced a sharp drop despite this activity. This indicates that passive buyers are absorbing sell orders.

Borisvest added that the funding rate, which hovered around 0.01, reflects the strengths or lack of aggressive leverage from short positions. This means that within the facility or large numbers of traders are gradually gaining positions, and usually avoiding extremes that lead to rapid price fluctuations.

Bitcoin downside shakeout before breakout

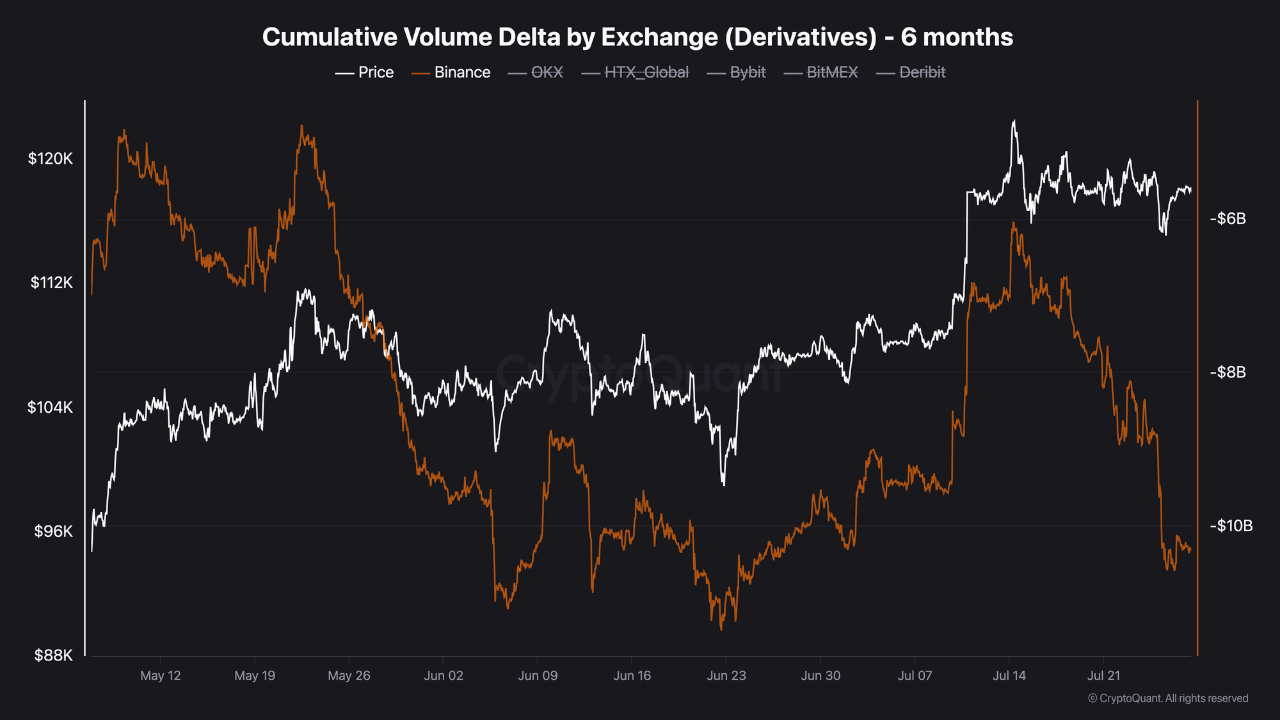

The analysis also examined cumulative volume Delta (CVD) data on binance. This indicates sustained sales in the futures market. However, despite continued sell-side activity, Bitcoin continues to resist a significant downward movement. According to Borisvest, this could set the stage for a potential liquidity-driven shakeout.

He suggested that BTC might clear weak long positions and attract even shorter interest to temporarily immerse himself in $110,000. This could pave the way for stronger, more sustainable breakouts in the future.

While these metrics do not guarantee immediate breakouts or breakdowns, they point to a weak equilibrium in Bitcoin’s market structure. Historically, the long-term integration phase of BTC has often preceded rapid movements in either direction.

Special images created with Dall-E, TradingView chart