Strategic stock fell 1.4% in trading after opening hours, despite earnings of $10 billion in the second quarter as CEO Phong Le called the Bitcoin Holding Company “the most misunderstood and undervalued stock” on the market.

The strategy’s operating profit rose 7100% year-on-year to $14 billion, Michael Saylor co-founded it, said in a revenue statement Thursday.

This marked the second reporting period in which fair value accounting was applied, including unrealized profits from Bitcoin (BTC).

The strategy has also announced plans to buy more Bitcoin by raising another $4.2 billion worth of shares through one of its preferred stocks. This is part of our long-term goal of purchasing $84 billion worth of cryptocurrency under the upgraded “42/42” plan.

Strategies are misunderstood and underrated: von Le

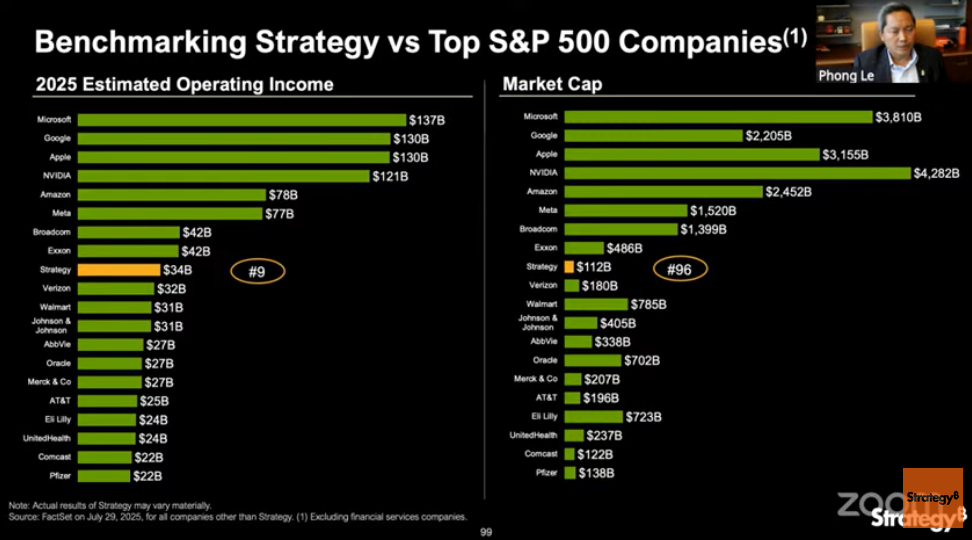

The strategy’s estimated operating income for fiscal year 2025 is currently $34 billion, the ninth largest revenue among Standard and Poor’s 500 (S&P 500) companies, Le says in his revenue call.

He said the strategy boasts 96th largest market capitalization and one of the lowest profit to revenue multiples among S&P 500 companies.

“We use the most innovative technologies and assets in human history. Meanwhile, we are perhaps the most misunderstood and undervalued stocks in the United States and potentially undervalued worldwide.”

Comparison of operating profit and market capitalization for strategies with other top S&P 500 companies. source: strategy

Strategy’s software arm, which covers business intelligence products and subscription services, generated revenue of $114 million in quarter.

Strategy’s common stock, MSTR, rose 1.73% to $401.86 on Thursday, but fell 1.4% outside of business hours, Google Finance data shows.

The strategy raises the standard for Bitcoin metrics

The strategy, which has accumulated 628,791 BTC, worth $73.3 billion, said it had already reached the strategy’s year-end target, with “BTC yields” rising 25% in the second quarter and “BTC $ gain” exceeding $13 billion.

BTC yields represent the rate of change between the strategy Bitcoin and its expected diluted stocks, while “BTC $ gain” reflects the profits of Bitcoin values measured in US dollars.

As a result, the strategy has raised its full-year “BTC yield” and “BTC $gain” targets to 30% and $20 billion, respectively, Le said.

“Companies that can double their target throughout the year will consider their success.”

Strategy to raise $4.2 billion to buy more Bitcoin

Meanwhile, the strategy said it has concluded an agreement to issue and sell up to $4.2 billion worth of shares, one of the preferred stock offers used to buy more Bitcoin.

The Variable Rate Series A Permanent Stretch Preferred Stock, STRC Ticker is one of the main investment tools in its strategy to strengthen Bitcoin Holding through what companies describe as “intelligent leverage.”

This marks the largest US stock raise ever in 2025 as the strategy raised $2.5 billion from STRC in the beginning of July, which once bought 21,021 Bitcoin.

At current market prices, the strategy can purchase an additional 36,128 Bitcoin from a $4.2 billion salary increase.