- ETH derivatives exhibit weak momentum despite strong ETF influx.

- Ethereum’s network activity and TVL continue to decline.

- Technical analysis suggests long-term benefits, but traders will remain cautious.

Ethereum (ETH) has seen a strong price surge in recent weeks, up over 54% in the past month, trading at around $3,755 at press.

But despite this rally and a powerful influx of spot ETFs, derivatives market data draws a very different picture, raising questions about whether Ethereum can quickly break through the psychologically significant $4,000 level.

Essentially, the disconnect between bullish institutional influx and weak derivative metrics raises some questions for market participants.

Is Ethereum’s recent rally sustainable or is it just a reflection of the speculative optimism driven by ETF hype?

Furthermore, amid growing competition with rival blockchains, have investors lost faith in the foundations of Ethereum’s network?

The Derivative Market tells a careful story

Ethereum’s spot market is energised by the influx of funds in exchange industry, but futures data shows traders are reluctant to harness their bullish position.

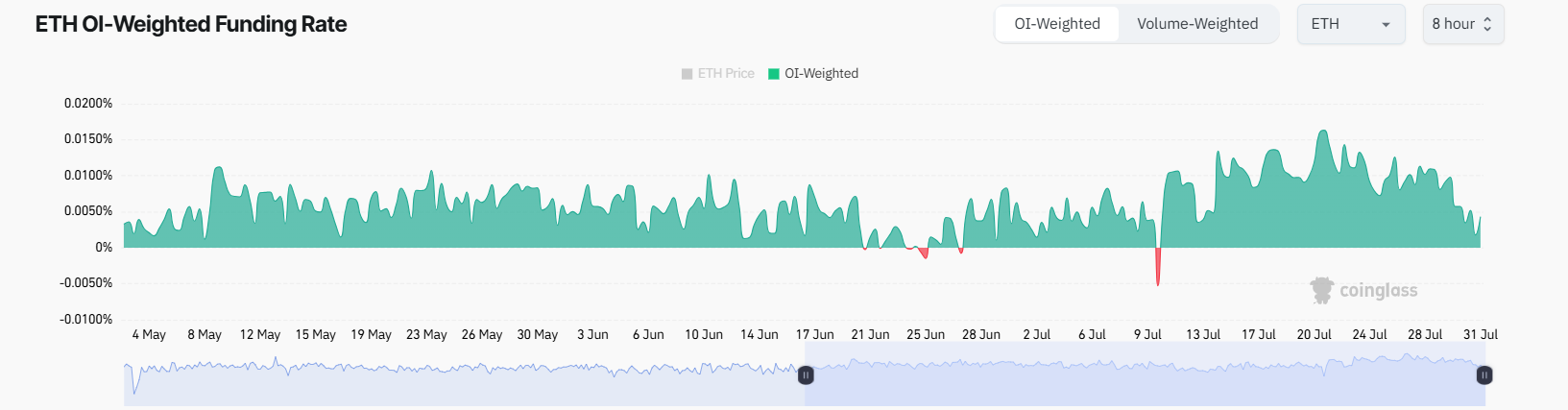

As of Thursday, the annual funding rate for ETH permanent futures had fallen to 9%, down from 19% the week, with the funding rate for ETH OI weights falling to 0.0043% from 0.0163% on July 21st.

This suggests that demand for long positions will decline even after ETH prices have risen nearly 46% since early July.

This behavior is rare. Historically, price increases are consistent with stronger futures premiums, but the current trends show a sense of hesitation.

The three-month ETH futures premium has softened slightly to 6% from 8% just a few days ago.

This is still in neutral range, but it makes clear that whales and market makers are unwilling to actively bet on even more price increases in the short term.

The weaknesses of the Ethereum network will irritate investors

The careful tone of the derivative may be fueled by stagnant chain activity.

Ethereum’s total is locked (TVL) fell to its five-month low of 23.4 million ETH, down 11% in just 30 days.

Despite the rising value of the ETH dollar, its sharp decline highlights a significant decline in the amount of assets deployed within the ecosystem.

In contrast, Solana’s TVL fell only 4% over the same period, while BNB chain’s TVL rose 15% in terms of native tokens.

These shifts indicate that competing platforms are maintaining or growing usefulness at the point where Ethereum’s activity appears to be a plateau.

Of even more concern is the decline in advantages among Ethereum distributed exchange (DEX) volumes.

According to Defillama, Ethereum has recorded $81.32 billion in DEX activities over the past month.

Solana surpassed that at $82.9 billion, while the BNB chain led by an astounding $189.2 billion.

These numbers highlight that Ethereum is no longer the go-to platform for certain core Defi activities.

Technical analysis shows mixed outlook for ETH prices

Despite the warm derivatives, technology analysts remain divided into Ethereum’s future trajectory.

Tech’s popular investor Ivan points to a symmetrical triangle pattern that could lead to a breakout of $7,709, more than twice its current price.

Monthly Ethereum breaks out!!!!!!!!

Target $7,700

yes

ooh yes guys pic.twitter.com/z0szvkxoyw– July 20, 2025, Ivan on tech🍳📈💰 (@ivanonttech)

Meanwhile, another analyst, Mikycrypto Bull, identified the formation of a long-term ascending triangle five years ago.

Ethereum is set to macro breakout

When that happens, it causes a huge altszn

Ethereum pic.twitter.com/iozx77A very important moment for dvmr

– Mikybull🐂Crypto (@mikybullcrypto) July 30, 2025

In addition to bullish emotions, there is the MACD crossover on the recent monthly charts. This is the signal that preceded the major gatherings in previous cycles.

However, while long-term technology suggests explosive potential, short-term forecasts are more cautious.

ETH must first break past $4,100 and hold above $3,700 to maintain upward momentum.

Company trust grows amid the doubts of the market

Ethereum’s institutional and corporate adoption continues to grow.

Companies such as Sharplink Gaming and World Liberty Financial have accumulated a significant ETH reserve in recent months.

Sharplink currently has over 438,000 ETH and is actively betting on assets to generate passive income.

World Liberty Financial has earned over 77,000 ETH, with its recent purchases reaching nearly $3,294 per coin.

These moves suggest that some agencies position Ethereum as a long-term strategic asset.

Their investments reflect trust in the evolving role of Ethereum as a fundamental infrastructure for decentralized applications and finance.