Momentum Finance, a decentralized exchange (DEX) of the SUI blockchain, has daily trading volumes exceeding $100 million.

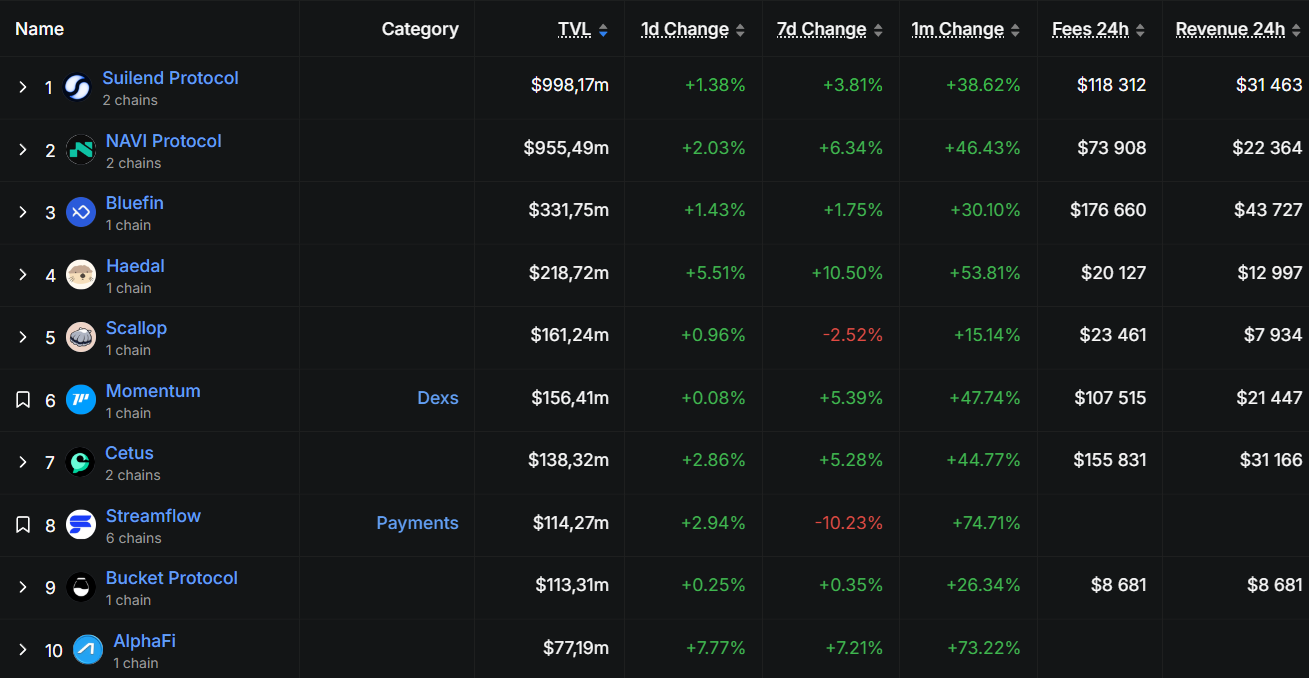

At press time, Momentum totaled $156.4 million, ranked as the sixth largest protocol and the largest DEX on SUI networks, according to Defillama data. SUI’s Decentralized Finance (DEFI) ecosystem continues to expand, with TVL totaling $2.26 billion and Stablecoin’s market capitalization exceeding $1 billion.

Top 10 protocols by SUI’s TVL

A press release shared with rebellious momentum, it was noted that TVL first surpassed the $100 million mark on June 26th, with daily swap volume reaching the same milestone within a month.

The Momentum team told the rebels that the rebound reflects the resilience of the SUI network and the ability of infrastructure players to respond quickly.

Founder Wendy Fu added that after its launch on March 31, the exchange experienced rapid growth, with new users joining the SUI ecosystem, from about $7,000 in late March to over 1.2 million percent by late April. Fu pointed out that “the focus is on attracting fresh fluidity from outside the SUI ecosystem.”

Cetus Exploit

This growth follows a major security breaches in May targeting Cetus protocol, a competing DEX in SUI. The attacker exploited mathematical errors in the project’s smart contract code, resulting in a loss of around $260 million in cryptocurrency.

The team later frozen about $160 million of stolen funds and pledged to return the money to liquidity providers once the forensic investigation is complete.

Commenting on the incident, Fu said the exploit was “a crucial moment for the entire SUI ecosystem. After reopening Dex, it fell from $67 million to $42 million a night.”

To address user concerns, the momentum coordinated with the SUI Foundation and Mysten Labs “have fully increased security, started additional audits and implemented new protocol-level safeguards.” Following the upgrade, FU claims that the TVL on the exchange “in just five days” has recovered.

Extends beyond SUI

Momentum uses the VE(3,3) model, which aims to balance the incentives of liquidity providers and future MMT governance token holders. The team says the mechanism will help ensure consistent liquidity by adjusting incentives to the active price range.

Fu told Defiant that Dex plans to “absolutely” expand beyond SUI, but no specific timeline was revealed.

“Absolutely when it comes to expansion beyond SUI. From day one, we have imagined momentum as a multi-chine ve (3,3) Dex, taking clues from what Velodrome built on optimism,” Fu said.

The team is currently working with the Wormhole Cross-Chain Bridge to promote the integration of EVM and Solana-based protocols into SUI using upcoming NTT bridges. Despite these plans, Fu stressed that momentum is “fully committed to making Sui the best entry point for sustainable on-chain liquidity.”