Bitcoin (BTC) mining difficulty reached an all-time high of 127.6 trillion this week, but is expected to drop during the next difficulty adjustment on August 9th.

According to Coinwarz, mining difficulty is expected to fall by around 3% to 123.7 trillion during the next adjustment period, with the current average blocking time being around 10 minutes and 20 seconds.

Data from Cryptoquant shows that mining difficulty declined in June, with difficulties falling to 116.9 trillion in the end of the month and the first two weeks of July. However, the difficulty resumed the long-term uptrend in the second half of July.

The difficulty of Bitcoin mining and the network hashrate – the total computing power committed to protecting the network – is central to maintaining the profitability of miners and the high stock-to-flow ratio of Bitcoin, protecting the price of BTC from overproduction.

The difficulty of Bitcoin mining has become the newest ever, and is gradually increasing over time. sauce: Encryption

Related: Solo Bitcoin Miner wins a block reward of $373,000

Bitcoin difficulty adjustment and stock and flow ratio

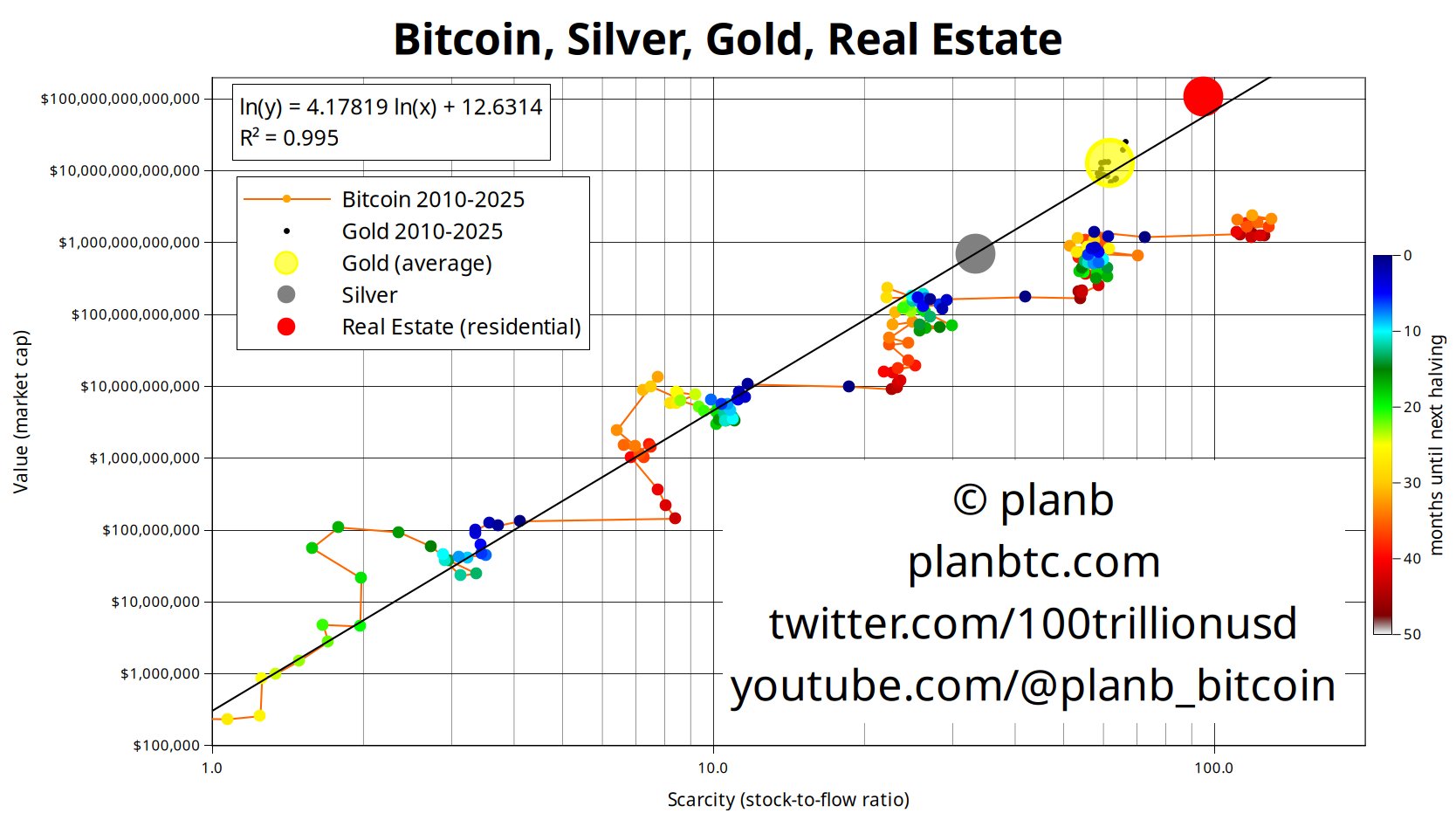

The share-to-flow ratio measures the total available supply of financial assets or goods to newly created supplies added by miners or commodity producers.

The higher the ratio, the more resilient the asset or commodity is due to price changes caused by overproduction. The lower the ratio, the more the assets or goods are affected by the new supply.

This ratio is part of the reason why silver was demoed with gold. Silver has a lower stock-to-flow ratio than gold. The rising prices of silver will lead miners and producers to generate more supply, killing new silver in the market and pushing prices down.

Bitcoin has a higher share price to flow than gold, with about 94% of BTC’s 21 million supply already mined and distributed in the market. In comparison, gold does not have a hard supply cap and inflation rates are around 2% per year.

Compare the stock-to-flow ratio of Bitcoin with gold, silver and residential real estate. sauce: planb

“The scarcity of gold, the stock-to-flow ratio, is about 60. The scarcity of Bitcoin is about 120. Therefore, Bitcoin is twice as poor as gold,” according to Planb, creator of the Bitcoin Stock-to-Flow Price Analysis Model.

With difficulty adjustments, Bitcoin’s price becomes inelastic in production and is proportional to the total computing power deployed by miners.

Adjusting the difficulty prevents overproduction and subsequent prices collapse as new supplies are dumped in large quantities into the market for a short period of time.

The hashrate of a Bitcoin network represents the total amount of computing power deployed to protect the network. sauce: Encryption

As more computing power is deployed and Bitcoin networks are protected, it will become difficult to match new computing resources, and block production will keep it as close as possible to the 10-minute target of protocols.

Conversely, when computing power decreases, the network difficulty is adjusted, ensuring that new blocks are mined at a stable pace of about 10 minutes.

magazine: Bitcoin vs. Quantum Computer Threats: Timelines and Solutions (2025–2035)