Ethereum price forecast: bullish recovery or short-term trap?

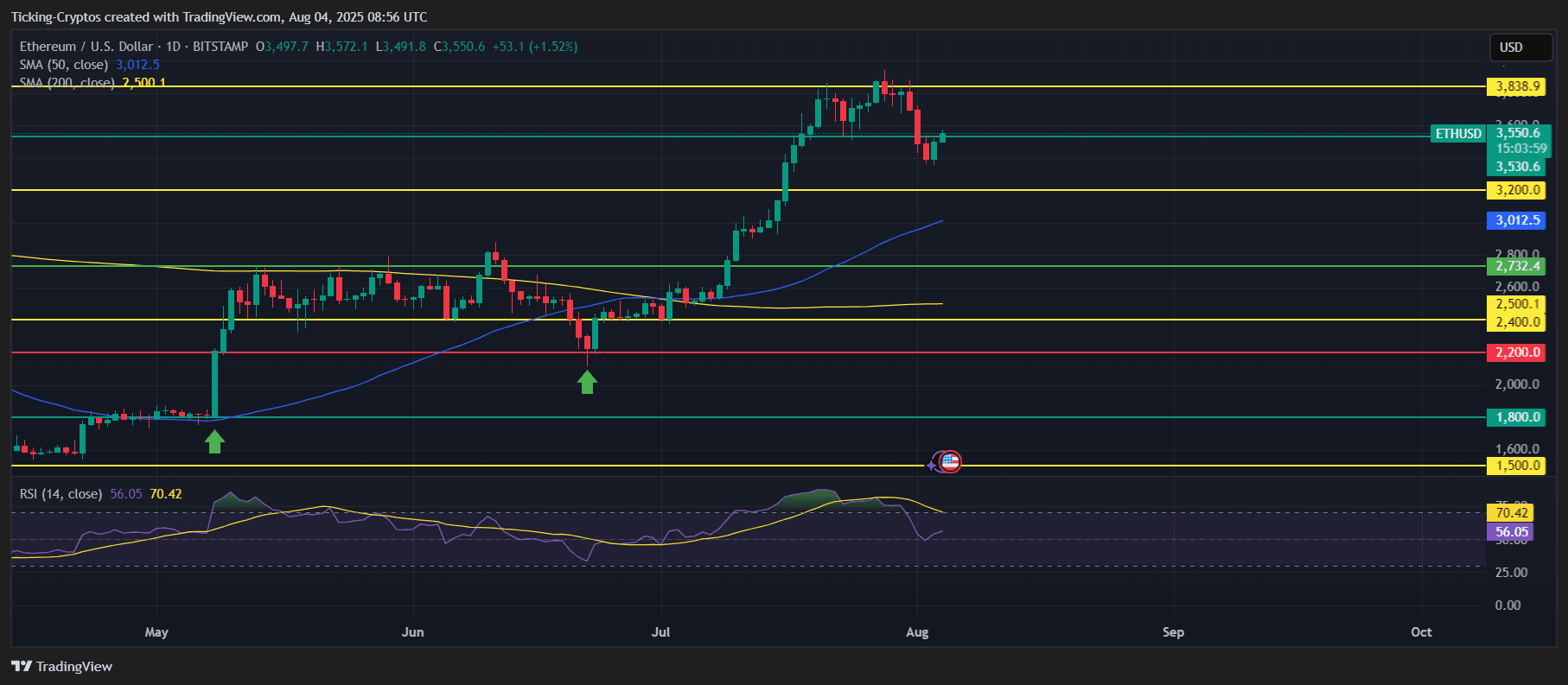

Ethereum ($eth) is traded $3,550recovered from a recent decline that tested support over $3,500. After multiple weekly meetings that peaked below $3,838 Resistance, the chart suggests that ETH is integrated, but are you ready for another foot or do you see a more downside?

ETH coins held above key support

After reaching the local top nearby $3,838Ethereum retreated and support was found around it $3,530-$3,550 zone. This area has reached a significant short-term demand level. The bounce here is especially encouraging when daily candles form higher and lower than July lows.

ETH/USD 1-Day Chart – TradingView

50 Day SMA Currently $3,012served as dynamic support during the June-July rally. As long as ETH is above this level, the bullish structure remains intact.

Major levels to see

From the chart:

resistance:

🔼$3,838 (recent highs)

🔼$3,620 (minor horizontal resistance)

support:

🔽$3,530 (current support)

🔽$3,200 (key horizontal support)

🔽$3,012 (50-day SMA)

🔽$2,732 (strong demand zone)

Losing the $3,530 level could open a retest of $3,200. Under that, $3,012 will be the bull’s make-up or break level.

RSI proposes reconstruction of potential momentum

14 Days of RSI It has been cooled from recently acquired territory and is now sitting 56.05. This suggests that there is still room for higher movement before the ETH heats up again.

Importantly, the RSI bouncing off after a clean test at 50 level.

ETH vs Bitcoin: Monitoring correlation

Ethereum retains support, but it’s worth noting Bitcoin is still integrated $112,000 to $115,000, close to that level of support. If BTC drops, ETH may continue. Even if your own chart looks healthy.