By Omkar Godbole (unless otherwise indicated)

Bitcoin

On Monday, the nine-spot Ether ETFS recorded $465 million (the largest net runoff on record), following a $152 million drawdown on Friday. The Bitcoin ETF saw a substantial leak that bleed $333 million after $812 million on Friday. This suggests that facility capital is less optimistic than spot markets.

Meanwhile, long-term bullishness has evaporated from the BTC options as concerns about new US inflation and labor market slowdowns and weighted investors’ risk appetite.

Conversely, some analysts still hold largely constructive market outlook, predicting Fed interest rate cuts.

“Despite short-term volatility, structural data still suggests that the US is undergoing a slowdown in growth rather than a complete recession,” HTX research analyst Chloe Zheng told Coindesk. “Home debt remains low compared to income, reducing credit stress and continuing growth in business lending. This mix of labour data softening and mitigation expectations historically precedes financial easing.

Data from CME’s FedWatch tool shows that traders were priced at three rate reductions by the January 2026 meeting. In other words, the Fed is expected to reduce borrowing costs at three of the following four meetings:

The new Crypto Market Highs hinges on Fed rate reductions, according to Wincent’s Paul Howard, senior director of Crypto Market-Making Firm.

“The majority of the next macro news will likely come as early as September with rate changes,” said Howar. “If that happens, you can expect prices to be catapulted through current ATH as cheap money is looking for yields. My sense is BTC and the major ALTs have a strong outperformance in the fourth quarter.”

Speaking of the broader market, according to Analytics Firm Sentora, the standard coin volume for the July chain reached a high of over $1.5 trillion in July. The UNISWAP V4, which debuted at the end of January, has surpassed $100 million in trading volume, according to data tracked by 21Shares.

In traditional markets, US stock futures traded positively in flats, showing a sluggish opening following a 1.3% increase on Monday. The dollar index traded slightly higher at nearly 99.00, but gold dropped to $3,360 per ounce as the freight market cratered, sending warnings to the economy. Keep alerts!

What to see

- Crypto

- August 5th at 1:30pm: The Stellar Development Foundation (SDF) will be holding an AMA session on Reddit. CEO Denelle Dixon, Chief Marketing Officer Jason Karsh and Chief Growth Officer José Fernández Da Ponte answer your questions.

- August 7th, 10am: The circle will be holding a webinar. “The era of genius acts begins.” This session will cover the first US federal payments stable framework and its impact on crypto innovation and regulations.

- August 15: Record the date of the next FTX distribution to the holders of the Class 5 customer qualifications, general unsecured and convenience claims for Class 6.

- August 18: Coinbase Derivatives launches Nano Sol and Nano XRP US Perpetual Style Futures.

- Macros

- August 5th 10am: Supply Management Institute (ISM) will release US Services Sector data for July.

- The PMI service is. east. 51.5 vs. 50.8

- August 5th 2pm: Uruguay National Institute of Statistics will release July inflation data.

- Before the annual inflation rate. 4.59%

- August 6th, 12:01am: 50% US tariffs begin most Brazilian imports.

- August 6th 2pm: Federal Reserve Governor Lisa D. Cook will give a speech entitled “The United States and the Global Economy.” Live stream link.

- August 7, 12:01am: The new US mutual tariffs outlined in President Trump’s July 31 executive order will be effective for a wide range of trading partners who have not secured transactions by August 1. These tariffs range from 15% to 41% depending on the country.

- August 7th: 8am: Mexico National Institute of Statistics releases consumer price inflation data for July.

- Core inflation rate before mom. 0.39%

- Around the core inflation rate. 4.24%

- Before moms inflation. 0.28%

- Around the inflation rate. 4.32%

- August 7th: 3pm: Mexico’s central bank, Banco de Mexico, announces its monetary policy decision.

- Overnight interbank target rate EST. 7.75% vs. 8%

- August 8: Federal Reserve Governor Adriana D. Coogler’s resignation will be effective and create an early vacancies for the Governor’s Committee that will allow President Trump to nominate his successor.

- August 5th 10am: Supply Management Institute (ISM) will release US Services Sector data for July.

- Revenue (Estimation based on fact set data)

- August 5: Galaxy Digital (GLXY), in front of the market, $0.19

- August 7: Block (XYZ), Post Market, $0.67

- August 7: CleanSpark (CLSK), Postmarket, $0.19

- August 7: Coincheck Group (CNCK), Post Market

- August 7: Crypto Mining (CIFR), former market

- August 7: HUT 8 (HUT), pre-market – $0.08

- August 8: Terawulf (Wulf), former market, – $0.06

- August 11: Exod, Postmarket

- August 12th: Bitfarm (BITF), former market

- August 12th: Foldable (FLD), Post Market

- August 14th (TBC): Core Scientific (Corz), Post Market

- August 15th: Bitfufu (Fufu), former market

- August 18: Bitdeer Technologies Group (BTDR), former market

- August 27: Nvidia (NVDA), Post Market, $1.00

Token Event

- Governance votes and phone calls

- Combined DAO votes to select the next Security Service Provider (SSP). Representatives have chosen Chainsecurity & Certora and Cyfrin. Voting will end on August 5th.

- Balancer Dao is voting to create Balancer Business, a profit-owned subsidiary of Balancer Opco Ltd. The new corporation will formalize protocol fee management and chain operations on behalf of the current DAO multisig model. Voting will end on August 5th.

- Arbitrum Dao is voting to renew its partnership with Entropy Advisors for another two years starting in September. The proposal includes $6 million in funding and $15 million ARB for incentives where Entropy focuses on financial management, incentive design, data infrastructure and ecosystem growth. Voting will end on August 7th.

- Benddao is voting for a plan to stabilize Bend by burning 50% of the Treasury tokens, restarting lender compensation, and using 20% of protocol revenue to start monthly buybacks. Voting will end on August 10th

- August 5th, 1:30pm: CEO, CMO, and Head of Strategies and Partnerships for participating in Ask Me Anything (AMA) sessions at Stellar Development Foundation.

- August 7th 12pm: Cello hosts the governance call.

- Unlock

- August 9: Unlocking 1.3% of the circulation supply worth $12.4 million (IMX).

- August 12: APTOS unlocks 1.73% of distribution supply worth $48.07 million.

- August 15: An avalanche unlocking 0.39% of distribution supply worth $37.45 million.

- August 15: StarkNet (STRK) unlocks 3.53% of its distribution supply worth $14.95 million.

- August 15: SEI unlocks 0.96% of the circulation supply worth $16.42 million.

- August 16: arbitrum unlocks 1.8% of its distribution supply worth $36.35 million.

- August 18: FastToken unlocks 4.64% of its distribution supply worth $91.6 million.

- Token launch

- August 5: Keeta (KTA) listed in Kraken.

- August 5: USDC, Tron, Tron, Ondo, Chainlink, Cardano, and Polkadot listed on Arkham Exchange.

meeting

Coindesk Policy & Regulation Conference (Formerly known as Cryptographic State) At a one-day boutique event held in Washington on September 10th, generals, compliance officers and regulatory executives will be able to meet with civil servants responsible for crypto law and regulatory oversight. Space is limited. Please use Code CDB10 for 10% off registration until August 31st.

- Day 3: Blockchain Conference Science of 2025 (Berkeley, California)

- August 6-7: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- August 6th-10th: Rarebo (Las Vegas)

- August 7-8: Bitcoin++ (Latvia, Riga)

- August 9th-10th: Baltotic Honey Badger 2025 (Riga, Latvia)

- August 9th-10th: Conviction 2025 (Ho Chi Minh City, Vietnam)

- August 11th: Paraguay Blockchain Summit 2025 (Asuncion)

- August 11th-13th: MATB 2025 (Intanbul)

- August 11th-17th: Ethereum NYC (New York)

- August 13th-14th: Cryptowinter ’25 (Queenstown, New Zealand)

- August 15th: Bitcoin Educator’s Non-Customs (Vancouver)

- August 17th-21st: Crypto 2025 (Santa Barbara, California)

- August 18th-21: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

- August 21st-22: Coinfest Asia 2025 (Indonesia, Bali)

- August 25th-25th: Webx 2025 (Tokyo)

Token talk

By Shaurya Malwa

- Hyperliquid closed its highest month of all time, reaching a trading volume of $320 billion in July. This was increased by 47% due to activity in ethers and other Altcoins.

- Dex also surpassed its total open profit for the first time by over $15 billion.

- High lipids generated more than $4 million in daily fees over the period, reflecting record-breaking trader engagement.

- With a $597 million TVL, the Exchange currently leads nearly 12% of Binance’s derivatives market share, strengthening its whale activity and highly leveraged trading.

- The platform’s hype token slid to $38.54 after nearly touching $50.

- The hype’s open interest fell a month low to $1.46 billion, with 70% of traders longer and the possibility of a adjusted liquidation flash.

- Price discoveries moved to external exchanges, attenuating the reflective momentum that drove the early profits of the hype.

Positioning of derivatives

- Open interest on BTC futures fell by more than 1%, in contrast to increased participation in futures related to other major tokens, including ether and XRP.

- Funding rates hover at 5%-10% per year on most major coins, indicating a bullish position in the market.

- In Delibit, long-term BTC calls trades on par with puts, showing a bullish to neutral change in emotions. The block flow on the paradigm features a Bitcoin calendar spread on August 8th, short stradule.

Market movements

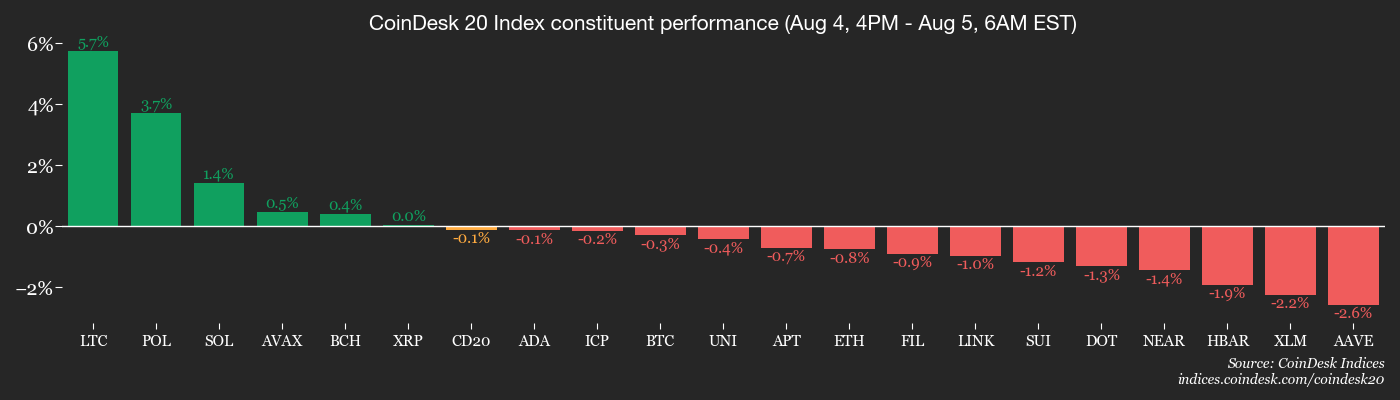

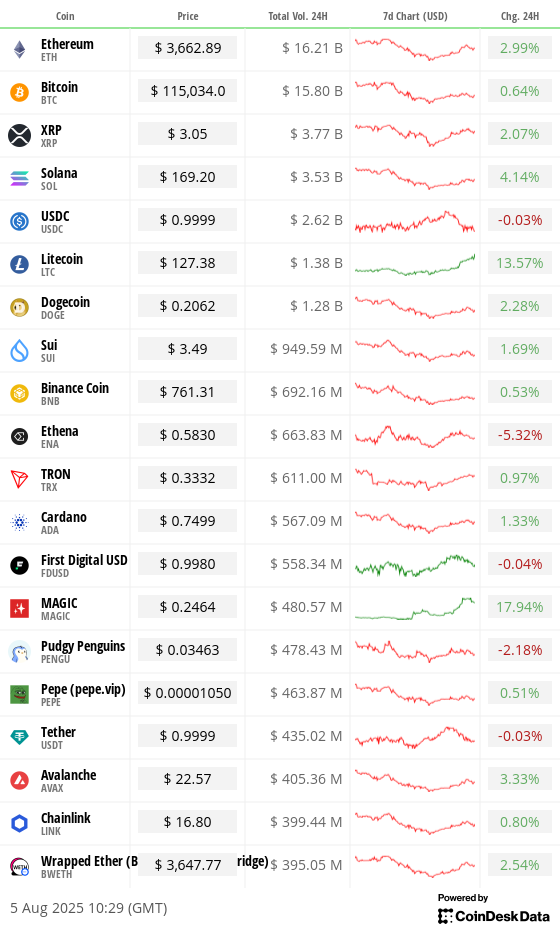

- BTC has remained unchanged at $114,615.76 (24 hours: 0.18%) from 4pm on Monday

- ETH is down 0.87% at $3,661.62 (24 hours: 2.9%)

- Coindesk 20 is up 3.14% at 3,839 (24 hours: +1.95%)

- Ether CESR Composite staking rate fell 6 bps at 2.857%

- BTC’s funding rate is 0.0189% (20.69% per year) for Kucoin.

- DXY is up 0.18% at 98.97

- Gold futures fell 0.39% at $3,413.10

- Silver futures increased by 0.13% to $37.38

- The Nikkei 225 rose 0.64% to 40,549.54

- Hang Seng rose 0.68% at 24,902.53

- FTSE is up 0.32% at 9,157.57

- The Euro Stoxx 50 is up 0.24% at 5,254.78

- DJIA rose 1.34% on Monday to 44,173.64

- S&P 500 closed 1.47% at 6,329.94

- NASDAQ Composite rose 1.95% to 21,053.58

- S&P/TSX Composite closed 0.88% at 27,020.43

- S&P 40 Latin America closed 0.72% at 2,572.27

- The 10-year financial ratio in the US is up 1.6 bps at 4.214%

- E-Mini S&P 500 futures are up 0.17% at 6,366.50

- E-Mini Nasdaq-100 futures are up 0.23% at 23,349.00

- The e-mini dow Jones Industrial Average Index is up 0.11% at 44,351.00

Bitcoin statistics

- BTC dominance: 61.6% (0.27%)

- Ether to Bitcoin ratio: 0.03192 (-1.24%)

- Hash rate (7-day moving average): 926 EH/s

- Hashpris (spot): $56.83

- Total fee: 3.33 BTC/$382,733

- CME Futures Open Interest: 136,145 BTC

- Gold Price BTC: 34 oz

- BTC vs. Gold Market Cap: 9.61%

Technical Analysis

- The XRP/ETH ratio carries head and shoulder patterns in daily charts.

- A break below the horizontal support line confirms signaling reversal of ether outperformance against XRP.

Crypto stocks

- Strategy (MSTR): Closed on Monday at $389.24 (+6.17%), at -0.42% at a market value of $387.59

- Coinbase Global (Coin): Closed at $318.17 (+1.11%), and unchanged pre-market.

- Circle (CRCL): $164.82 (-1.95%), closed at -1.65% at $162.18.

- Galaxy Digital (GLXY): Closed at $28.89 (+7.48%), with +5.23% at $30.40.

- Mara Holdings (Mara): $16.04 (+3.48%), closed at -0.19% at $16.01

- Riot Platforms (Riot): Closed at $11.42 (+3.54%) and has not been changed.

- Core Scientific (CORZ): $13.65 (+7.91%), closed at +0.81% at $13.76.

- CleanSpark (CLSK): $10.62 (+1.72%), +0.19% at $10.64 at +0.19%.

- Coinshares Valkyrie Bitcoin Miners ETF (WGMI): Closed at $24.83 (+6.02%)

- Semler Scientific (SMLR): Closed at $35.37 (+2.64%) and has not been changed.

- Exodus Movement (Exod): Closed at $29.57 (+4.19%) and has not been changed.

- Sharplink Gaming (SBET): $19.14 (+11.67%), +2.61% at $19.64 at +2.61%.

ETF Flow

Spot BTC ETF

- Daily Net Flow: -$323.5 million

- Cumulative net flow: $5.383 billion

- Total BTC holdings: 129 million

Spot ETH ETF

- Daily Net Flow: -$465.1 million

- Cumulative net flow: $9.04 billion

- Total ETH holdings: 569 million

Source: Farside Investors

One night flow

The chart of the day

Ether ETF: Daily Net Flow. (sosovalue)

- The US-registered ether ETF registered a record $465 million spill on Monday.

- The lack of participation via ETF raises question marks regarding the sustainability of ether price recovery after Sunday.

While you’re asleep

- The base network suffers from its first downtime since 2023 and will stop operation for 29 minutes (Coindesk): Technical flaws have been identified and resolved within minutes of investigation. The outage is noteworthy given the growing importance of bases in the Ethereum Layer-2 ecosystem.

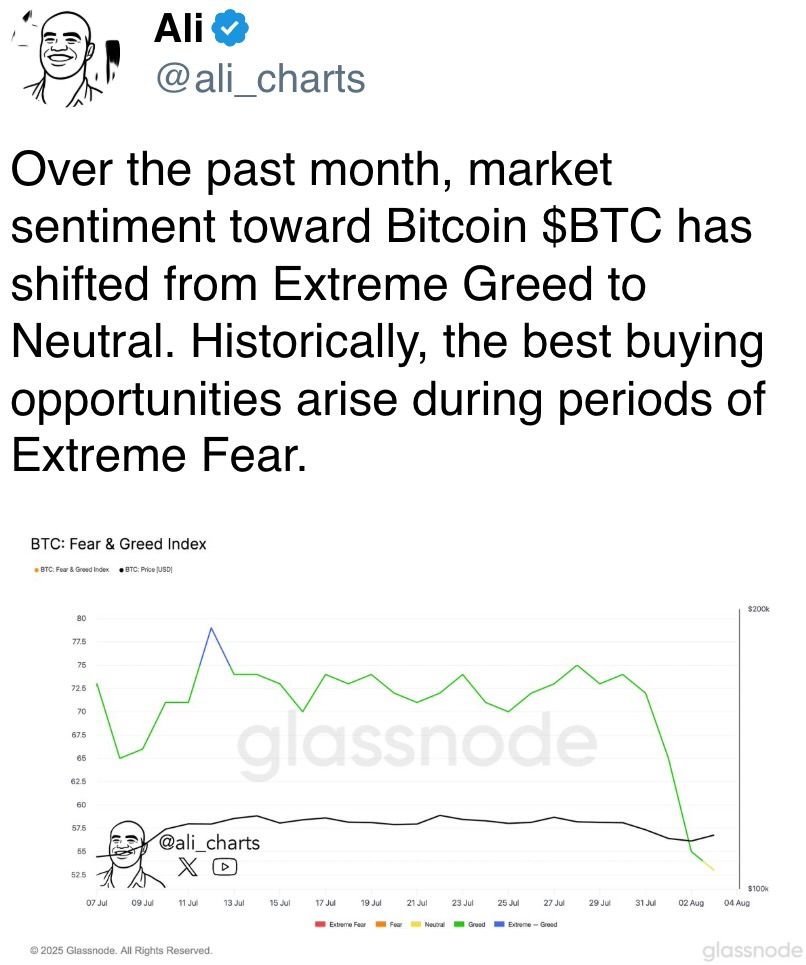

- Bitcoin’s long-term bullishness evaporates from options markets as inflation concerns rise (Coindesk): Bitcoin options market metrics show that long-term sentiment has shifted from bullish to neutral as analysts warn that US inflation data could complicate potential rate cuts by the Federal Reserve.

- Trump’s BLS firing test Wall Street reliance on government data (Wall Street Journal): Some investors have questioned the reliability of US inflation and employment data after Trump fired Erica Mantelfer, raising long-term concerns about the transparency and reliability of economic reporting.

- A year ago today, Bitcoin won $49K in the winding up of the Yen Carry trade. It is currently an increase of 130% (Coindesk). Over the past year, Bitcoin has bounced along with stocks and gold despite rising bond yields, but long-term holders have doubled their supply percentage and convicted them through stronger market volatility through strong convictions.

- The Brazilian Supreme Court places Bolsonaro under house arrest (The New York Times): The judge said Bolsonaro used his allies’ social media accounts to reach his supporters, indicating “a lightly empty against the judicial decision,” and ordered police to grab a phone and limit visits to their homes.

- In nearly two weeks, Gold Hover will raise rate-cut bets (Reuters) in US employment data. OANDA analysts said Gold’s recent strength reflects expectations for a reduction in interest rates, but even stronger catalysts could be limited without a stronger catalyst to overcome the near $3,450 technical resistance.

With ether