Just minutes before midnight Thursday, US President Donald Trump announced his updated tariff policy, declaring, “It’s midnight!!! Billions of dollars in tariffs are flowing through America!”

Bitcoin shows little response to Trump’s new trade tariffs

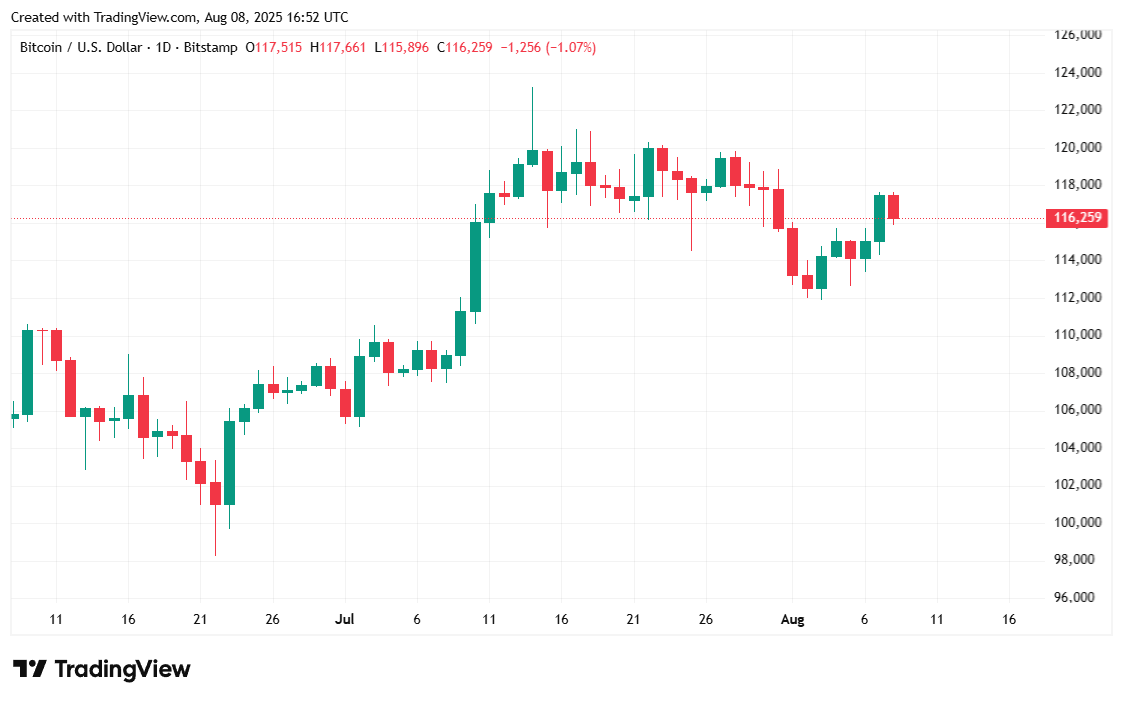

We call it tariff fatigue, but even after the Trump administration’s controversial trade policy came into effect in the middle of Thursday’s midnight, Bitcoin prices remained largely unchanged, continuing to maintain the $116,000 mark over the past 24 hours.

US President Donald Trump has characterized his controversial taxes on imports into the country as retaliatory, claiming that other countries have “used the United States for many years.” Tariffs on Thursday left the country that is rushing to attack deals with the administration after Trump slapped European countries with 39% tax on taxes. The longtime allies, the US’s biggest trading partners, as well as neighbors in northern Canada, received 35% tariffs, and Trump sniffed him when Canadian Prime Minister Mark Kearney tried to negotiate.

“We didn’t have much luck in Canada,” Trump said last month while talking to a reporter at the White House. “I think Canada could just pay customs duties, and that’s not really a negotiation.”

But despite all the tariff controversy, stocks and crypto markets are rising and Bitcoin is flat. The S&P 500, Nasdaq and Dow all reached 0.77%, 0.90% and 0.52% on Friday, respectively. The broader crypto market has risen 0.76% even if dominant digital assets step on the water.

Market Metric Overview

Just like yesterday, Bitcoin rose just 0.41% to $116,188.20 over the last 24 hours, up 0.82% per week, according to CoinmarketCap at the time of reporting. Cryptocurrency prices have rocked between $115,696.49 and $117,689.20 starting Thursday.

(BTC Price/Trade View)

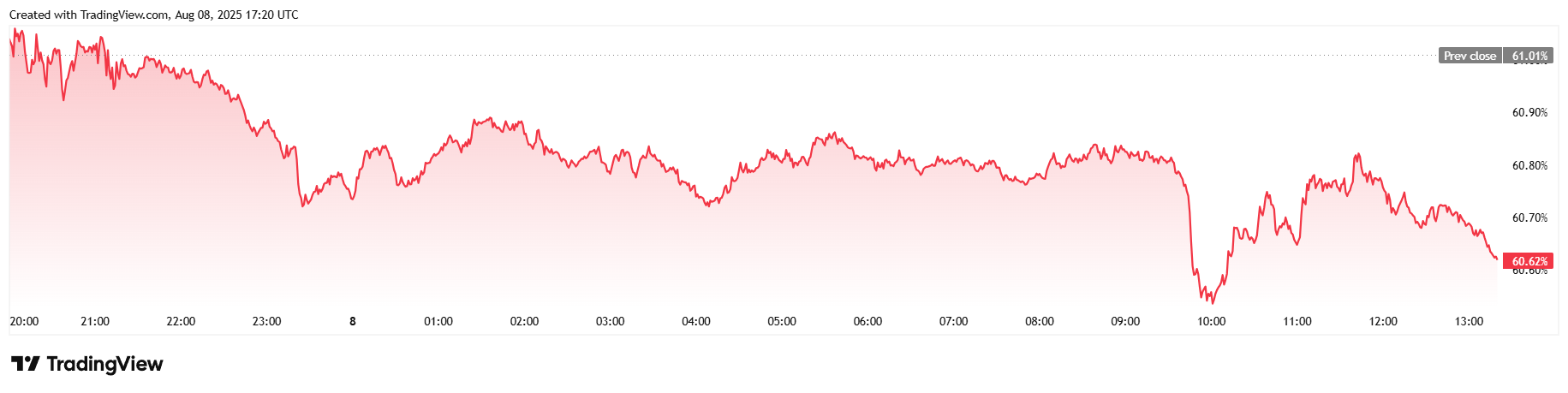

Trading volumes have risen 8.07% to $63.26 billion over the past 24 hours, but the market capitalization remained flat at $2.31 trillion. Bitcoin’s dominance fell by 0.64% to 60.62% as various altcoins, such as Ether (ETH), surpassed the flagship cryptocurrencies.

(BTC dominance/trade view)

Open interest on Bitcoin futures totaled $80.43 billion, up just 0.19%. Total Bitcoin liquidation also remained flat for 24 hours, reaching $32.86 million. A short liquidation once again ruled that overall figure, accounting for $23.47 million for all liquidations. The rest was a long liquidation, at $9.39 million.