Ethereum prices have been gaining higher and lowest prices for a while, climbing towards the key $4,000 mark.

Both technical methods and centimetrics have been pointed out more upside down, but caution is advised as the market could pull back quickly.

By Shayan

Daily Charts

Daily charts show the upward path of ETH within a large ascending channel. This uptrend began in mid-April, with prices disrupting multiple levels of resistance.

Both the 100-day and 200-day moving averages are below prices, with the 100-day MA having an upward slope following a previously bullish crossover.

As things stand, the market is very likely to be heading for a new history high in the coming months, if the channel is even broken.

However, on the other hand, a rejection from the channel’s higher trendline could push prices back into the $3,200 area.

4-hour chart

The 4-hour chart shows an interesting reworking stage, which occurs mostly after the meeting. Prices are integrated between the $3,500 to $3,800 levels, with fake breakouts and liquidity sweeps below the $3,500 zone.

Currently, prices are on the brink of breaking highs above $3,900, and in the case of impulsive follow-up, the market could launch a new offensive rally as ETH hunts at the highest ever. The RSI is also around 67, confirming bullish momentum, but suggesting a potential excess that will occur soon. But it does not mean that the market will drop, at least before the bearish release occurs.

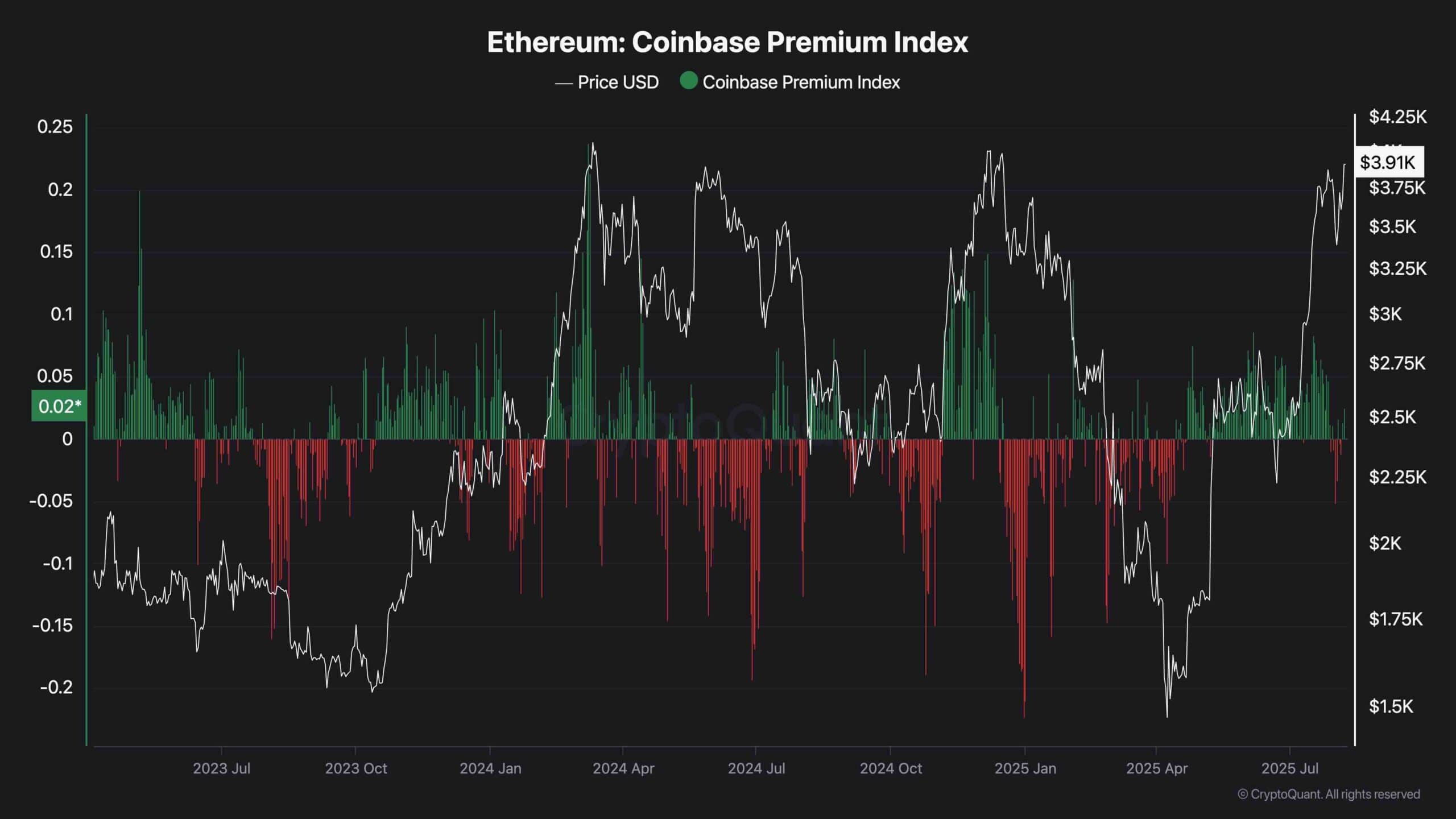

Coinbase Premium Index

The Coinbase Premium Index is a metric that measures the difference between Coinbase’s Bitcoin price and Binance price. As the chart shows, the index has mainly printed positive values since the start of the current gathering in April. This indicates that there is significant demand from American investors compared to other countries.

Looking at the past, the Coinbase Premium Index shows a positive correlation with price action.

Therefore, as the current situation suggests, the probability of further bullish price movement is higher than inversion, and market sentiment supports the upward price action seen on the technology chart.