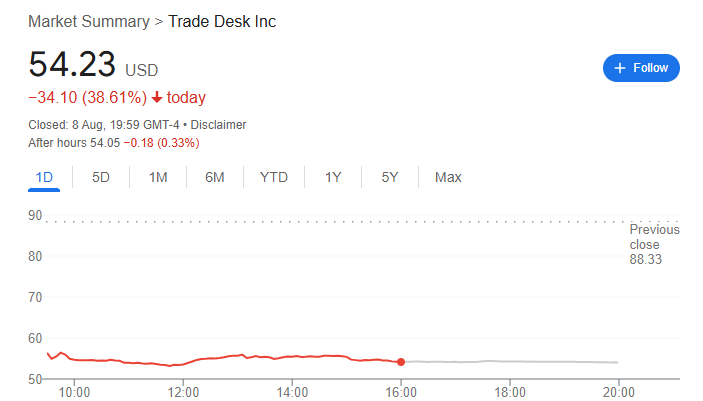

Shares of Trade Desk (NASDAQ:TTD) suffered a brutal 38% entry on Friday, closing at $54.23 on the steepest day drop on record. Since the beginning of the year, stocks have now fallen 54%.

Seloff erased a massive market value and hit BlackRock, the top shareholder, who held 26.87 million shares worth approximately $1.46 billion as of March 31, 2025.

Why TTD stock prices are collapsing

The collapse comes after Trade Desk’s second quarter results revealed slower growth, increased competition from Amazon and major leadership changes. Interestingly, the quarter marked the company’s first revenue release since joining the lucrative S&P 500.

Based on the results, Trade Desk revenues rose 19% year-on-year to $694 million, slightly surpassing Wall Street’s $685 million forecast. The adjusted EBITDA appeared at $270.8 million, raising its forecast of $261 million.

However, the revenue cap was in contrast to the outperformance of 7.1% in the last quarter, this time at 1.3%. Management was led by at least $717 million in third quarter revenue.

It is worth noting that Amazon’s advertising technology expansion has emerged as the most important headwind for the company. In particular, the e-commerce giant’s advertising revenue rose 23% year-on-year to $156.9 billion in the second quarter.

At the same time, leadership changes will be added to investor UNEASE, with CFO Laura Schenkein resigning on August 21st and board member Alex Kayyal taking over. This comes when AI entrepreneur, Rembrand CEO Omar Tawakol joined Trade Desk’s board of directors.

Wall Street is taking in TTD stocks

Meanwhile, Wall Street is also paying attention to TTD’s short-term performance. In this case, RBC Capital Markets cut its price target from $100 to $90, maintaining its “outperform” rating, calling the Trade Desk results “solid,” but warns that it has not reached its high expectations.

Meanwhile, Michael Nathanson of Moffettnathanson reduced inventory from “hold” to “selling” and reduced its price target from $75 to $45.

In addition to the bearish sentiment, both Wedbush’s Scott David and City’s Igal Aronian have downgraded their stocks to “hold.” They cited weaker growth trends, limited forward visuals, and the mounting competition with Amazon’s rapidly expanding demand-side platforms.

Featured Images via ShutterStock