Ethereum price forecast: BlackRock raises bullish hope for a $4,000 ETH

Ethereum ($eth) has returned to the spotlight after the report surfaced Black Rock– The world’s largest asset manager – purchased ETH worth $103 million. The news has rekindled bullish sentiment across the crypto market. $4,000 Resistance Level As the next big milestone.

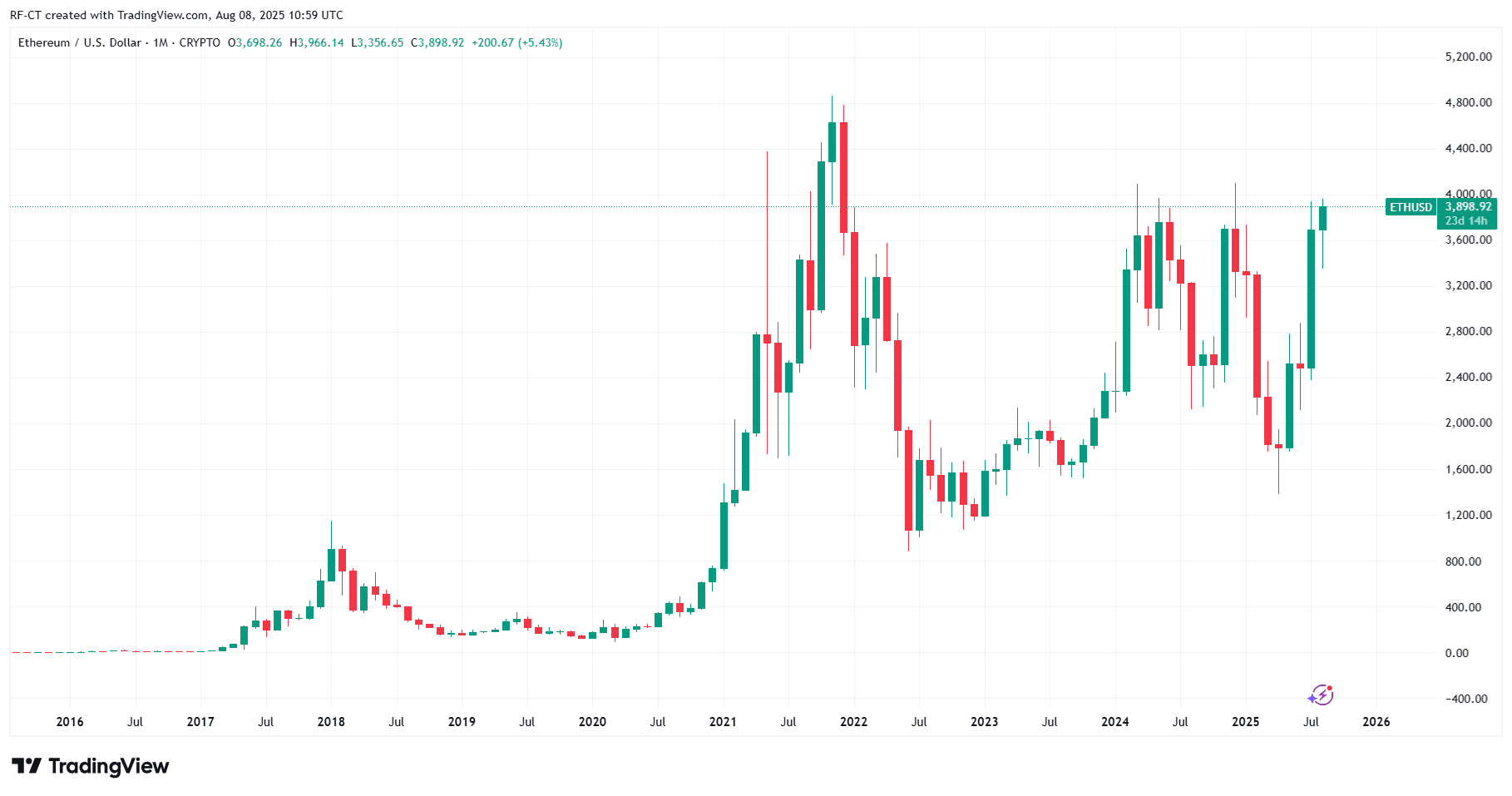

cordingView-ethusd_2025-08-08 (ytd)

Ethereum price performance

At the time of writing, ETH trades about $3,894a little above that day. Last week, tokens have been holding a tight range in between. $3,805 and $3,953suggests post-term integration of volatility.

- Immediate resistance: $3,950-4,000 (psychological and technical barriers)

- Main support: $3,800, with stronger support near $3,600 if sales pressure is increased

BlackRock’s $103 million Ethereum purchase

According to Market Chatter, the BlackRock move is one of the most important institutional Ethereum purchases to date. Although it has not yet been officially confirmed through regulatory submissions, the size of the purchase is sufficient to raise short-term sentiment.

- Institutional confidence: The BlackRock entry shows the growing acceptance of Ethereum as a facility-grade asset.

- Potential ETF play: This timing coincides with rising speculations regarding the launch of the US spot Ethereum ETF later this year.

- Market impact: Large-scale purchases could shift market liquidity and encourage retail investors to follow suits.

Technical Analysis

- RSI (Relative Strength Index): Hovering near neutrals, ETH shows that there is room for movement before hitting the acquired territory.

- MACD: Near bullish crossovers, it suggests that continuing purchases could boost upward momentum.

- Bollinger Band: The price is close to the upper band and points to possible short-term resistance before attempting a breakout.

If ETH breaks above $4,000 With a strong volume, the next target is around $4,150-$4,250. Otherwise, you may see a level of support for retesting the price.

Basic drivers beyond Black Rock

- Growth of the Ethereum Network: Rising Defi activity and NFT volume continue to drive demand for ETH gas prices.

- On-Chain Metric: Active addresses and staking participation are healthy and demonstrate steady user engagement.

- Macro factors: The US Federal Reserve policy and broader risk-on sentiment in equities and crypto play a role in the direction of ETH.

Ethereum price forecast

- Short term (1-2 weeks): If bullish momentum from BlackRock News is held, ETH could try and break $4,000.

- Medium period (1-3 months): A confirmed breakout may push towards ETH $4,250-$4,500especially if ETF approval rumours gain traction.

- Bearish scenario: If you don’t break $4,000, your ETH could potentially drift back towards the $3,600 support zone.

cordingView-ethusd_2025-08-08 (All)

The $103 million Ethereum purchase reported by BlackRock adds a new bullish side to ETH’s market outlook. While $4,000 resistance remains a horrifying barrier, institutional benefits combined with sound technical indicators suggest that bulls have a fighting chance.

💡 Where to buy ETH: Compare Top Exchanges here

📊 Live ETH Price: Find Ethereum prices in real time