GlassNode data could mean that Ethereum’s price dynamics are more affected by derivatives and other off-chain markets compared to Bitcoin.

CBD data shows divergence of spot activity in Bitcoin and Ethereum

In a new post from X, on-chain analytics firm GlassNode spoke about how the cost-based distribution (CBD) has recently diverged between Bitcoin and Ethereum.

CBD refers to an indicator that conveys the address or investor to the network address or investor that was last purchased at each price level visited by a cryptocurrency in its history.

This metric is useful as investors are particularly focused on their own unbreakable levels and tend to make some move when that retest occurs. The more assets a holder has purchased at a certain level, the stronger the response to retesting.

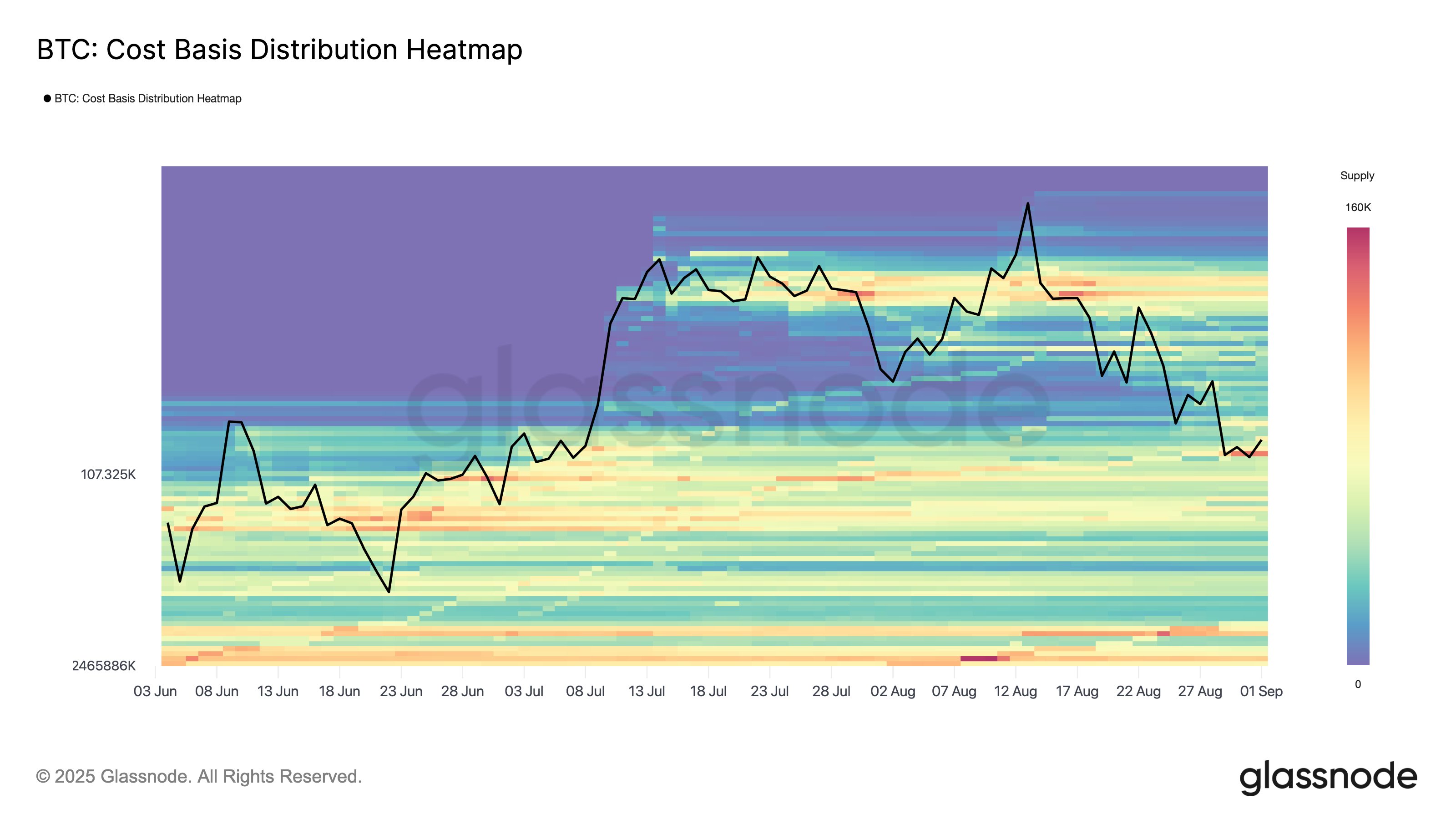

Well, first of all, there is a chart showing the trends in Bitcoin CBD over the last few months.

Looks like BTC is currently retesting a major demand zone | Source: Glassnode on X

As shown in the graph above, Bitcoin CBD got a big “air gap” when Bitcoin saw an explosive rally in July. This happened because BTC was too fast to buy and sell, and the price level was too fast to receive the cost base to them.

Once the BTC was integrated after the rally was cooled, the levels began to fill with supply. The same continues at the latest stage of decline, and now the previous air gap has disappeared. This indicates that demand for spot trading in cryptocurrency is being maintained.

Bitcoin has seen this trend, but CBD behaved differently against Ethereum, the second largest asset in the sector.

How the CBD has changed for ETH over the past few months | Source: Glassnode on X

It is clear from the chart that Ethereum’s gatherings also created gaps in air, but unlike Bitcoin, its slowing stages are not filled to a noticeable degree. “This suggests that ETH price dynamics could be more affected by the off-chain market impacts, such as derivatives,” GlassNode said.

Historically, price actions built on products such as derivatives have often proven to be more volatile. Given that Ethereum is currently not observing high-level spot purchases, it’s not just a look at what the fate of the Bull Run is.

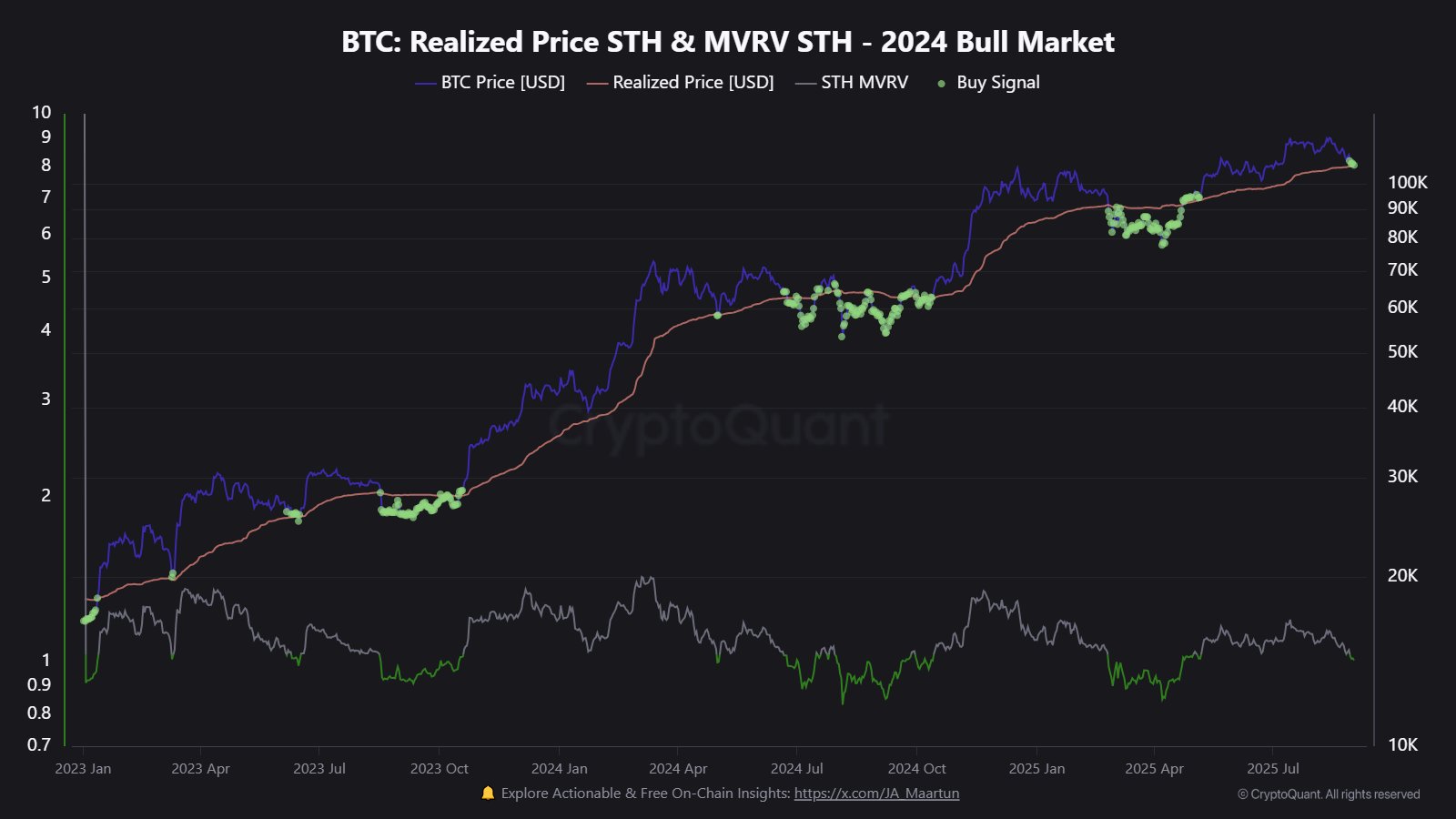

In some other news, Bitcoin has been trading near a critical on-chain cost base level after the recent price drop.

The trend in the Realized Price of the BTC short-term holders | Source: @JA_Maartun on X

The level of question is on an average cost basis for short-term holders and investors who have purchased Bitcoin within the last 155 days. In the past, losing levels often resulted in a short-term shift to the bearish stage.

ETH Price

Ethereum has recently fallen to $4,270 after a 6% weekly pullback.

The price of the coin appears to have gone down recently | Source: ETHUSDT on TradingView

Featured images from Dall-E, Cryptoquant.com, GlassNode.com, Charts from cordingView.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.