Bitcoin prices are under pressure after retreating from a record high earlier this month, exceeding $124,000. At the time of writing, BTC is trading at $113,146, reflecting an 8.7% decline from its recent peak, but has recorded a modest 1.8% increase daily.

The movement highlights ongoing volatility as investors weigh both on-chain metrics and broader market sentiment to determine whether they can regain bullishness.

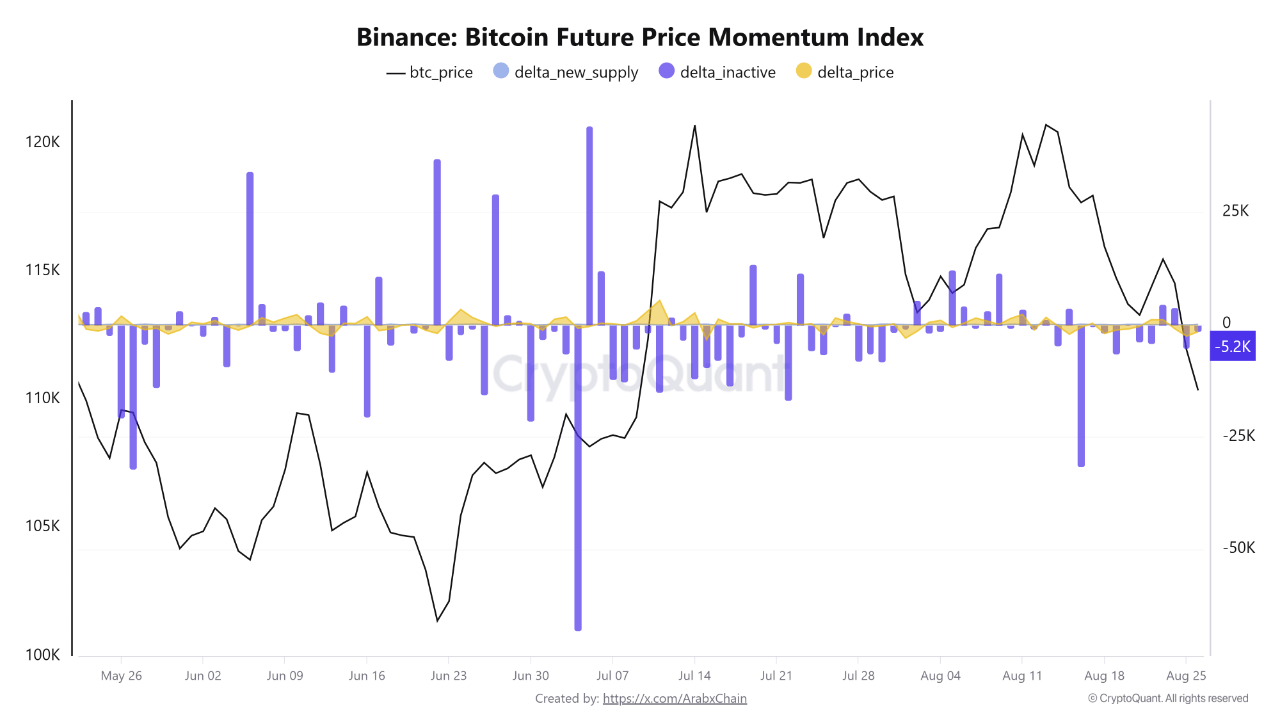

Analysts point to changes in behavior among large traders, particularly changes in Binance, which is the exchange at the world’s largest volume. According to Arab chains, a contributor to Cryptoquant’s Quicktake platform, the activities of large-scale holding investors have played a key role in recent revisions.

His analysis of trading activities in August suggests that weakened momentum and new sales pressure could explain Bitcoin’s inability to maintain its highs.

Whale activity in binance shows weakening momentum

Throughout July, the Arab chain said Bitcoin had fluctuated between $118,000 and $122,000, which it described as a “trendless” market with low volatility and limited directional movement.

During this period, an inactive delta measuring the circulation of old coins has declined, suggesting that the whales have suspended sales or temporarily left the market. However, by mid-August, the trend has reversed as the inactive deltas surge, indicating that longer coins have been moved again and potentially sold.

This activity coincided with a decline in Bitcoin below $112,000, with the delta indicator remaining close to zero and no clear purchasing pressure. The Arab chain explained that a lack of demand in the midst of an increase in coin circulation usually results in corrections.

“Large investors are selling again without a strong wave of new buyers appearing to balance their effectiveness. This is not the end of the bull cycle, but momentum is beginning to lose steam,” he said. He added that future price movements could depend on whether new catalysts such as macroeconomic development and institutional influx can rekindle demand.

Bitcoin exchange data highlights mixed emotions

Another encryption analyst, Traderoasis, looked into several metrics to provide further context. He observed that the Coinbase Premium Index, which compares US exchanges and trading activities between global platforms, showed accumulation even as prices fell.

This suggests that some investors, perhaps institutions, were buying during the dip. However, he flagged it carefully considering that his funding rate remains positive, and there are indications that traders are still bullish even if prices drop, raising concerns about the risk of a liquidity reset.

Traderoasis also pointed out the number of favorable interests or outstanding derivative contracts as key factors. He argued that open interest often serves as support or resistance compared to spot prices. Currently, open interest is above market prices. This can act as a resistance unless it breaks. “If this level is broken, the price will continue to rise,” he pointed out.

Together, these insights reveal complex backgrounds. While long-term recruitment indicators and institutional purchases remain supportive, short-term dynamics indicate the potential for cautious sentiment and volatility.

With whales being sold, stubcoin inflows increasing and derivatives markets intensifying, Bitcoin’s next move could depend on whether demand can be reasserted strongly enough to offset recent profits.

Special images created with Dall-E, TradingView chart