On-chain data holds more than half of Ethereum’s supply by just 10 addresses. Here’s how other ETH-based tokens, like Shiba Inu, stack up:

Shiba Inu, Uniswap and Ethereum are one of the most centralized ETKENs

In a new X post, on-chain analytics firm Santiment talked about how the various assets in the Ethereum ecosystem line up with each other in terms of supply that are concentrated in the top 10 wallets.

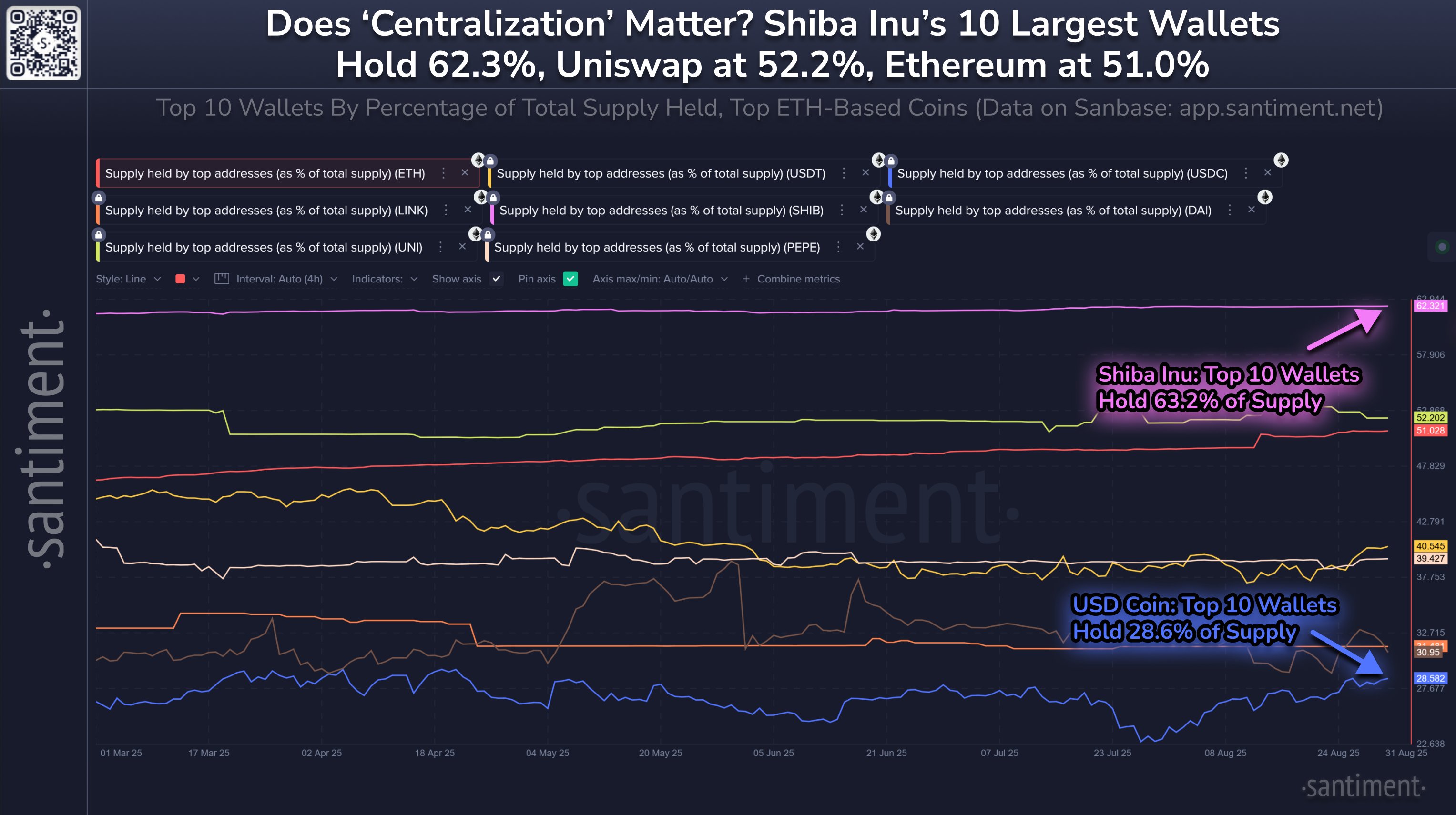

Below is a chart shared by Santiment, which shows trends in this metric for eight cryptocurrencies over the past few months.

Looks like SHIB is at the top of the list at the moment | Source: Santiment on X

From the graph, we can see that 51% of Ethereum supply is owned by the 10 largest wallets on the network. This is more than most of the other ETH-based tokens on the list.

The two coins ahead of this metric are Shiba inu (Shib) and Uniswap (uni). The latter is slightly ahead of ETH at a 52.2% value, while the former is well ahead at 62.3%.

Generally, a supply of cryptocurrency, which is heavily concentrated in just a hand, does not tend to be a constructive signal, as it means that there are fewer players needed to move through the market.

Beyond market dynamics, supply centralization has another drawback. This can weaken your network security. A chain like the execution of Ethereum in a consensus mechanism called The Proof-of-Stake (POS). Under this system, a valtter called a staker must lock the stakes in order to have the opportunity to add the next block to the chain.

The more Haiter is the interest of the validator, the more likely they are to be chosen. If a single staker exceeds the 51% supply threshold, in theory you have full control over the blockchain.

This type of attack does not exist in Bitcoin. Bitcoin uses a Proof of Work (POW) consensus mechanism instead. In POW networks, miners compete with each other using computing power. However, once again, if the validator gains more than 51% control of the network computing resources, the BTC can be shaped to your will.

Considering that Ethereum only has 10 holders controlling 51% of its supply, if these entities come together, they can attack the network. But the chances that this could happen are very slim.

Still, the fact that things like Eth, Shib and Uni are particularly centralized to just a few holders is worth noting. In contrast, other ecosystem tokens such as USDC (28.6%), DAI (31%), and ChainLink (31.5%) are in healthy zones in terms of this metric.

ETH Price

Ethereum has raised its price to $4,380, seeing a nearly 4% surge in the last 24 hours.

The price of the coin seems to have shot up over the past day | Source: ETHUSDT on TradingView

Featured images from charts on Dall-E, santiment.net, and tradingview.com

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.