Ethereum (ETH) has expanded today’s downward trend, leading to liquidation and liquidation of crypto traders and losses for millions.

This comes amid a wider decline in the crypto market. Major cryptocurrencies continue to suffer losses, and today is no exception.

Ethereum Market Modifications Attack Traders Violate

Data from Beincrypto Markets showed that ETH had slipped 7.3% since the beginning of the week. This DIP follows the rise to the second-largest cryptocurrency rise to multi-year highs.

Ethereum’s value has declined by 1.54% over the past day alone. At the time of writing, it was trading for $4,166.

Ethereum (ETH) price performance. Source: Beincrypto Markets

The revision is typical, but has proven expensive for those who bet on the upside in the market. Coinglass data reveals that total liquidation has reached $486.6 million over the past 24 hours.

This figure reflects the liquidation of 136,855 traders. Ethereum is facing a decline in the market, with its $199.8 million position being settled. Of this, $155.15 million came from a long position.

Blockchain analytics firm Lookonchain has recently highlighted traders who have long profited Ethereum by millions.

Traders started four months ago with a deposit of $125,000 to high liquids. He strategically entered his long positions in ETH on two accounts. The trader used his profits to raise his position to 66,749 ETH.

This strategy has resulted in his total stock surges from $125,000 to an impressive $29.6 million. Additionally, earlier this week, the trader closed all 66,749 long ETH positions, securing a profit of $6.86 million.

However, amid the recent market crash, traders re-entered the ETH market, but were eventually liquidated, losing $6.22 million in the process.

“Starting at just $125,000, he grew his account to $699 million (more than $43 million peak), and now only $771,000 remains. In just two days, four months’ profits have been wiped out,” Lookonchain said.

High-risk leverage trader James Wynn also experienced partial liquidation. LookonChain reported that Wynn opened a 25x leveraged length against ETH after claiming 19,206.72 USDC (USDC) in referral reward. Nevertheless, his position was partially liquidated as the market moved south.

“James Wynn’s ETH Long was partially liquidated, leaving him with a long position at $71.6 ETH ($300,000),” the post read.

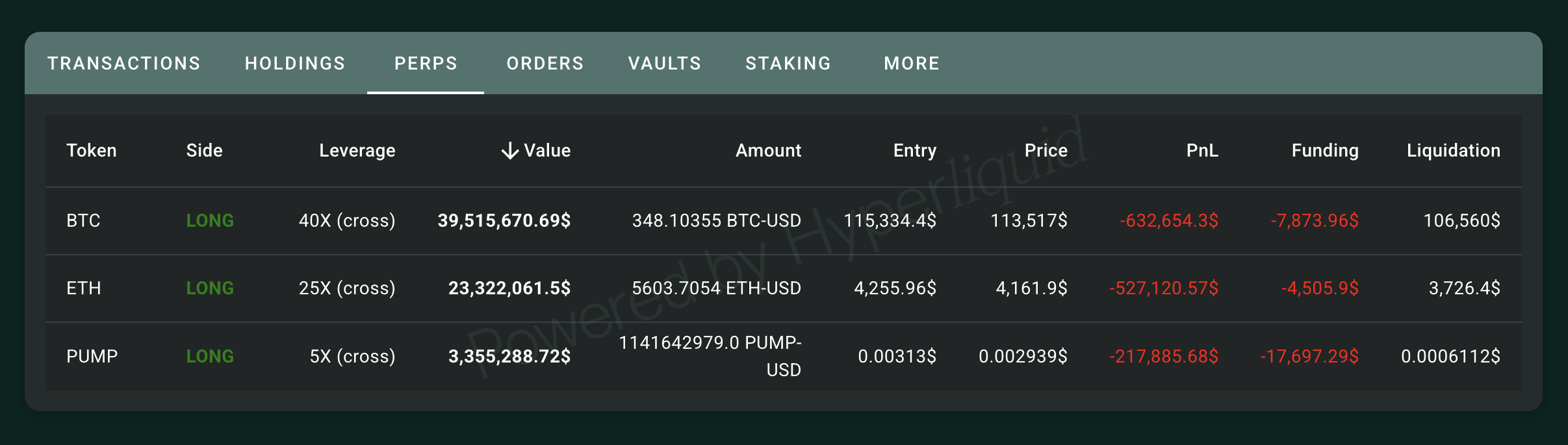

Additionally, the blockchain analytics company noted that traders made 1 million USDC deposits to high lipids yesterday. This fund was used to open long positions of maximum leverage to ETH, Bitcoin (BTC), and Pump.Fun.

Nevertheless, Hypurrscan’s latest data showed traders currently face unrealized losses of over $1 million.

Loss of long positions for high lipid liquid traders. Source: Hypurrscan

Institutional investors buy dip

Amid widespread liquidation, institutional investors are using ETH dip. Bitmine Immersion, the largest public ETH owner, acquired 52,475 ETH, pushing its total ETH shares to 1,575,848 ETH, worth nearly $6.6 billion.

“Sharplink bought 143,593 ETH ($667 million) for $4,648 last week and currently owns 740,760 ETH ($31.9 billion). Along with Bitmine, we bought 516,703 ETH ($22.2 billion) last week,” writes Lookonchain.

Additionally, two institutional related wallets, 0x50A5 and 0x9BDB, received 9,044 ETH, about $38 million from Falconx. In addition to purchasing, panic cellars were also common.

Whale is a panic cellar $eth as the market plummets!

0x1D8D deposited $17,972 ETH (77.4m) at #coinbase an hour ago.

0x5A8E has deposited 13,521 $ETH ($57.72M) with #Binance in the last 12 minutes.

deposited to 0x3684 3,003 $eth ($12.89m) 20 minutes ago. …pic.twitter.com/oxkpqsl9nv

– lookonchain (@lookonchain) August 19, 2025

This highlights the diverse strategies investors employ in response to market conditions. Still, purchasing the facility shows strong confidence in Ethereum’s long-term potential.

Ethereum Post Ethereum Dip triggered a trader’s $1 million loss.