Tokenization Platform Securitize predicts that Ethereum will become the future hub of the real world assets (RWA) market, pointing to the possibility of blockchain dominance and trillion dollar opportunities in institutional adoption.

In a guest thread posted on Ethereum’s X account, Securitize’s CEO and founder Carlos Domingo pointed to the $26.5 billion sector growth in the tokenized market, with Ethereum hosting $7.5 billion worth of tokenized RWA and $5.5 billion tokenized Toreas, gaining a 72% market share share.

“It’s where institutions deploy capital,” the company wrote, adding that even a 1% slice of RWA opportunities over $20 trillion can unlock more than $200 billion in chain value.

Domingo described 2025 as the year “RWAS found a real utility-on-chain,” highlighting faster settlements as key institutional incentives for adopting daily dividend payments, programmerity, and tokenization.

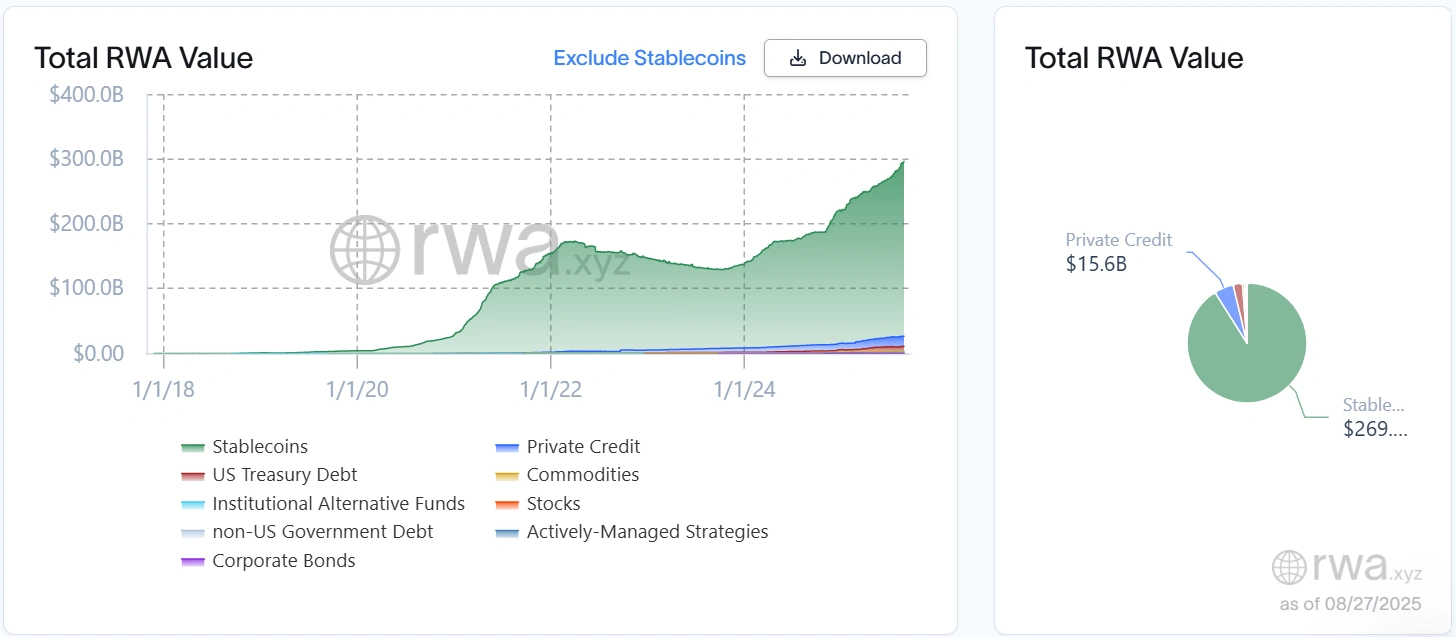

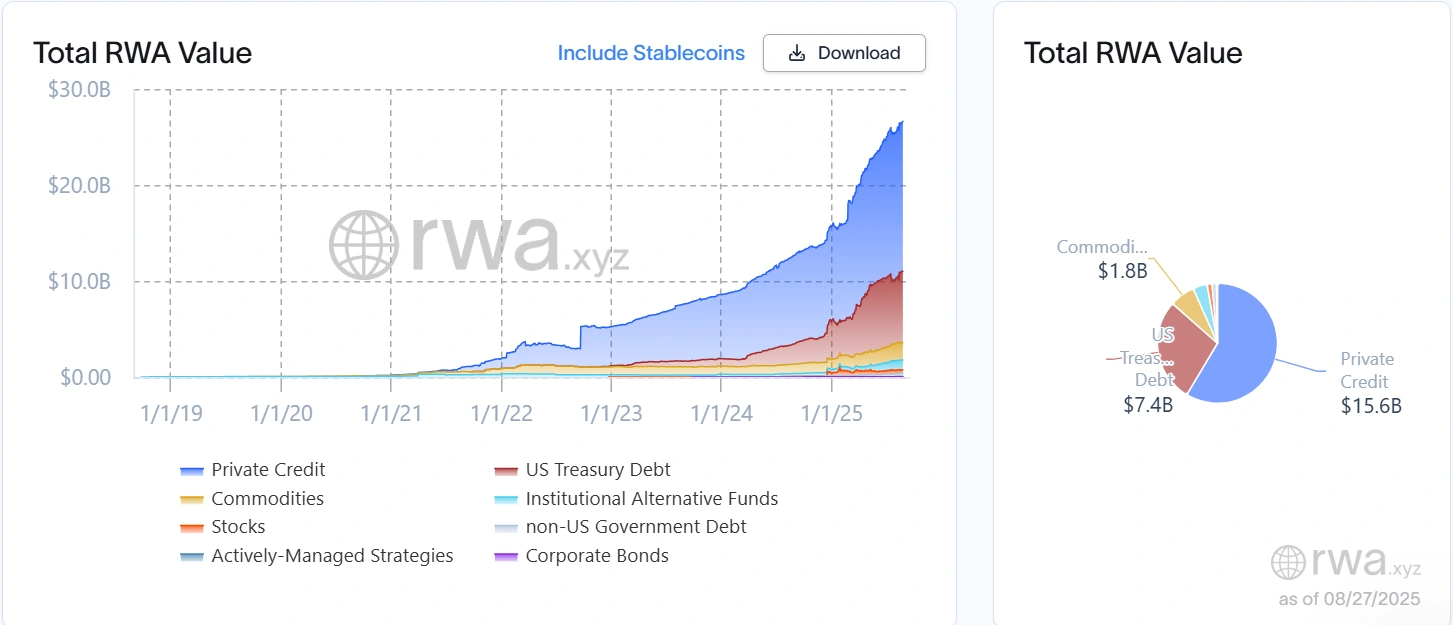

Global market overview of total RWA values. Source: rwa.xyz

Ethereum grip against RWA tokenization

Ethereum has emerged as the main blockchain for RWA, tokenized by market capitalization. According to data from RWA.xyz, the network accounts for more than half of all tokenized assets, with over $7.5 billion minted in its mainnet.

Considering Ethereum Layer 2 networks such as polygon, arbitrum, mantle, optimism, and more, the share will grow even further if it, along with the main chain, accounts for about 85% of the securitized tokenized assets related to Ethereum’s mainnet.

Industry analysts say Ethereum’s advantage is the product of its deep liquidity pool, complexity with distributed financial (DEFI) protocols, and regulatory token standards such as the ERC-1400 and ERC-3643.

“Ethereum provides the most secure, configurable, and censor-resistant foundation for tokenized financial products,” Domingo said in the thread.

We guarantee adoption of the system to gather pace

A global market overview of total RWA values, excluding Stablecoin data. Source: rwa.xyz

Key asset managers have already experimented with large-scale tokenization, with almost all flagship projects pinning in Ethereum.

BlackRock’s Buidl fund, issued primarily in Ethereum via Securitize, has grown to over $2.4 billion, making it the largest tokenized financial vehicle on-chain. Apollo’s $110 million Acred Private Credit Fund and Vaneck’s $75 million VBill tokenized Treasury are also live in Ethereum, in addition to Hamilton Lane’s $9.6 million scoped vehicle.

Securitize itself has filled more than $3.36 billion in tokenized assets and has become the world’s largest tokenized platform. Ethereum has more than $3.36 billion in seats. The company also argues the distinction that five tokenized RWAs are worth more than $100 million. This is most of most providers.

For institutions, the pitch that draws them into the blockchain exceeds cost savings. Domingo noted that he sees asset managers can distribute dividends daily in place of a quarter, “they see the opportunity right away.” He described the changes in payment cycles and value delivery as Wall Street’s “light bulb moment.”

Domingo points out that the utility, liquidity and complexity of the Defi protocol define the next stage of tokenization. In reality, this could mean the equity and credit instruments used in the lending market, or the funds that tap on tokenized assets to optimize capital efficiency.

“Ethereum is tokenized with Ethereum because it is instantly programmable and always on,” the founder of Securitize said, adding that infrastructure for mainstream adoption is currently in place.