Hyperliquid answered the challenges of new, lasting DEX by opening infrastructure for user-created markets. DEX becomes a permanent platform with built-in deployed using independent liquidity and margin rules.

The major, lasting future Dex, Hyperliquid answered the challenges of its competitors by evolving into a platform for creating new markets. Exchange founder Jeff Yan has announced the HIP-3 infrastructure that will enable Builder to create deployed markets.

As cryptopolitan It has been reported Previously, high lipids have struggled to maintain the appeal of their platform and boost native hype tokens. Upgrades and additions allow you to keep high lipids ahead of your competitors. The HIP-3 market could arrive early next month, allowing for more diverse assets trading, including tokenized RWAs. The platform allows builders to turn any market into a permanent pair of futures, tapping on a wider range of assets outside of crypto.

A permanent new infrastructure that has been depleted with builders known as HIP-3 was presented in one of Hyperliquid’s mismatched channels. The first launch will require a 500K hype bet, reduced from the original intention of the 1M hype stock. As infrastructure matures, the requirements for deploying new, permanent markets decrease.

Initially, the deployer can launch a specific Dex Margin Rules Isolated fluidity. In the future, Hyperliquid plans to build multiple permanent market opportunities for each deployer. The HIP-3 infrastructure is a bug bounty program that detects some flaws before deploying MainNet, available on TestNet. Hyperliquid is aware of bugs and is preparing fixes, but uses them to drive team engagement.

High lipids provide a more diverse market

Hyperliquid plans to sell rights to the HIP-3 market at a Dutch auction. Each new market will launch free of charge with up to three assets, and hold auctions for each additional permanent pair.

New markets become more diverse and receive all assets as collateral. It also costs twice as much as Builder Deployed Dex, but high lipids require a 50% reduction.

New markets could expand asset selection and create isolated liquidity in certain projects that also want their own permanent DEX. The platform will evolve with additional silly things to be determined in the future.

Permanent Dex extends volumes to new records every day

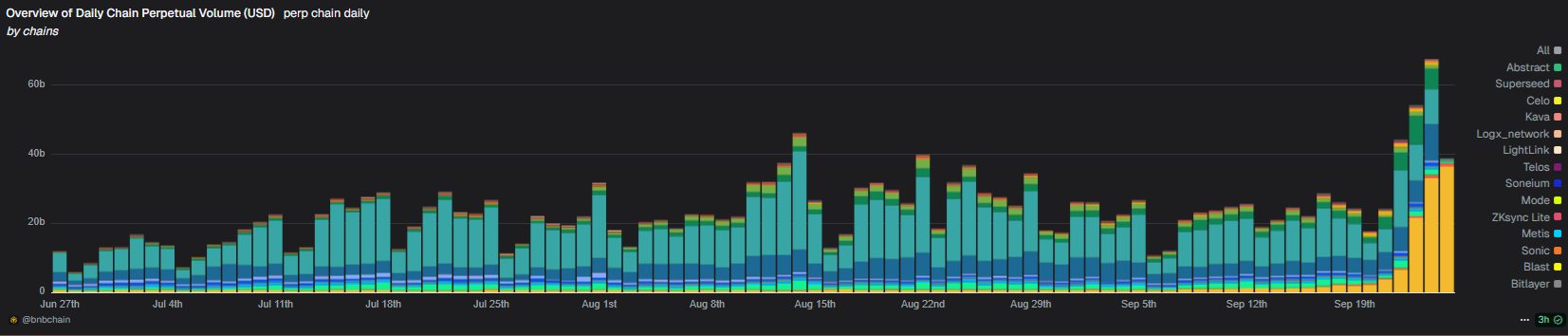

Over the past week, Aster’s success has rapidly spread the story of a lasting Dex. This trend further affected small markets, with multiple older permanent DEXs expanding their volume.

Dex Dex was boosted by the success of Aster Dex, and Dex picked up the activity. Some small exchanges increased the daily volume by 80% within days. |Source: Dune Analytics

Aster has put the BNB Smart Chain in the spotlight as a venue for permanent futures trading. Over the past few days, the total volume of the 24 major DEX market exceeded $67 billion, with Aster, Lighter and Hyperquid reaching their highest shares.

Some of the emergent permanent DEXs have questioned the organic nature of volume growth, increasing volume by 80% in one day. Small markets like Edgex and Paradex are also trying to ride the waves and compete with visible markets.

The competition knocked out the hype token to $42.45, but Aster also fell to $1.92. Also, as key assets are moving into the lower price range, Permanent DEX must face another market slump.