According to Token Terminal, the total value locked (TVL) across all applications on the Solana (SOL) network reached an all-time high of $42.4 billion. The rise in TVL indicates the increasing adoption of applications built on SOL networks. Despite TVL’s growth, SOL’s price continues to slump amid the overall market decline. Let’s discuss when SOL will rebound.

Will Solana recover after TVL hits all-time high?

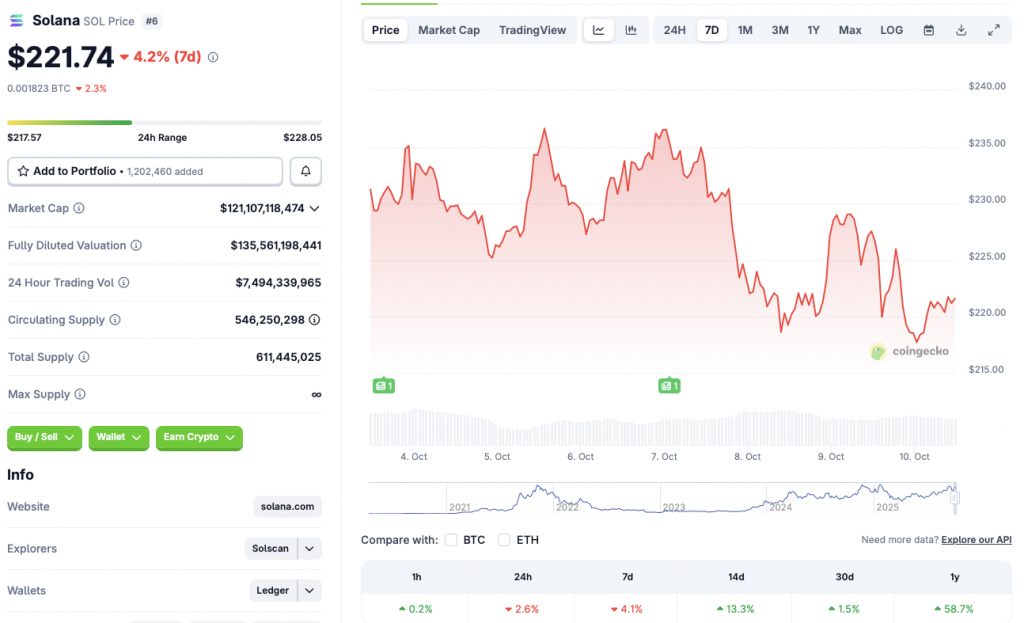

The cryptocurrency market started to rise earlier this month, with Bitcoin (BTC) hitting a new all-time high of $126,080. Solana (SOL) also followed a bullish trajectory and regained the $236 price level. However, the rise did not last long. The market faced a sharp correction, and SOL’s price fell to $220. SOL is currently facing some support at the $220 price range.

According to CoinGecko’s SOL data, Solana has fallen 2.6% in the past 24 hours and 4.1% in the past week. However, this asset remains profitable on other time frames as well. SOL is up 13.3% on the 14-day chart, 1.5% month-over-month, and 58.7% since October 2024.

The cryptocurrency market is likely to recover in the coming weeks. October is typically a bullish month for the crypto market. This time too, it is likely to follow a historical pattern.

Furthermore, the Fed is likely to introduce further rate cuts after its next meeting. Bullish historical data and potential rate cuts could spark another bull run for Solana (SOL) and the larger crypto market.

The US SEC is also expected to decide on the application for the Spot Solana (SOL) ETF on October 10th, and a positive decision could lead to big gains for SOL. However, the SEC may even decide to postpone a final verdict.