Ethereum’s bullish structure is starting to show early signs of exhaustion as the price retreats from the $4,400 resistance zone. Despite maintaining a strong medium-term uptrend, localized bearish divergences and recent changes in market structure have weakened short-term momentum.

The next few days will be key in determining whether this is just a healthy correction or the beginning of a deeper decline.

technical analysis

Written by Shayan

daily chart

On the daily time frame, ETH remains within a long-term ascending channel, but once again failed to break out of the $4,800 resistance area. The asset is currently falling towards the lower trendline of the channel and the 100-day moving average at $4,000.

The RSI has also fallen to 49, indicating that although the bullish momentum has faded for now, it is not yet bearish. As long as this structure holds above $4,000, the broader trend remains intact. However, a loss of that level could open the door for a further rally to the next key demand zone at $3,400.

4 hour chart

Looking ahead after 4 hours, ETH has confirmed a change in market structure (MSS) after failing to sustain highs near $4,800. A clear bearish divergence in the RSI supported this move, indicating a decline in momentum prior to the decline. Prices are currently in a short-term correction phase and may revisit the $4,200-$4,100 zone, consistent with previous demand.

For buyers to regain control, ETH would need to regain $4,500 and invalidate the recent low-to-high formation. Until then, the short-term bias remains slightly bearish within the context of a broader bullish channel.

sentiment analysis

Open interest

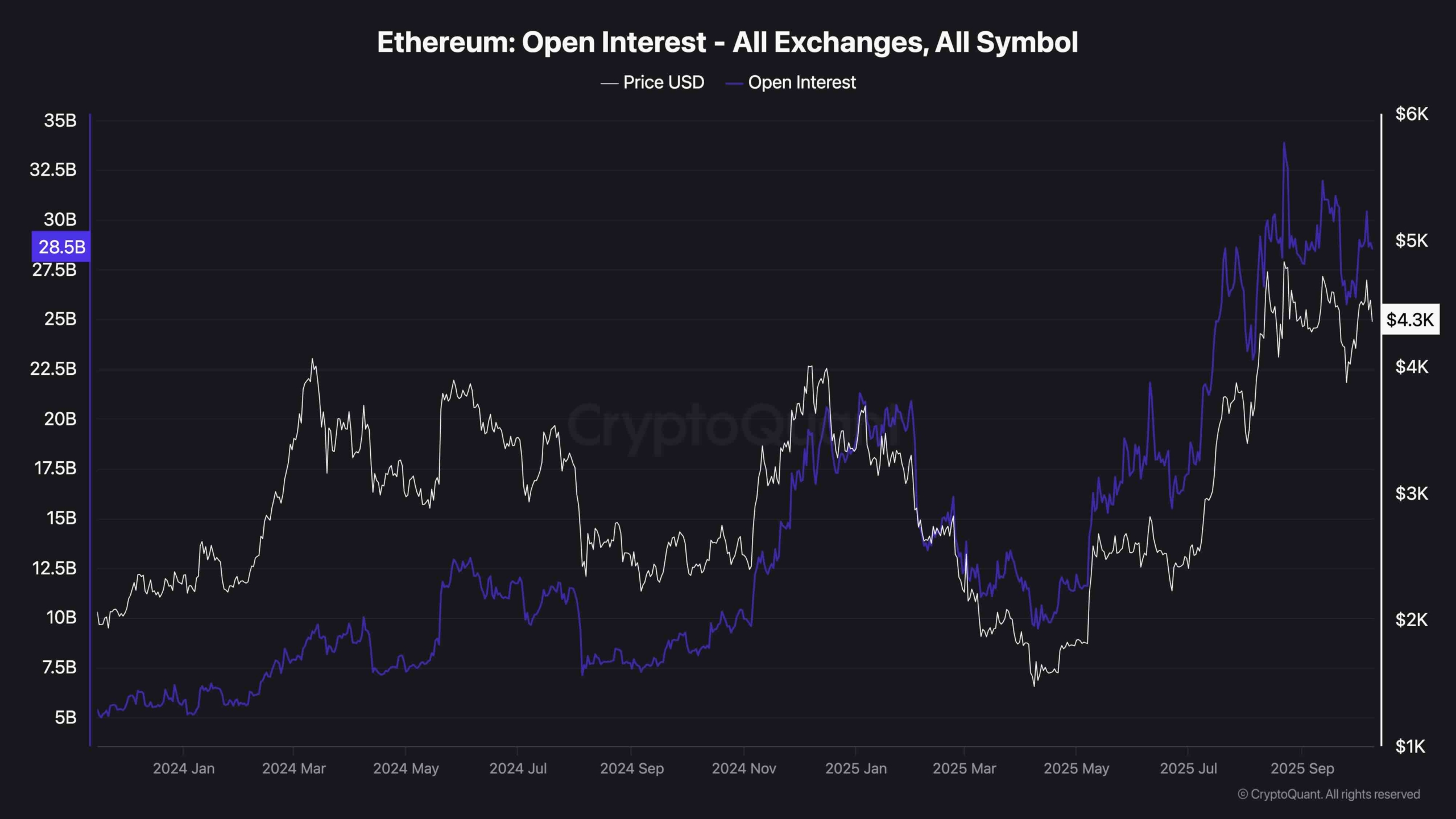

Open interest across all exchanges remains elevated at around $28.5 billion, indicating that the position of derivatives traders remains heavy despite the recent decline. This suggests strong speculative interest, but it also means that markets are more likely to be liquidated when volatility increases.

If open interest remains high while the price trend declines, it could trigger a cascade of forced long liquidations before a suitable bottom forms. Conversely, a gradual cooling of open interest during this correction could signal a healthy reset of leverage, setting the stage for ETH’s next leg higher.