Bitcoin prices are nearing all-time highs, supported by increased open interest. Price trends are above key levels and market structure remains bullish.

summary

- Bitcoin is testing the $123,348 resistance level, the last significant barrier before a new all-time high.

- The channel structure remains bullish with consecutive highs and lows.

- Open interest is rising, confirming demand and supporting continued bullishness towards $131,000.

Bitcoin (BTC) momentum continues to build as the price approaches the upper bound of its long-term trading channel. After defending the channel below the confluence with the control point, BTC began a rally to the high timeframe resistance zone at $123,348. This region is currently the last barrier before reaching new all-time highs.

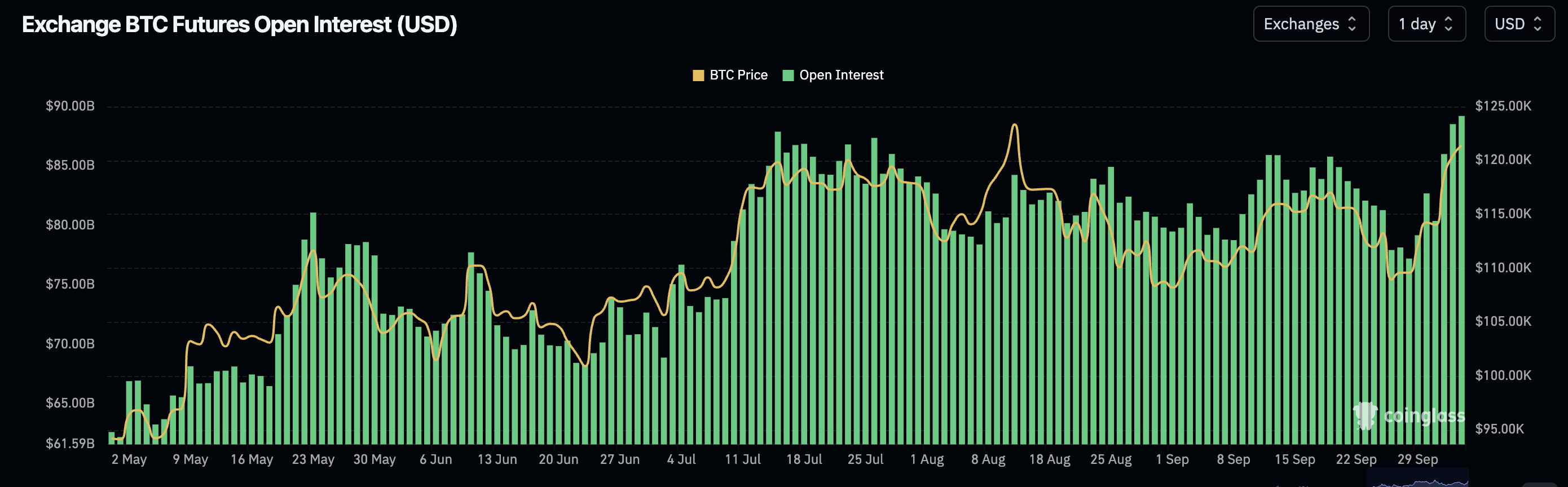

Open interest has increased in tandem with the price, supported by healthy demand and increased market participation. This strength, along with BTC’s return to the $120,000 level, increased Strategy’s Bitcoin holdings to $77.4 billion, confirming confidence from major institutional investors.

Important technical points for Bitcoin price

- Bitcoin is testing the high resistance level at $123,348, the last barrier before making a new all-time high.

- The channel structure remains intact, with successive highs and lows.

- The increase in open interest confirms strong demand and supports the current bullish expansion.

You may also like: Stock Market News: S&P 500 Gains Gains as Government Shutdown Delays Jobs Report

BTCUSDT (1D) chart, source: TradingView

Bitcoin’s price structure continues to respect established trading channels. Each pivot, represented by a major dollar level on the chart, maintains a bullish structure. The most recent respect occurred at the channel low, coinciding with the control point and creating the perfect launching pad for a bullish rally. This reaction sent Bitcoin into the resistance at $123,348. This zone is an important zone to watch right now as the market prepares for a potential breakout.

You may also like: If the SEC approves the DOGE ETF this month, will the price of Dogecoin reach $1?

If this resistance is decisively regained, the market opens the door to a “blue sky breakout” and price discovery takes Bitcoin into uncharted territory. Historically, such situations lead to increased volatility as liquidity declines beyond all-time highs. The next logical target within the channel is the $131,000 area, which coincides with the channel’s upper resistance line.

Market structure continues to support this bullish scenario. The sequence of higher highs and higher lows remains intact, highlighting the strength of the uptrend. Each expansion is followed by a healthy correction, keeping the trend sustainable. This controlled progress adds credence to the idea that Bitcoin is not only rising, but building a structurally sound foundation for continuation.

BTC Open Interest, Source: Coinglass

The increase in open interest is another confirming factor. As prices increase, the number of active positions in the market also increases. This coincidence of rising prices and growing open interest shows that the move is being driven by real demand, not just short-term speculation.

In previous cycles, increased open interest coupled with a bullish structure has been a harbinger of a continued strong rally. Reflecting this growing optimism, major Wall Street banks are even predicting that Bitcoin could rise to $231,000, highlighting the scale of bullish expectations building in the market.

What to expect from future price trends

Bitcoin remains bullish from all technical standpoints including price structure, market structure, and open interest. A break above $123,348 is likely to accelerate momentum towards $131,000, where channel resistance exists. Traders should expect increased volatility in the blue sky area as open interest is rising, but the setup favors a continuation of the rally.

read more: As the market enters an oversold situation, will Pi Network’s price be able to defend and reverse its year-to-date lows?