According to asset management firm VanEck, network revenue across the blockchain ecosystem in September decreased by 16% month-on-month, mainly due to lower volatility in the cryptocurrency market.

Governance proposals to reduce gas fees by more than 50% in August caused Ethereum network revenue to decline by 6%, Solana’s revenue to decline by 11%, and Tron network to record a 37% fee reduction, according to VanEck’s report.

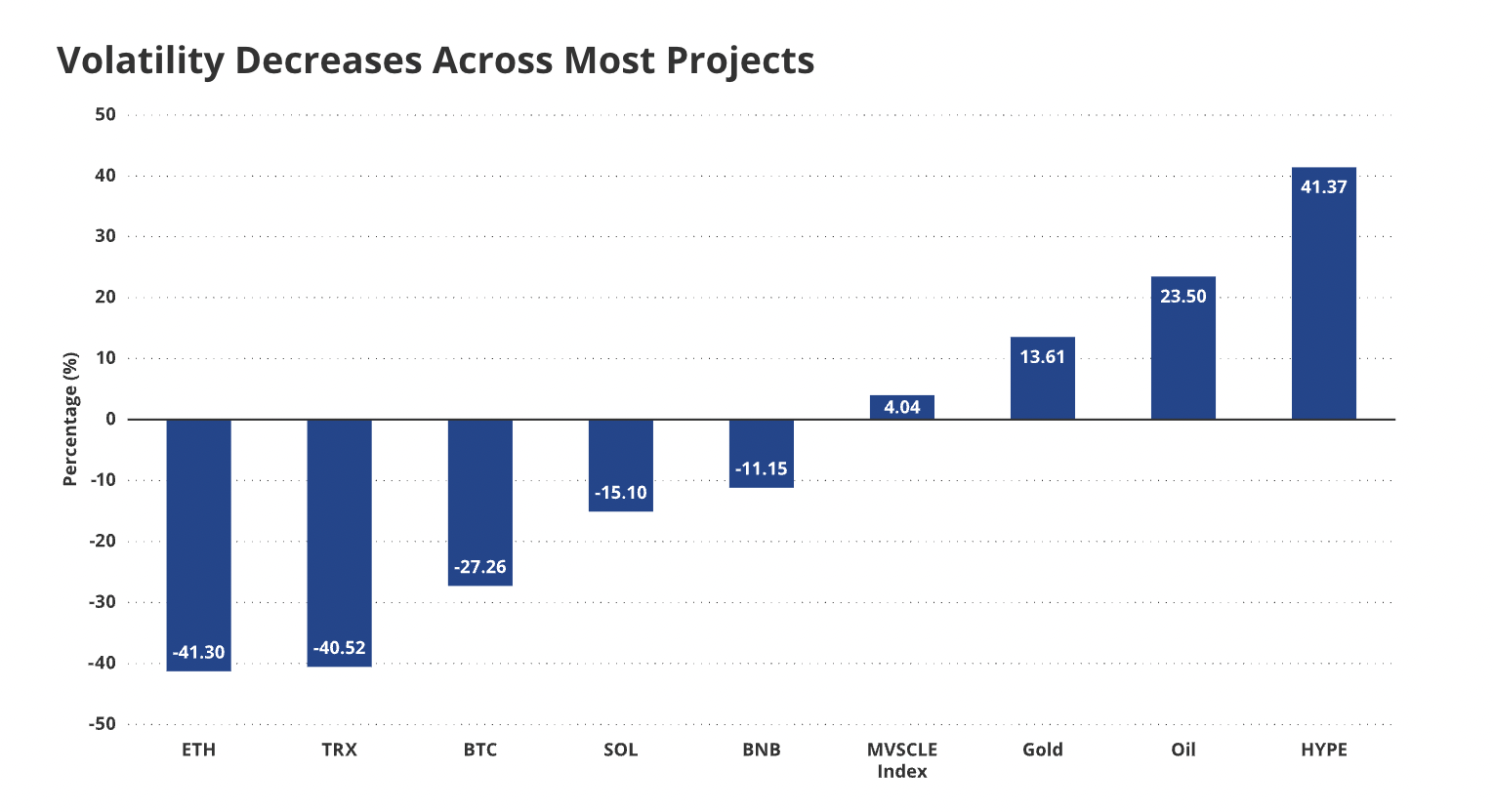

The decline in returns on other networks can be attributed to lower volatility in the crypto market and the underlying tokens underpinning those networks. In September, Ether (ETH) volatility fell by 40%, Sol (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26%.

Volatility for most cryptocurrencies decreased in September. sauce: Van Eck

“Reduced volatility in digital assets reduces arbitrage opportunities that force traders to pay priority fees,” the report’s authors explained.

Network revenues and fees are important indicators for the economic activity of the cryptocurrency ecosystem. Market analysts, traders, and investors monitor network fundamentals to assess the overall health of specific ecosystems, individual projects, and the broader crypto sector.

Related: Ethereum revenue drops 44% in August as ETH hits all-time high

Tron network continues to dominate revenue metrics

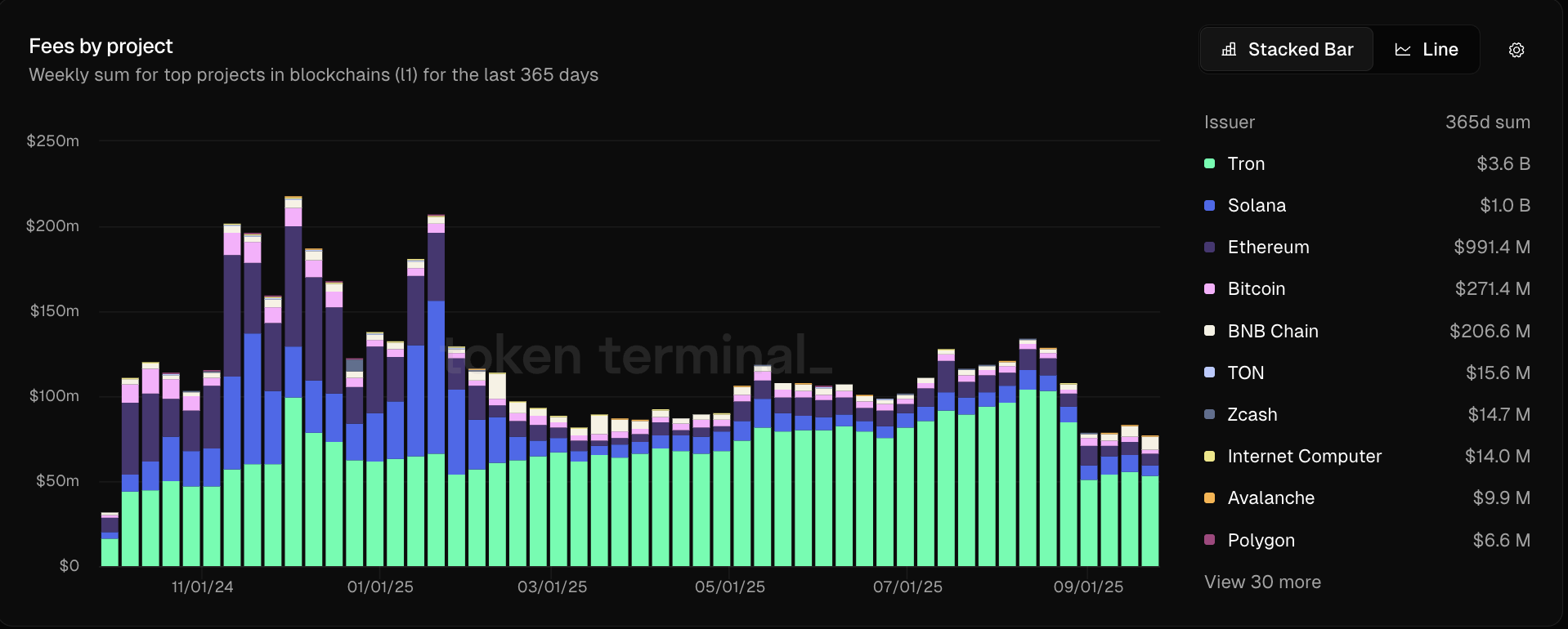

The Tron network ranks as the number one cryptocurrency ecosystem by revenue, generating $3.6 billion last year, according to data from Token Terminal.

By comparison, Ethereum only generated $1 billion in revenue last year, more than 16 times the TRX (TRX) market cap and just north of $32 billion, even though ETH hit an all-time high in August and has a market cap of about $539 billion.

Comparison of cryptocurrency network charges over the past year. sauce: token terminal

Tron’s revenue is believed to be due to its role in stablecoin payments. 51% of the circulating Tether USDT (USDT) supply is issued on the TRON network.

According to RWA.XYZ data, the market capitalization of stablecoins exceeded $292 billion in October 2025 and has been steadily increasing since 2023.

Stablecoins are a major use case for blockchain technology, as governments seek to increase the salability of fiat currencies by putting them on cryptocurrency rails.

Blockchain Rail enables the flow of currencies across borders with near-instantaneous settlement times, minimal fees, and 24/7 transactions, with no bank account or traditional infrastructure required for access.

magazine: Ether could “crash like 2021” as SOL traders brace for 10% drop: Trade secrets