Luxembourg is just making history in European finance. The state fund Fonds Souverain Intergénérationnel du Luxembourg has become the first state fund in the euro zone to invest in Bitcoin.

According to the announcement, 1% of his portfolio, or approximately $9 million, will be invested in Bitcoin ETFs. he confirmed this decision Bob KeeferFinance Minister and Secretary General of Luxembourg. Luxembourg invests in Bitcoin, will other countries follow suit?

A bold step towards Bitcoin

While 1% may seem like a small percentage, it is a very important step for conservatively managed sovereign funds. FSIL manages assets worth approximately €764 million. He also decided to expose himself regulated ETFit is not a direct purchase of virtual currency.

Some may argue that we are acting too slowly or too cautiously. Some may point to the asset’s volatility and speculative nature, Kiefer wrote.

However, the FSIL Management Committee recognizes that 1% is a reasonable compromise between innovation and stability. – he added.

The decision shows that Luxembourg, despite its caution, sees long-term potential in Bitcoin. This is also a clear signal for the euro area as a whole. Cryptocurrency is consistently gaining importance as a strategic asset.

From vigilance to action

FSIL’s decision surprised many analysts. A particular smokescreen was the fact that in May Luxembourg classified crypto companies as: High risk from a money laundering perspective.

The 2025 National Risk Report showed that companies operating in the field of digital assets often operate in a decentralized environment, making it difficult to control and track the flow of funds.

Despite this, Luxembourg continues to attract large crypto companies by offering stable and transparent regulation. stock exchange in may bit stamp Obtained crypto asset service provider license based on EU regulations mica.

they followed a similar path standard chartered and coinbasehas opened a European operations center for virtual currency and digital asset services in Luxembourg.

Bitcoin Government and State Reserves

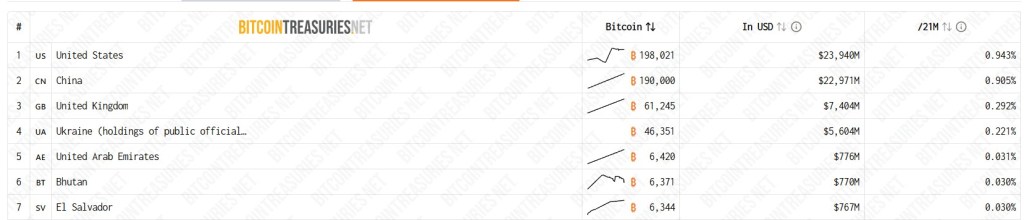

According to Bitcoin Treasury data, governments and state agencies around the world have a total of approximately 515 885 BTC The total amount exceeds $63 billion, which is 2.46% of total Bitcoin supply.

they remain leaders US They are right behind with 198,021 BTC China For 190,000BTC. Interestingly, most of China’s resources have been seized by authorities as part of actions against illegal exchanges.

she came in 3rd place England (61,245 BTC), and just behind ukraine (46,351 BTC), the cryptocurrency is used for the following purposes: Obtaining donations during wartime.

salvador It is the only country that issues Bitcoin as a legal tender, with reserves amounting to 6,344 BTC, or approximately $776 million.

Country I like more united arab emirates Whether or not bhutanhas also accumulated BTC as part of its strategic reserves. Will Poland be added to this list in the future?

A symbolic step with big results

Although FSIL only has a 1% share in Bitcoin, this move is symbolic. For the first time, the eurozone’s state-funded fund has officially acknowledged that Bitcoin can be a serious investment asset.

This can cause a domino effect. Other countries, especially those with developed financial sectors, may also follow Luxembourg’s example. For many investors, this is also a signal that it is worth taking a closer look at the cryptocurrency market, especially in the context of projects developing Bitcoin infrastructure.

Bitcoin Hyper – A new layer of innovation for Bitcoin

One of the projects that has been the talk of the cryptocurrency community in recent months is Bitcoin Hyper. As in Luxembourg, there are groundbreaking issues here too.

$Hyper is the first ever solution Layer 2 of the Bitcoin network. Its goal is to improve the functionality of the BTC chain. This is achieved by implementing elements such as fast transactions, smart contract support, and decentralized applications.

Bitcoin Hyper runs parallel to the Bitcoin main network. It’s using technology. solana virtual machine and zero knowledge proof. Thanks to this, users can perform lightning-fast operations and create DeFi applications, NFTs, and even games based on the Bitcoin ecosystem.

The potential of this project is eloquently illustrated by the astonishing numbers. Pre-sale of virtual currency alone is already $22.8 millionat the price of one token. $HYPER, $0.013085.

Why is Bitcoin Hyper attracting attention?

Bitcoin Hyper not only introduces scalability and interoperability between blockchains, but also guarantees security thanks to canonical bridges. This allows you to freeze your BTC and get its representation within the L2 network, giving you a good chance of reversing the transaction.

This project also passed the security audit conducted by the company solid proof I coinsault.

For those who are lost How to buy cryptocurrencythe creators of the project have created a detailed guide on their official website. The entire process is intuitive and adaptable even to less advanced users of the cryptocurrency market.

Project growth potential and prospects

Experts predict that if the project maintains its pace of development, Bitcoin Hyper’s value could register a significant increase in the coming years. The most optimistic predictions indicate that the price of the token could rise further by the end of 2025. 0,32 USD.

There are also more cautious predictions. According to them, the price of $HYPER token could be around USD 0.0167 in 2025 and USD 0.0231 in 2026. Even in this variant, investors who participate in the early stages have the opportunity to make significant profits.

Peace of mind and trust – the foundation of the project

Trust is very important in the world of cryptocurrencies. BitcoinHyper takes this very seriously. Transactions are protected by encryption and users are always in control of their funds.

The project also introduced a security fund and staking program to minimize risks associated with network infrastructure. Anonymous purchasing of cryptocurrencies is also an interesting option for those seeking greater privacy. For HYPER projects, this is carried out in accordance with applicable regulations.

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.