The feud between Fetch.ai CEO Humayun Sheikh and the Ocean Protocol Foundation has escalated to legal threats, on-chain accusations, and a response from Binance, all centered around approximately 286 million Fetch.ai (FET) tokens worth approximately $84 million.

The dispute stems from the Artificial Super Intelligence (ASI) Alliance, a 2024 merger that brought together AI-focused crypto projects Fetch.ai, Ocean Protocol, and SingularityNET under a shared token framework.

On Wednesday, Sheikh claimed that Ocean Protocol had minted and transferred millions of OCEAN tokens before the merger. He said the project later converted them into FETs and transferred large amounts of funds to centralized exchanges and market-making companies without proper disclosure.

“If Ocean as an independent project did this, it would be classified as a Ragpull,” Sheikh wrote to X, detailing how 719 million OCEAN were minted in 2023 and 661 million were exchanged for 286 million FET in July 2025. He claimed that some of these tokens have since been moved or liquidated.

sauce: Humayun Sheikh

Binance has limited support for OCEAN tokens

As the dispute escalates, crypto exchange Binance announced that it will stop supporting Ocean Deposit starting next Monday, October 20th.

The exchange said users can still deposit using other supported networks, but ERC-20 deposits made after October 20 “will not be credited and may result in loss of assets.”

Although the exchange did not cite the dispute as the cause of the move, many of the tokens in dispute are on Ethereum, so restricting ERC-20 deposits suggests the exchange is conducting internal risk controls or an investigation.

Sheikh interpreted Binance’s decision to suspend support for the token as the exchange “listening” to his public calls for an investigation into Ocean Protocol’s token transfers to X.

Related: Thiel-backed Erebor wins U.S. approval as Silicon Valley bank rivals emerge

Sheikh vows class action lawsuit, Ocean Protocol responds

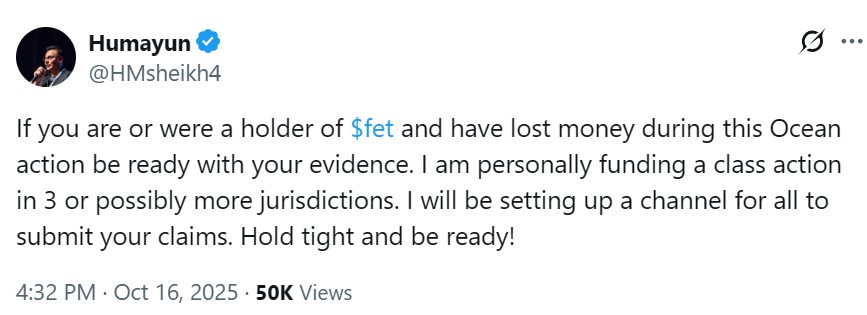

Sheikh promised to fund a class action lawsuit across three or more jurisdictions and called for investigations into Binance, GSR, and Exagroup. He also called on FET token holders to prepare evidence against Ocean Protocol and said he would establish channels through which they could submit their claims.

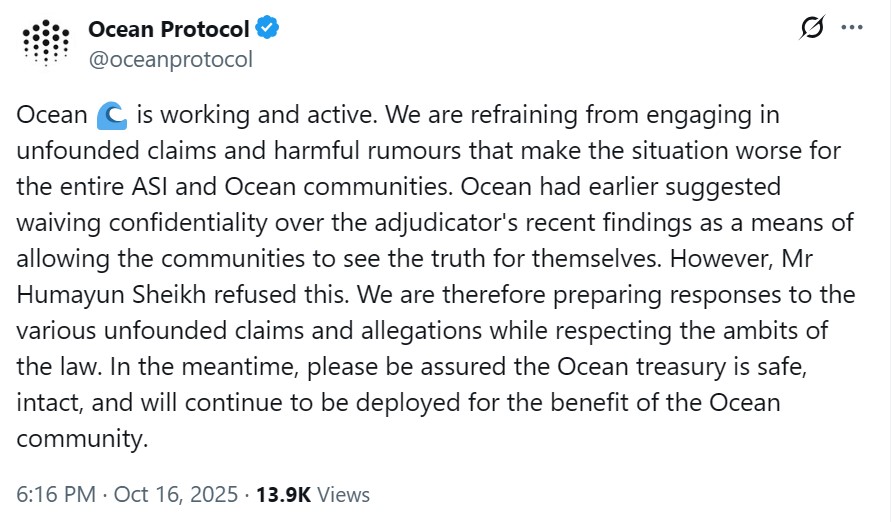

Ocean Protocol responded to reports regarding X by completely denying the allegations, calling them “baseless claims and harmful rumors.”

In a public statement regarding X, the company said its finances were intact and that it had offered to waive confidentiality on the adjudicator’s findings related to the dispute. Ocean claimed that the Sheikh rejected the proposal.

sauce: ocean protocol

“The ocean is functioning and active,” the post said. “We are preparing a response to a variety of unsubstantiated claims and allegations while respecting the spirit of the law.”

The adjudicator’s mention suggests that the dispute has already reached formal legal arbitration, presumably under the ASI Alliance’s merger framework governing token conversion.

Cointelegraph reached out to Fetch.ai and Ocean Protocol but did not receive a response in time for publication.

magazine: Worldcoin’s less “dystopian” and more cypherpunk rival: Billions Network