The $11 billion Bitcoin whale is back with another huge short position, suggesting some large investors are hedging against further crypto market downside amid tariff concerns and the ongoing government shutdown.

Bitcoin whales, a cryptocurrency slang term for large investors, have returned with a $235 million 10x leveraged short position in Bitcoin (BTC), effectively the world’s first bet that the cryptocurrency’s price will fall.

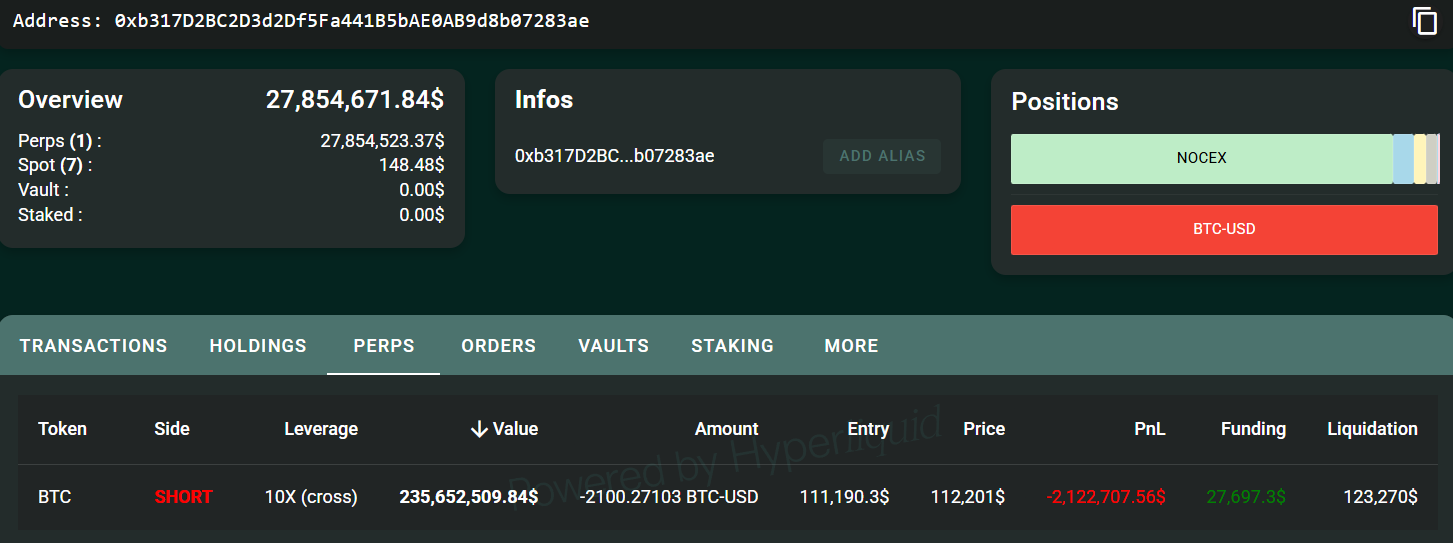

The large investor opened a short position on Monday when Bitcoin was trading at $111,190. According to Hypurrscan’s blockchain data, he currently has $2.6 million in unrealized losses on his short bets, which will be liquidated if Bitcoin’s price rises above $112,368.

The new short bet comes a week after the same whale made nearly $200 million in profits from the crypto market crash with a similar leveraged short position.

In trading, leverage refers to a strategy that allows investors to open positions that are larger than their holdings by “borrowing” capital. While leveraged trading can amplify potential profits, it also amplifies downside risk, which can result in a loss of the entire investment.

Wallet “0xb317”, short position. sauce: Hypurrscan.io

Related: SpaceX moves $257 million in Bitcoin, reigniting questions about cryptocurrency efforts

“The whale that made $200 million shorting the Bitcoin crash to $100,000 is now moving $30 million into Hyperliquid and shorting again,” blockchain data platform Arcam wrote in a post on Monday X.

The whale also transferred $540 million worth of Bitcoin to new wallets over the past week, including $220 million to wallets on the Coinbase exchange.

The $11 billion Bitcoin whale emerged two months ago and has rotated about $5 billion worth of BTC into ether (ETH), temporarily surpassing Sharplink, the second-largest corporate treasury firm, in terms of total ETH holdings, Cointelegraph reported on September 1.

According to Willy Wu, an analyst and early adopter of Bitcoin, the massive sell-off by previously dormant Bitcoin whales was one of the main factors limiting Bitcoin’s price movement in August.

Related: Grok, DeepSeek outperform ChatGPT, Gemini and sustain epic crypto market for longer

New Bitcoin whale faces $6.95 billion in unrealized losses as crypto market crashes

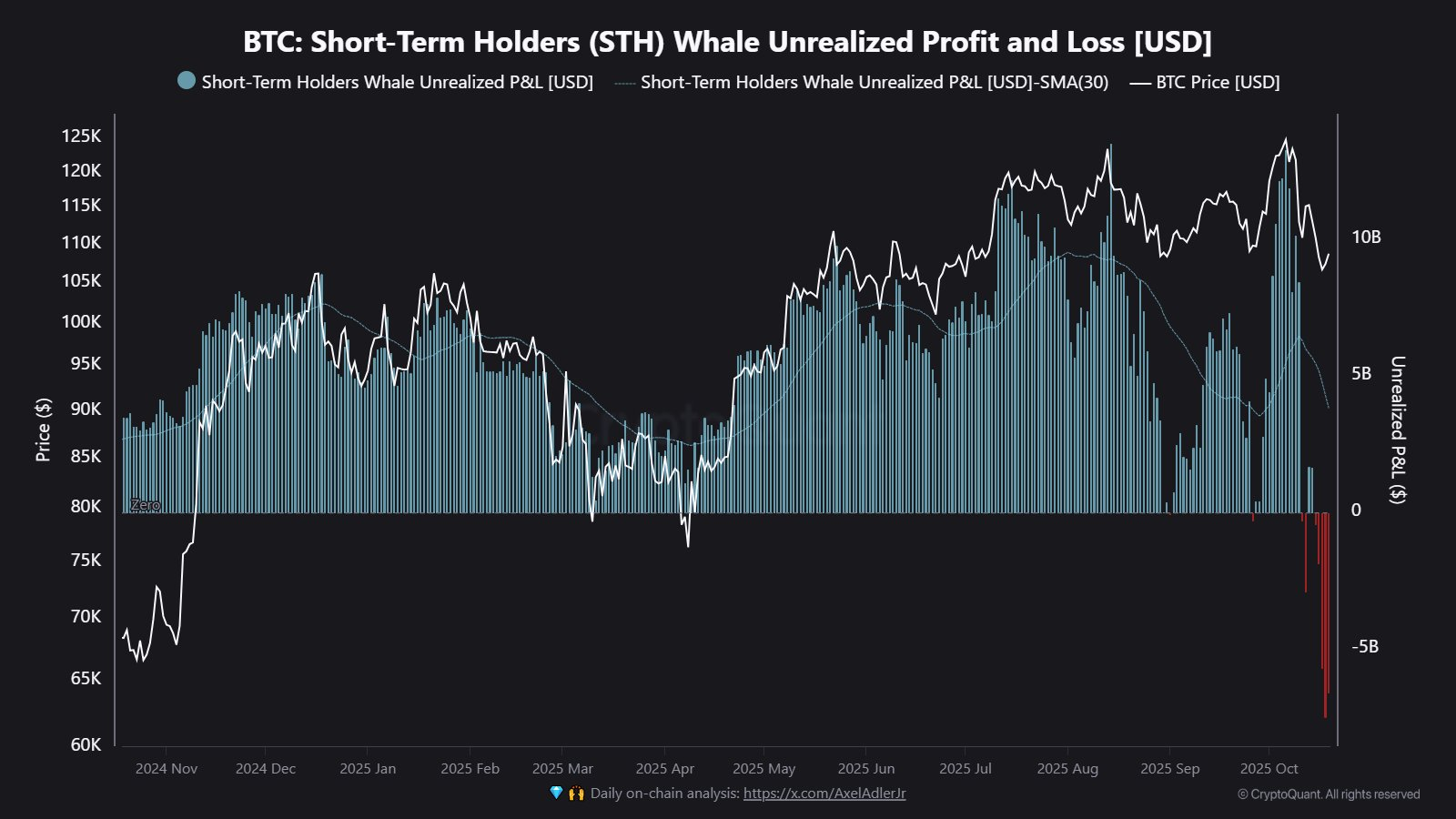

Meanwhile, new Bitcoin whales are facing cumulative unrealized losses of more than $6.95 billion after the recent crypto market crash sent Bitcoin below the critical $113,000 level.

“Bitcoin is trading below its average cost base of approximately $113,000, carrying $6.95 billion in unrealized losses, the largest since October 2023,” crypto analytics platform CryptoQuant wrote in a post on Tuesday X, adding that this cohort “represents approximately 45% of the total whale realized cap.”

sauce: cryptoquant

Despite the decline in investor sentiment, analysts see Bitcoin’s fall to $104,000 in four days as a healthy correction that wiped out excessive leverage and encouraged a more conservative stance among market participants.

Meanwhile, the supply of short-term Bitcoin holders is increasing and “speculative funds” are taking a larger share of the market, blockchain analytics firm Glassnode said in a report on Tuesday.

magazine: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom