Excitement surrounding the rollout of the XRP Spot ETF continues to build, but analysts are urging holders to be patient.

While expectations for additional XRP ETF listings grow, market commentators stress that the current environment does not support a sudden price explosion to $10, $50, or even $589, as some community members have rumored.

In a tweet, Good Evening Crypto Show co-host Johnny warned that XRP holders need to temper their expectations ahead of the new ETF launch.

Although the Canary Capital XRP ETF was the first of several publicly traded stocks to launch, he emphasized that a single ETF event rarely leads to immediate price increases.

His comments are consistent with previous explanations from other analysts who have argued that, by design, the ETF launch will not immediately spike public market demand for XRP. Instead, inflows trickle into the market gradually, through a process that can take days or weeks before any meaningful impact is visible.

ETF issuers cannot pre-purchase large amounts of XRP

On the other hand, one of the big misconceptions in the XRP community has been the belief that ETF issuers will accumulate large amounts of XRP before the release date, creating immediate buying pressure.

According to the information Johnny received from Gemini, the issuer will only pre-purchase a very small amount of XRP, known as seed capital.

Seed capital represents the minimum amount required to start trading on an exchange. Issuers cannot pre-purchase several months’ worth of expected XRP inflows. This means the big acquisitions that many investors assumed were happening behind the scenes simply won’t happen.

This movement has been confirmed in previous reports. ETF flows only become important when authorized participants create or redeem shares, not when the issuer prepares for a launch. These early purchases are limited so there will be no price shock on launch day.

Why has XRP not skyrocketed yet?

Now that Canary Capital and Bitwise XRP ETFs are in operation and seeing increased inflows, many are wondering why the XRP price isn’t rising higher.

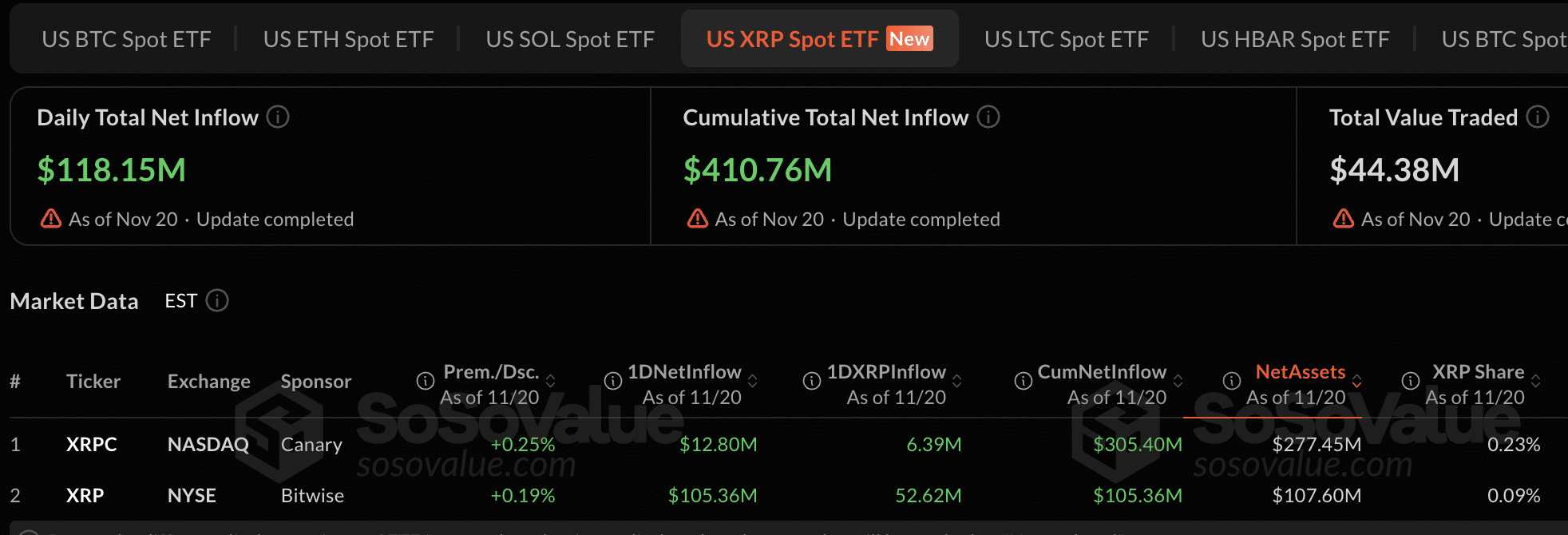

For example, Canary Capital had $12.8 million in inflows yesterday, bringing its total XRP assets to $305 million. On the other hand, Bitwise debuted with a huge inflow of $105.36 million on the first day.

Cumulatively, the XRP ETF saw $410 million in inflows in just one week after its launch. However, despite these heavy inflows, the price of XRP has fallen below $2 in the past 24 hours. Many people are now questioning this disparity.

XRP inflow record

Community analysts like VanQish and Nick have previously warned that ETF inflows won’t immediately translate into buying pressure. Although ETF shares are traded on traditional exchanges, this activity does not move real XRP.

XRP will only begin to respond if demand for ETF creation spikes and authorized participants are no longer able to source XRP cheaply through private channels and must purchase it directly from crypto exchanges. This is the point at which supply tightness appears.

Bitcoin followed the same pattern in early 2024. The price fell after the ETF was launched, but then rose once the ETF started accumulating BTC on a large scale.