Ethereum is showing notable relative strength as it regains the $3,150 level and attempts to move higher, showing early signs of recovery after weeks of intense selling pressure, fear, and uncertainty. While the broader market rally has helped restore confidence, ETH’s ability to outperform major altcoins highlights rising demand and improving sentiment towards the asset.

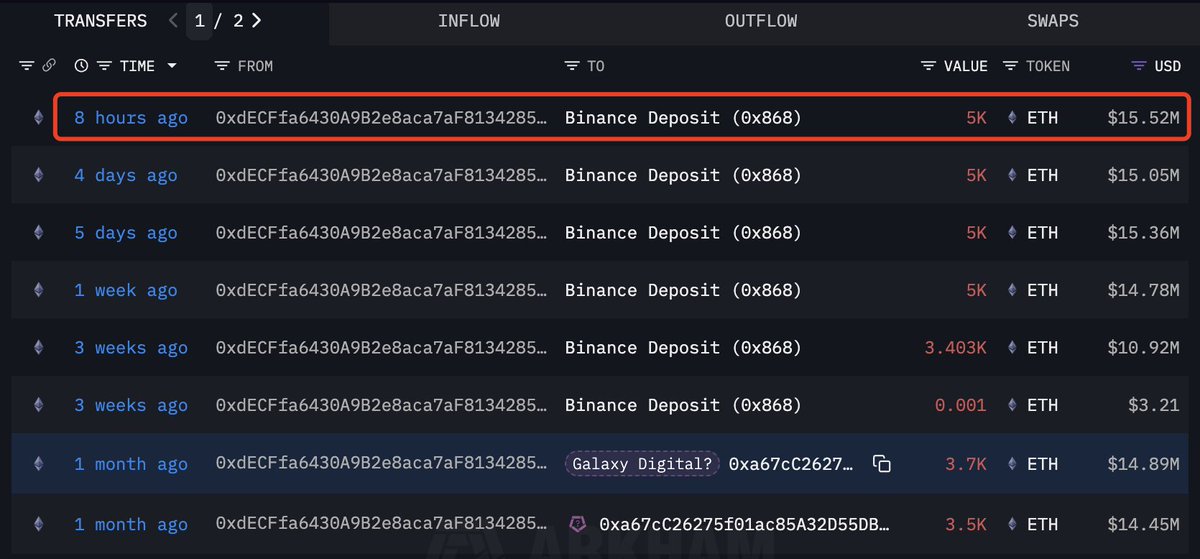

Lookonchain’s latest on-chain data reveals a major move from one of the most recognized whales in the market, adding to renewed optimism. During the rebound, whale 0xdECF deposited an additional 5,000 ETH (equivalent to approximately $15.52 million) to Binance.

This wallet is well known for transferring large amounts of ETH to exchanges during recent economic downturns, often at moments of heightened volatility and capitulation.

The latest deposits suggest that this whale is still very active and responsive to market conditions. While such moves can sometimes introduce uncertainty, they also highlight increased liquidity and commitment from major holders. Ethereum enters a critical phase as prices regain key levels and whales reposition, and sustained strength could confirm broader changes in market structure.

Ethereum whale distribution highlights market caution

According to Lookonchain, whale 0xdECF has sold 25,603 ETH (equivalent to approximately $85.44 million) on Binance and Galaxy Digital since October 28th. Despite this large distribution, there is still 5,000 ETH (approximately $15.52 million) held in the wallet, suggesting that while the whale has not fully exited its position, the recent market decline has significantly reduced its exposure.

This pattern of behavior provides important insight into the sentiment of large holders. While they have not completely abandoned Ethereum, they are actively managing risk and responding to volatility more aggressively than usual.

This sustained selling pressure from large wallets often weighs on prices during downturns, especially when market liquidity is thin. However, the fact that whales continue to maintain meaningful status indicates hope for a potential recovery, or at least a desire to remain strategically exposed to future upswings.

We recognize that Ethereum is currently at a critical stage. Although the asset has regained key levels, its medium-term structure remains highly sensitive to macro conditions and whale behavior. If selling from major holders slows and accumulations begin to outpace distributions, the recent rally could become a permanent trend. Otherwise, new sell flows could put Ethereum at risk of revisiting lower support zones.

ETH regains short-term momentum but faces significant resistance

Ethereum’s daily chart shows a clear improvement in momentum after reclaiming the $3,150-$3,200 area, but the broader structure remains fragile. A rebound from the $2,750-$2,850 support zone signals a decisive change in buyer behavior, and a strong bottom core indicates active demand. Although this rebound has pushed ETH above key short-term levels, the asset still faces a difficult road ahead.

The price is currently approaching the 50-day SMA and is currently trending down just above $3,250, acting as an immediate resistance level. This moving average has capped any gains since late October and remains the first major barrier for bulls to recover. Beyond that, the 100-day SMA near $3,450 and 200-day SMA near $3,600 form a tight cluster of overhead resistance that defines a medium-term downtrend.

The recent rebound volume has been stronger than previous attempts, indicating that buyers are showing more confidence compared to the mid-November recovery attempt. However, the overall trend remains bearish until ETH breaks above the 50-day SMA and daily candlesticks begin to close above $3,300.

Ethereum is at an important inflection point. A sustain above $3,100 would increase the chances of a continued recovery, while a rejection from the $3,250-$3,300 range could trigger a retest of the $2,800 area. The next few sessions will determine whether this rebound develops into a deeper trend reversal.

Featured image from ChatGPT, chart from TradingView.com

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.