13 years ago today, Bitcoin experienced its first halving event, reducing miner block rewards from an initial 50 BTC to 25 BTC.

To date, Bitcoin (BTC) has completed four halving events, the block reward remains at just 3.125 BTC, and the mining industry continues to transform as miners integrate and diversify with AI.

According to Bitfinex analysts interviewed by Cointelegraph, a niche trend called solo mining is also emerging.

“Despite the new surge in industrial Bitcoin mining, we would like to highlight how a new wave of individual miners and hobbyist miners are returning to the market thanks to improved mining pools, increased efficiency, and niche strategies,” the analysts said.

Bitcoin mining in 2024 and 2025: competition increases as production declines

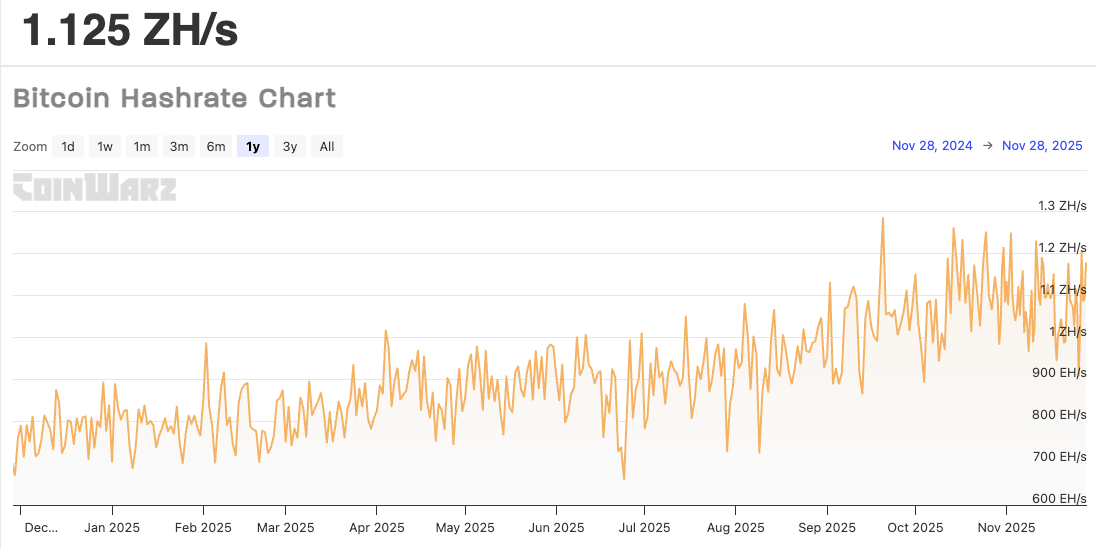

Since last year, the Bitcoin mining market has grown significantly in size, complexity, and competitiveness, with the global hashrate exceeding the iconic 1 zetahash per second (ZH/s) in August, according to data from CoinWarz.

“This reflects both increased investment and the introduction of ultra-efficient mining hardware such as the Antminer S21 series,” Bitfinex analysts said. “In short, the Bitcoin mining market in 2025 will be more industrialized, technologically advanced, and geographically dispersed than in 2024, but also more competitive and volatile.”

Bitcoin hashrate chart from December 2024 to November 2025. Source: CoinWarz

Despite increased competition, mine production has declined over the past year. According to Blockchain.com, the circulating supply of Bitcoin increased by approximately 155,000 BTC from November 27, 2024 to November 27, 2025, down 37% from 245,000 BTC the previous year.

“2024 has already been a tough year for miners,” Christian Sepser, chief marketing officer at BTC mining technology provider Brainins, told Cointelegraph, adding that miners are deploying hardware at record speed.

Related: Bitcoin miner hash price approaches $40, miners return to “survival mode”: report

Still, Csepcsar added that despite the rise in BTC prices, revenues continued to decline as hash prices, and therefore miners’ revenue per unit of hash power, plummeted due to increased mining competition.

Bitcoin’s Hash Price Index hit an all-time low of $34 on November 21, 2025. source: HashrateIndex.com

“2024 was a difficult year. Today is even worse. Miners are in the most competitive environment the industry has ever seen, and no one knows how long this will last,” Chepser said.

Personal and hobby mining returns to market

Despite increasing industrial competition and rising costs, independent miners are not going away. Instead, they are re-entering the market, supported by various improvements in mining pool technology, according to Bitfinex analysts.

“Tools such as CKPool, a platform suitable for solo mining known for its low latency, are helping to make this practice more accessible,” the analyst said. The company also observed that “winning the lottery” by individual miners, especially those using efficient, low-noise mining equipment at home, was becoming more prevalent in society.

sauce: red panda mining

“Hobby mining, while not entirely personal or industrial, is undergoing a mini-renaissance,” Bitfinex analysts said, adding that this trend has been driven by the availability of efficient, low-cost ASICs, the use of off-peak power strategies, heat recycling methods, and firmware such as BrainsOS, which allows miners to underclock their devices for optimal efficiency.

Related: Tether confirms withdrawal from Bitcoin mining in Uruguay amid soaring energy prices

“Since we are talking about regular users with limited hashrate available, it is unlikely that these groups will seize hashrate leadership in a capitulation scenario,” the analyst said.

If the largest miners capitulate significantly, medium-sized industrial operations will become the new major players, while individual miners and hobbyists will still be far behind them in terms of production capacity, Bitfinex said, concluding:

“It’s an interesting pattern, but it’s a long way from competing with larger, more industrial operators.”

magazine: South Koreans ‘pump’ alternatives after Upbit hack, China BTC mining surges: Asia Express