For the second week in a row, Bitcoin has slipped into a zone that traders both respect and fear. The price fell towards the true market average, the cost basis of all active coins minus miners, and then stayed there.

According to Glassnode, this level is what separates a light bear market from a deep bear market. Right now, the price is just above that. The structure around it is roughly consistent with what appeared in Q1 2022.

Spot prices fell below the 0.75 supply quantile in mid-November and are currently trading near $96.1,000, with more than 25% of total supply underwater.

At the same time, the seller may already be exhausted. The line that changes everything is still the 0.85 quantile near $106.2,000. Until prices return to that level, macro shocks remain in full control of direction.

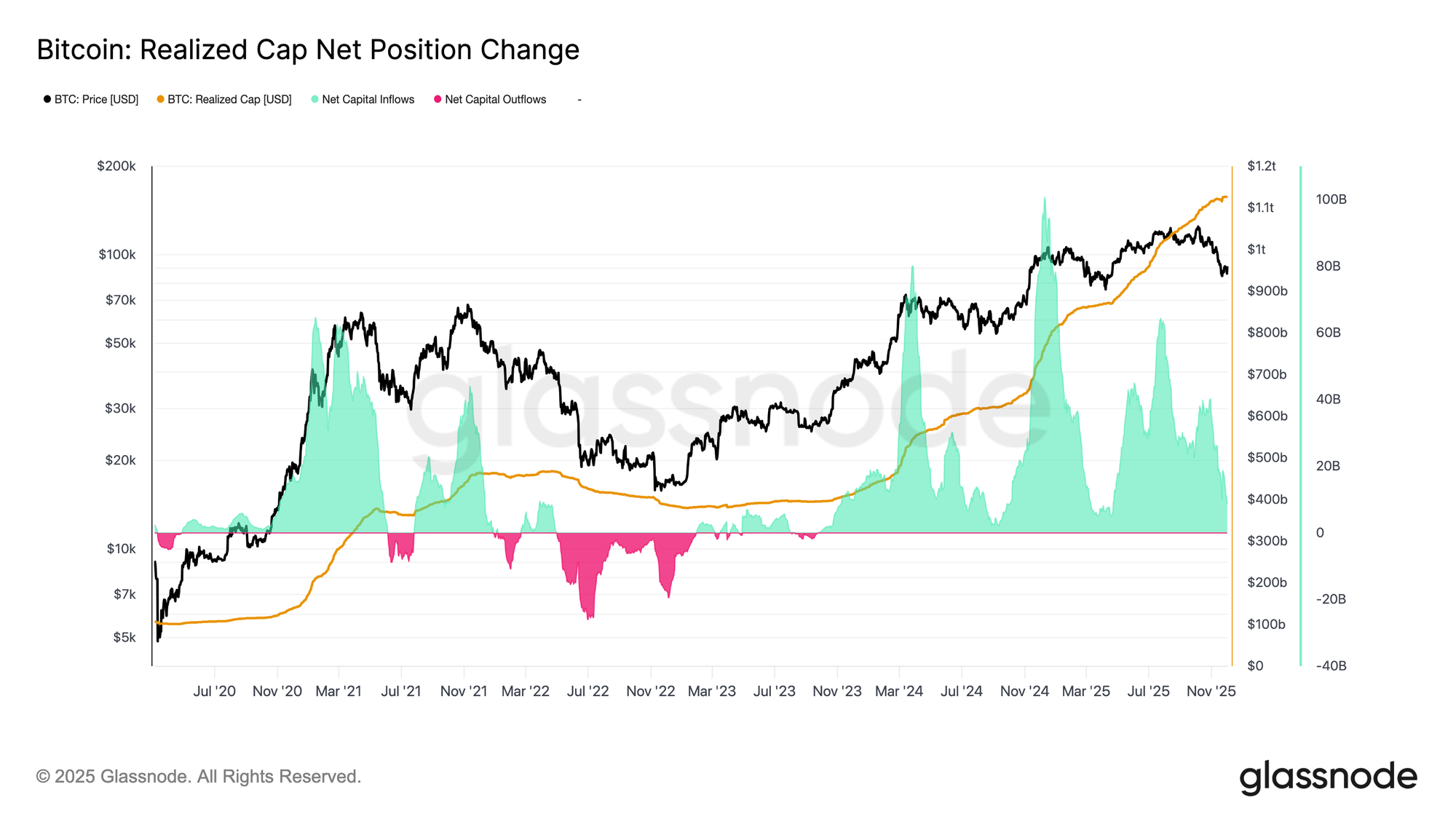

According to Glassnode data, the net change in Bitcoin’s realized cap was +$8.69 billion per month, which is quite weak compared to July’s peak of $64.3 billion per month, but not strictly negative.

As long as this remains above zero, the price can build a base without collapsing. Meanwhile, long-term investors continue to sell bullishly, but margins are narrowing and the SOPR (30D-SMA) for long-term holders is 1.43.

Derivatives and options reset risk across the board

Spot demand appears to have lightened. US Bitcoin ETFs saw net outflows throughout November on a three-day average basis. The steady capital inflows that supported prices earlier this year are gone. The breach hit many issuers at once. As market pressures mounted, financial institutions retreated. This leaves prices more exposed to external shocks.

At the same time, the cumulative volume delta of Binance and the entire comprehensive exchange group turned negative. This suggests steady take-selling. Coinbase is also flattened. This erased an important sign of U.S. bidding power. Spot demand is currently thin as both ETF flows and CVD are defensive.

Derivatives followed the same path. Futures open interest continued to decline until late November. Relaxation remained slow and methodical. The leverage built up during the uptrend is now all but gone. There is no new leverage. After months of positive print, funding rates have cooled to near zero. Occasionally, a small amount of negative funds would occur, but it would not last long. The shorts are not tightly compressed. Positioning is now neutral and flat.

In options, implied volatility has declined after last week’s spike. Short-term volatility fell from 57% to 48%, mid-tenors fell from 52% to 45%, and long-term volatility eased from 49% to 47% as Bitcoin failed to break above $92,000 and sellers retreated.

Short-term skew fell from 18.6% to 8.4% after Bitcoin prices rebounded from the Japanese government bond shock drop of $84,500. Those with longer maturities moved more slowly. Traders chased short-term gains but remained uncertain about follow-through.

Flows at the beginning of the week were heavily tilted toward buying puts due to concerns about a recurrence of carry trade stress in August 2024. Once the price stabilized, the flow turned to calls during the rebound.

For the $100,000 call strike, the call premium sold still exceeds the call premium bought, and the difference has widened over the past 48 hours. This shows that the belief in getting back to six figures is weak. Traders are also not chasing the upside as they prepare for the FOMC meeting.

Cryptocurrency entrepreneur Lark Davis pointed out that crypto whales had dumped the market, and later said, “Charles Schwab, Vanguard, and Bank of America all rolled out cryptocurrencies to their customers in the same week. What a happy coincidence!”