Ripple plans to unlock around $1 billion worth of XRP tomorrow, marking its first escrow release of 2026.

This event follows the company’s long-standing pre-planned supply mechanism and is closely monitored by investors, even though it is a routine and well-publicized event.

The escrow system introduced in 2017 was designed to ensure transparency and predictability in the supply of XRP. Every month, up to 1 billion XRP is unlocked from time-locked contracts, but Ripple typically uses only a portion of it for operations, ecosystem growth, and liquidity, and returns most of the tokens to escrow under new locks.

Historically, Ripple has relocked approximately 60% to 80% of each release, or approximately 600 million to 800 million XRP. As a result, only an estimated 200 million to 400 million XRP is typically available outside of escrow, with limited immediate impact on circulating supply.

Typically, a large portion of unlocked XRP is relocked, so headline numbers often overstate the true market effect. As a result, XRP price has so far had a modest reaction to escrow releases.

Impact on XRP price

However, the first unlock of the year could still impact near-term sentiment, especially during periods of low liquidity and overall market uncertainty. This comes as XRP’s price has come under pressure due to weakness across the broader crypto market.

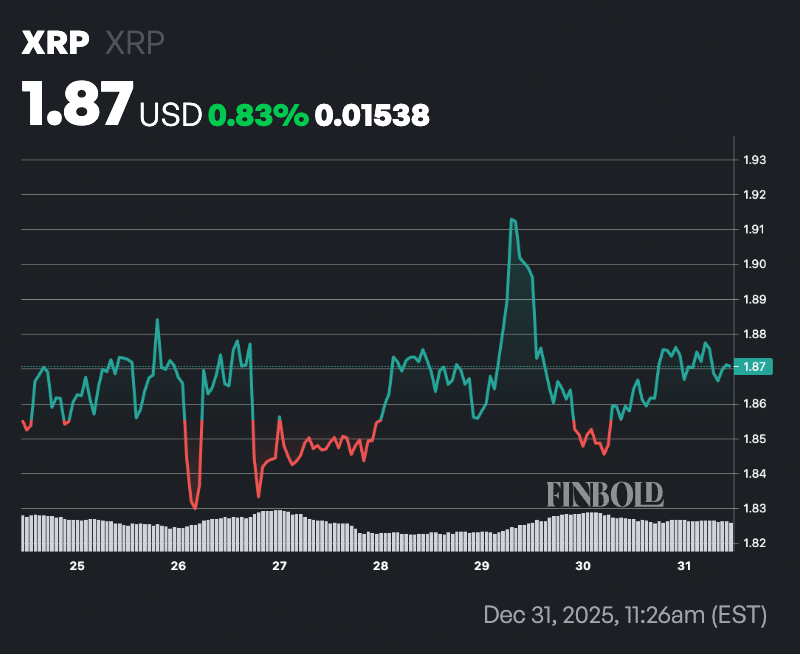

At the time of this writing, the token is trading at $1.87, up modestly by nearly 0.4% in the past 24 hours and up almost 1% over the past week.

At its current price, XRP is trading well below its 50-day simple moving average (SMA) of $2.07 and 200-day SMA of $2.49. This position below both short-term and long-term moving averages indicates that downward pressure will continue and the downtrend may extend, as price has not yet regained these key resistance levels.

Complementing this, the 14-day Relative Strength Index (RSI) is at 42.74, still in neutral territory. While not indicative of extreme overbought or oversold conditions, readings below 50 indicate underlying weakness amid prevailing market uncertainty.

Featured image via Shutterstock