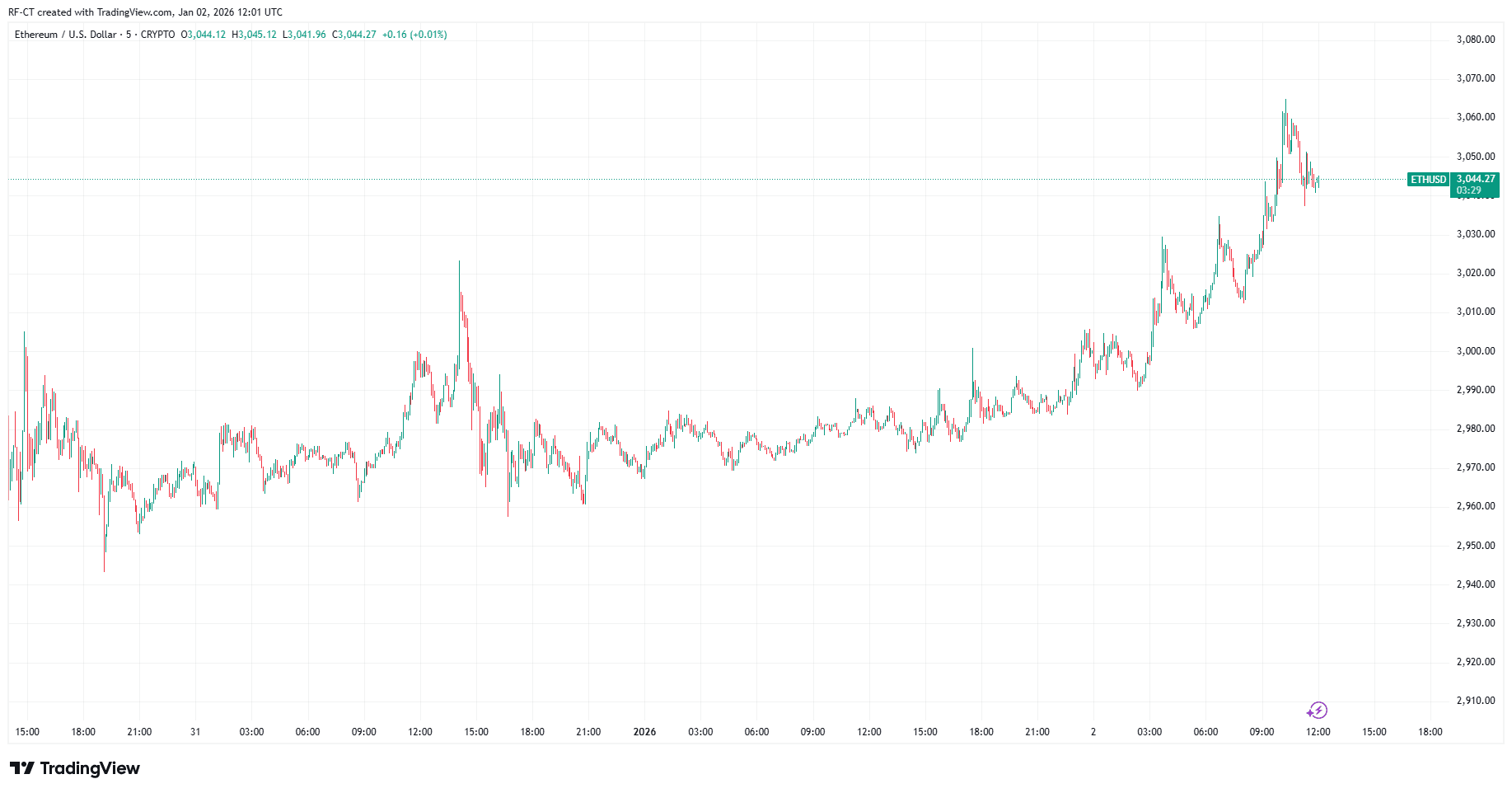

By TradingView – ETHUSD_2026-01-02 (YTD)

Ethereum Pushing to new state returns focus Highest price of the yearshows a whole new momentum cryptocurrency market. This move is made at a critical moment, Billions of Dollars of Crypto Options Expiresetting the stage for short-term volatility in ETH as well as ETH. Bitcoincontinues to hover near key resistance levels.

Ethereum breakout: What’s driving the movement?

ETH has skyrocketed beyond the past $3,000 levelreached a new yearly high and confirmed a strong bullish structure on the chart. Momentum accelerated as buyers stepped in aggressively, pushing prices above the recent consolidation zone.

There are several factors coming together behind Ethereum’s movement.

- Strong spot demand after weeks of sideways trading

- New confidence in large crypto assets

- Derivatives activity increases ahead of major option expirations

From a technical perspective, the ETH breakout suggests that buyers are still in control, although a short-term pullback remains possible given current market conditions.

Option expiration: Why volatility is rising

around it $2.2 billion worth of Bitcoin and Ethereum options This is a scenario that often causes sudden movements during the day. When traders exit or roll positions, price movements can become volatile, especially if the asset is trading close to key psychological levels.

For Ethereum, this means:

- Sudden spike or pullback near expiration date

- Increased liquidation of overleveraged positions

- Possible false breakout before direction stabilizes

Bitcoin is in the background but still important

While Ethereum is leading the story today, Bitcoin remains an important anchor for the overall market. BTC has recently New year-to-date high price It is unique and continues to trade close to historically significant resistance zones.

As long as Bitcoin remains above the breakout area, Ethereum and other large altcoins are likely to continue to find support. However, any sudden movement in BTC could quickly spill over into ETH price fluctuations.

Short-term outlook for ETH

Ethereum’s structure remains bullish, but traders need to remain cautious in the short term. Options expiration and increased leverage increase the likelihood of volatility spiking before a clearer trend resumes.

Main levels to note:

- support: $2,950 – $3,000

- resistance: $3,100 – $3,200

A solid break above $3,000 would increase the chances of further upside, while a rejection could trigger a temporary cooldown.

conclusion

Ethereum hits new high for the year We are at a critical moment for the crypto market. With Bitcoin’s strength and option-driven volatility rising, the coming sessions could determine its near-term direction. For now, ETH remains in the spotlight, but all eyes are on Bitcoin for confirmation.