aster The token price fell by more than 12% on Monday, hitting a new all-time low, even as Aster Protocol moved to activate its long-planned token buyback strategy.

This initiative is aimed at stabilizing prices and restoring market confidence, as token buybacks are known to impact supply capacity.

A share buyback is initiated as follows: aster Market pressure intensifies as record lows

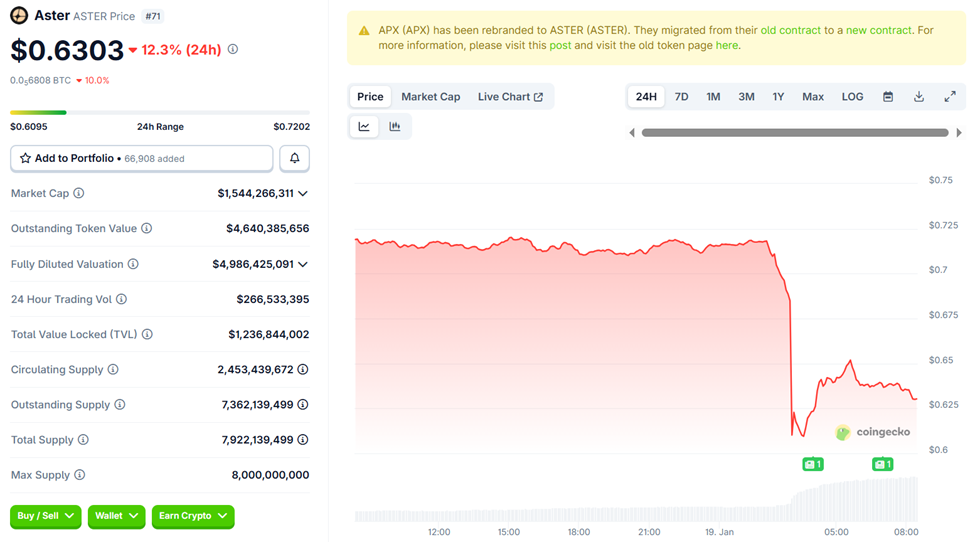

According to data from CoinGecko, aster At the time of writing, the token is trading at $0.63, down more than 12% in the past 24 hours.

Aster price performance. Source: CoinGecko

The economic downturn coincided with the launch of Astor’s strategic buyback program. aster It began buying back strategic tokens in the early hours of Monday’s Asian session after the price hit a new record low of $0.61.

“We are currently actively utilizing our strategic repurchase reserves at $.aster Tokens will be automatically repurchased. “Building on the Stage 5 buyback program we announced last month, this activation allocates 20-40% of daily platform fees to targeted buybacks to dynamically respond to market conditions to maximize value and reduce circulating supply,” Astor said in the post.

This move highlights the tension between short-term price declines and long-term tokenomic intervention.

Aster’s price decline comes amid continued pressure on small-cap DEX tokens amid widespread market uncertainty.

However, fee-driven share buybacks can absorb significant sell-side momentum. aster‘s latest move suggests the team is accelerating its response amid heightened volatility.

Accordingly, Aster began deploying funds from its strategic repurchase reserve to enable automatic repurchases tied directly to platform revenue.

Stage 5 buyback program puts Aster’s fee-backed tokenomics to the test

Since execution has already started, the first buyback will occur automatically from the on-chain verifiable reserve wallet 0x5E4969C41ca9F9831468B98328A370b7AbD5a397.

Meanwhile, the latest activation is part of Aster’s broader Stage 5 buyback program announced in late December. The team presented it as a structured approach to support it. aster You acquire tokens through fees generated by the protocol, rather than through discretionary intervention.

At the time, Astor outlined a two-track mechanism that combined predictability and flexibility.

“Stage 5 Buyback Program: Structured Support for $”aster We have implemented a systematic share repurchase program designed to strengthen the dollar.aster Leveraging tokenomics to create sustainable value for our communities,” Astor wrote on Dec. 22.

The protocol announced that from December 23, 2025, up to 80% of daily platform fees will be allocated to share buybacks.

The framework provides “daily automatic repurchases (40% of fees) – automatically executed every day, providing consistent on-chain support and gradual supply reductions.

This creates a predictable basis for token value with transactions routed through dedicated wallets.

In parallel, a strategic repurchase reserve (20% to 40% of fees) is allocated for targeted repurchases based on market conditions. This reserve provides flexibility to respond to volatility and maximize value creation when opportunities arise.

This is in line with what Lighter DEX has done recently, but the market reaction to the LIT token was different as the altcoin rose nearly 20%.

therefore, asterThe continued decline may be due to protocol-driven buybacks in bear markets and illiquid markets. Therefore, the token is currently trading near record lows.

post aster Token buybacks began as the price fell 12% to record lows and appeared first on BeInCrypto.