Ethereum price action is starting to calm down after a sharp decline from the swing high of $3,400, but the broader 4-hour structure still looks fragile. $ETH The latest reading was hovering around $3,010 as traders watched for signs of stabilization after several Fibonacci supports failed.

Although the attempted bounce has alleviated short-term panic, analysts tracking momentum tools say bulls still need more than a pullback. Key resistance zones need to be cleared cleanly for sentiment to return to recovery mode.

Support zones define the next risk point

$ETH It is currently located in a key support cluster around $3,010 to $2,990, which serves as the current hold area. In addition to that, traders are also highlighting $2,965 as a short-term pivot where buyers have recently intervened. $ETH Losing $2,965 on strength, the focus shifts to $2,922, the level that connects to the 0.236 Fibonacci zone.

As a result, a break below $2,922 could open the door to a deeper downside target of $2,773. This level is also the lower bound of the current Fibonacci structure. Analysts say these zones are important as the market moves into a reaction phase. Price now reacts faster to each technical break.

$ETH Price dynamics (Source: Trading View)

On the positive side, $ETHThe first challenge of is located around $3,014, coinciding with the 0.382 Fibonacci mark. Moreover, $3,089 remains a key midrange level that bulls must recover to alleviate selling pressure. Above that, $3,163 stands out as a rejection zone, with $3,268 serving as a stronger breakout confirmation level.

Importantly, regaining the $3,163-$3,268 band would indicate that buyers are regaining control of the trend. Until then, this rally still looks like a short-term recovery attempt. The $3,403 swing high remains a larger supply zone that was previously dominated by sellers.

Adding context with open interest and spot flows

Derivative activities add another layer to your setup. Ethereum’s open interest expanded rapidly into the second half of 2025 and remained elevated until January. The latest figure was nearly $38.57 billion. $ETH It traded for about $2,979. Therefore, liquidation risk remains high as traders still hold large leveraged positions.

Source: Coin Glass

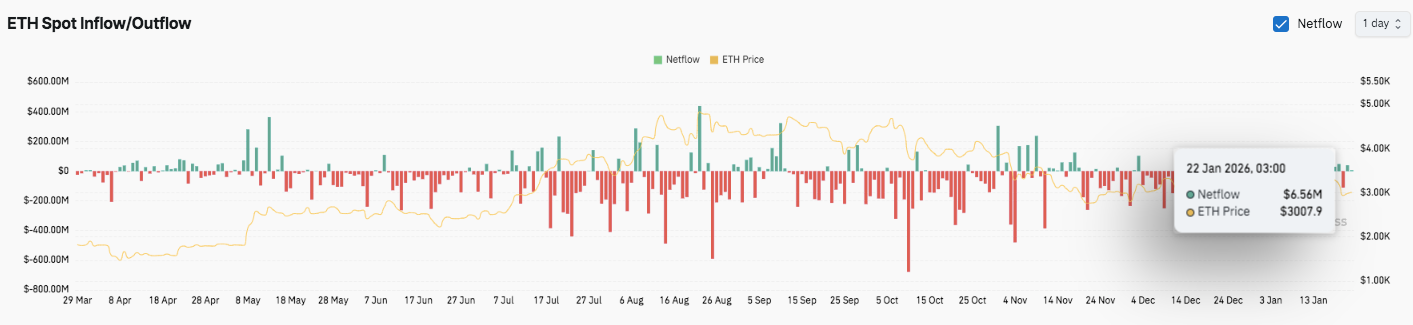

Additionally, spot flow trends show that exchange outflows will expand throughout 2025, with clusters concentrated in August, October, and mid-November. However, recent trends have become more complex. The latest net flows were slightly positive at approximately $6.56 million, suggesting short-term stabilization.

Technical outlook for Ethereum price

Major levels remain clear $ETH Attempts to stabilize after $3,400 rejection.

- Top level: $3,014, $3,089, and $3,163 are the first hurdles that the seller may defend aggressively. A clean breakout could extend to $3,268, with $3,403 acting as the key supply ceiling that bulls need to reverse to confirm a broader recovery.

- Lower price level: $3,010 to $2,990 is the immediate support zone, followed by a short-term pivot at $2,965. Below that, $2,922 becomes a key defensive level, with $2,773 being a deeper breakdown target if weakness returns.

The technical image suggests that $ETH It remains vulnerable on the 4H chart, with bearish-to-neutral momentum remaining until price regains the mid-level resistance cluster.

Will Ethereum go up?

$ETH’s near-term direction depends on whether buyers can hold on to $2,965 and rebuild above $3,089-$3,163. If capital inflows improve and prices convert resistance to support, $ETH It is possible that it will regain some bullish traction.

However, failure to protect $2,965 risks further decline towards $2,922 and even $2,773. For now, $ETH It remains in a very important zone.

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.