Bitcoin (BTC) has been rediscovered at the heart of the turbulence of the market, not because of internal crypto drama, but as a direct response to the macroeconomic situation. The US market opened with a “hangover” pullback following a strong rally yesterday.

Investors have shifted their focus to the big picture. In particular, it had an increased friction with China and a long-term impact on the global economy.

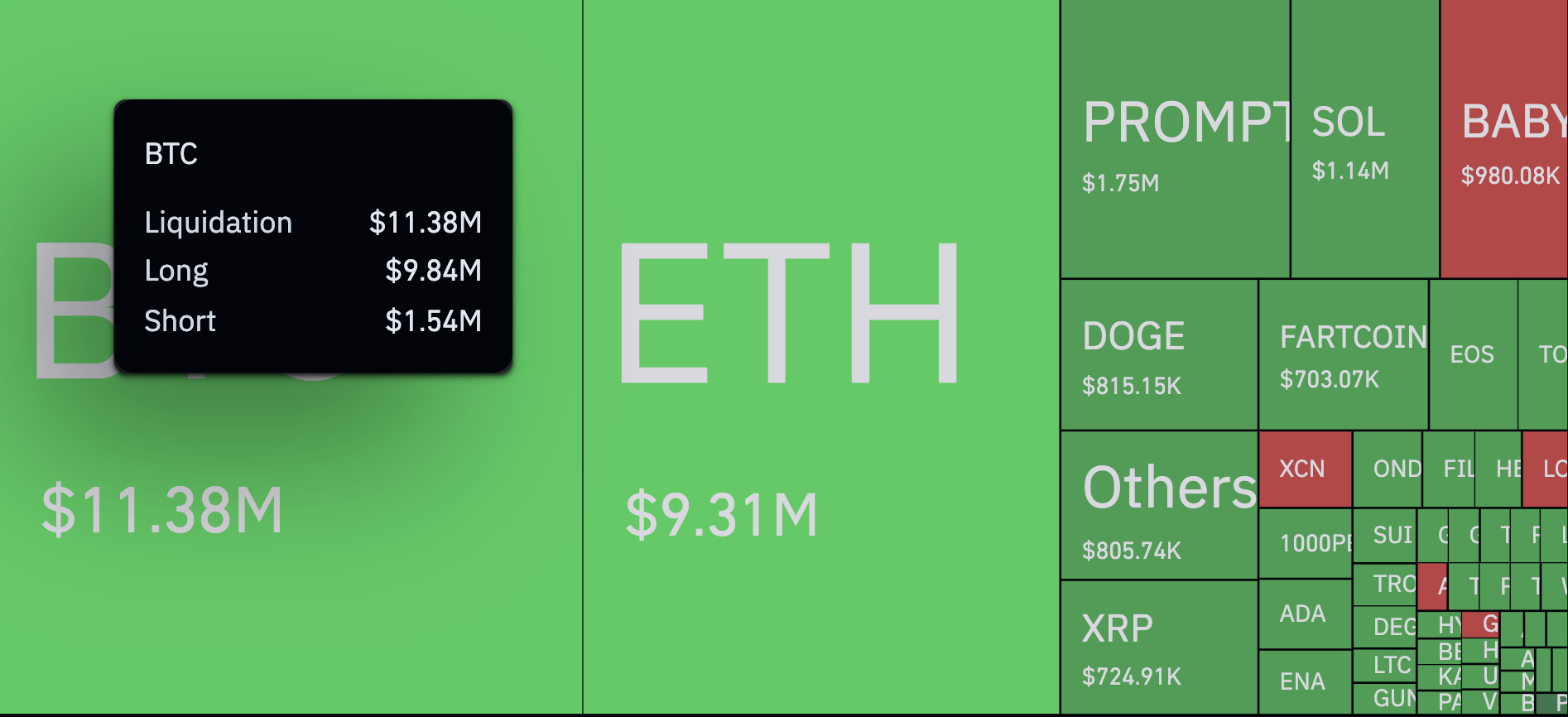

That sentiment was passed down to the crypto space, where a highly utilized positioning encountered a sudden check of reality. Bitcoin led the liquidation, referring to a market where positions of $11.38 million have been wiped out ($9.84 million from long and just $1.54 million from shorts) have become abnormally unbalanced in one direction.

The move didn’t have much drama on the surface, but under the hood, it reflected an overgrowth of traders after being caught up in offside in football terms as sentiment changed.

The fix wasn’t just a blip. Within an hour, the $26.1 million position was closed and the majority from Long was closed again. As reported by Coinglas, it was liquidated at $68.7 million in the last four hours, reaching a total of $465.5 million with 134,811 traders in 24 hours.

The biggest single liquidation – a $3.33 million BTC/USDT position on Bibit – highlighted how risky there is to play.

Altcoins like XRP, Doge and Sol were also hit, but the data highlights Bitcoin as a volatility anchor in the market. The inflation report from the US had only minor effects. The CPI fell 0.1% in March, but traders are already expecting a recession as the trade war escalates.