A closely followed crypto strategist believes Bitcoin (BTC) is on the pullback crisis after facing resistance at the key level.

Analyst Justin Bennett tells 115,600 followers of social media platform X that Bitcoin has formed a pattern of bear flags, potentially waning more than 7% of its current value.

Weak flag patterns have been used in technical analysis to predict sudden movements to the downside. They form when prices integrate upwards after a strong downtrend, but they cannot break the main support level.

“There’s another perspective on BTC in the same conclusion. In addition to the trendline break in April, you can win a potential bear flag that is below resistance to not being able to maintain $106,600. $97,000 – $98,000 is the goal. $106,600 – $106,800 is my invalidation.”

Source: Justin Bennett/X

However, analysts say that Bitcoin may not immerse in under six figures if the stock market continues to gather.

“The big wildcard with a bearish code stance is the US stock market. If there’s no pullback there, you have to wonder if we’ll get more pullbacks here. Time will tell.”

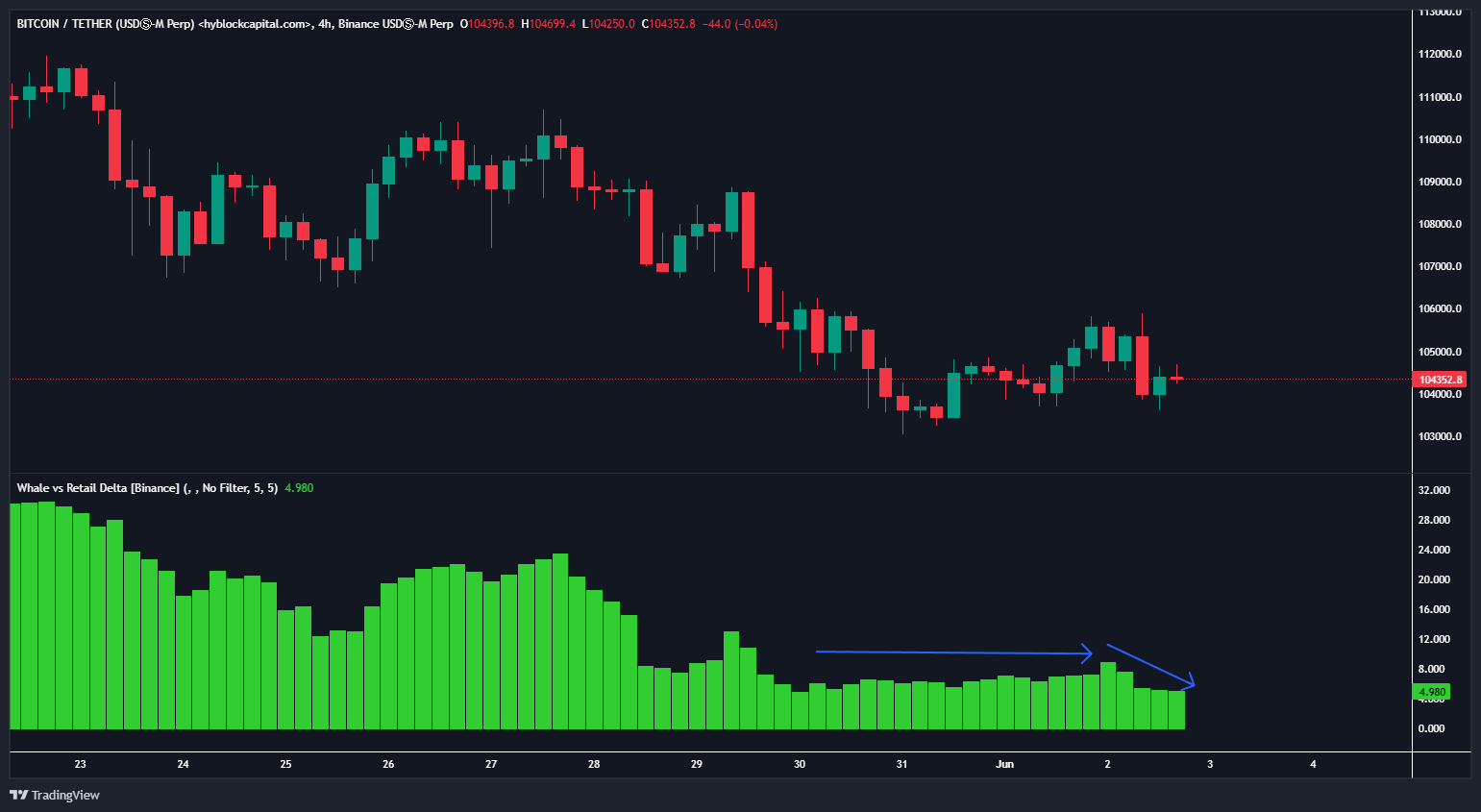

Finally, analysts say Bitcoin is bearish based on the Whale and Retail Delta Indicator (WRD). High value means more whales make Bitcoin longer than retailers.

A decline in WRD values is bearish for Bitcoin, as whales tend to be better predictors of market direction.

“It’s not a great sign of Bitcoin. High Block Capital Whale vs Retail Delta was slightly higher towards the side, but again returned to a drop.

Source: Justin Bennett/X

Bitcoin has traded at $105,069 at the time of writing, down 1.2% over the past 24 hours.

Generated Image: Midjourney