Analytics platform SwissBlock warns that key metrics are flashing Bitcoin (BTC) bearish signals.

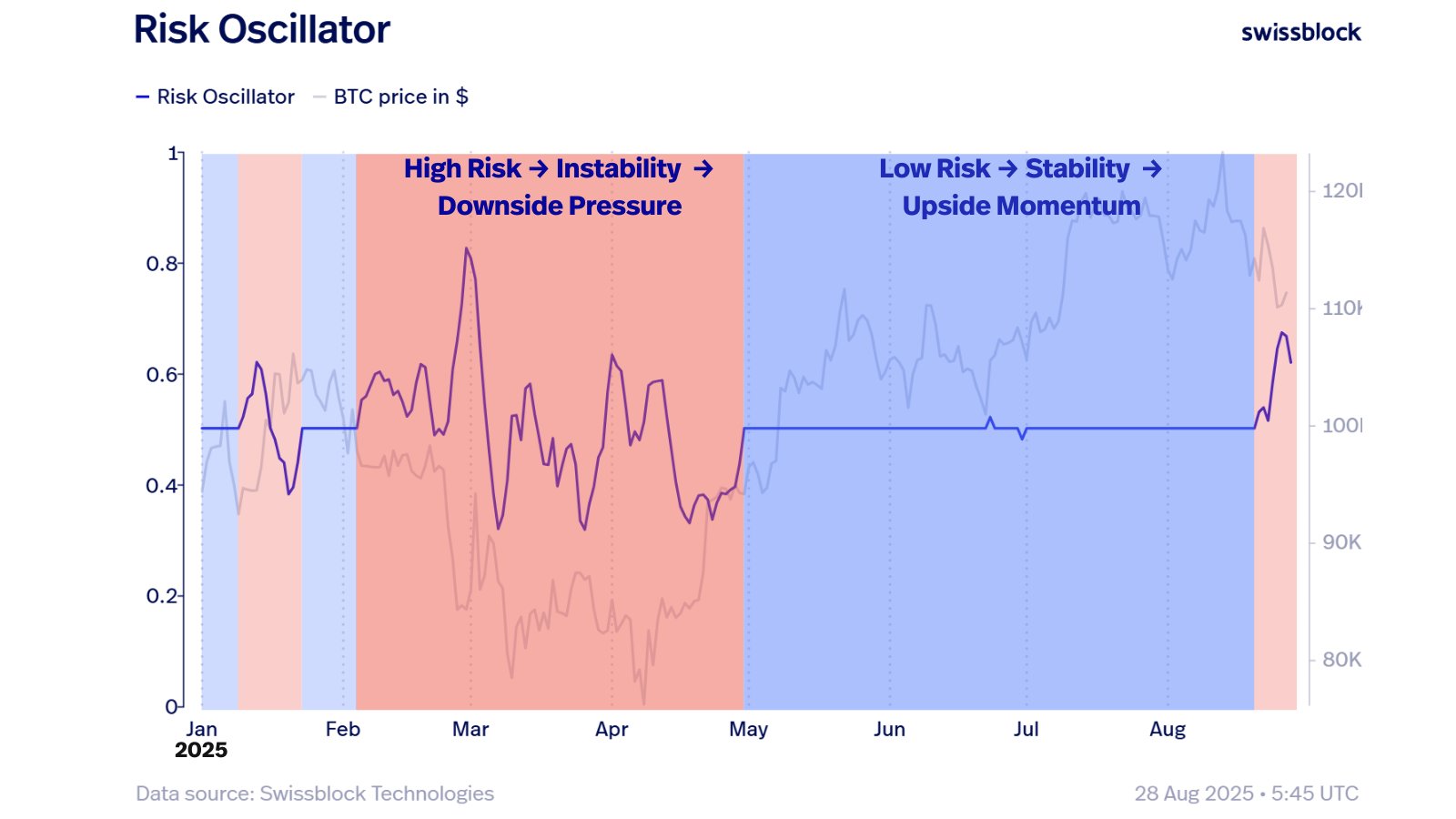

SwissBlock’s unique risk oscillator metrics that direct market sentiment using on-chain data, price behavior, and other criteria suggest that Bitcoin may already be at its cycle peak.

However, the analytics company says if Bitcoin can convincingly recapture the $113,500 level in support, the further downside risk will disappear.

“The risks show signs of toppings and prices are recovering, but we are not out of danger yet. The first step to alleviating pressure is for price action to confirm.

- Recovering $112,000 equals the initial relief signal.

- Breaking $113,500 in strength equals true mitigation of risk.

Without these confirmations, the system remains fragile. It’s upward upper limit, short-lived and downside volatility is still regenerated. If confirmed, this is the basis for a broader recovery momentum. ”

Source: SwissBlock/X

According to the chart, Swissblock risk oscillators suggest a higher risk market if prices could drop.

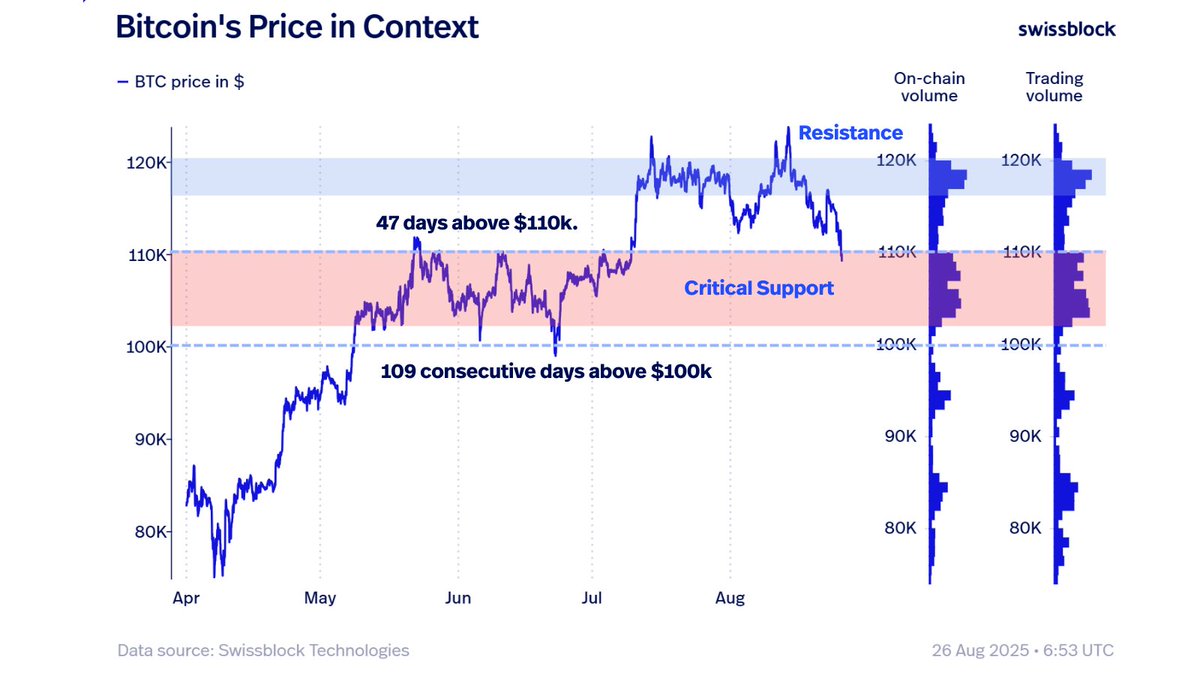

The analytics company also says it needs to hold $110,000 in support of Bitcoin to stay on the bullish trend.

“BTC is at the make-up or break level.

- $110,000 equals lifeline support.

- $121,000 is equal to the maximum breakdown limit.

In short, BTC has proven resilience above $100,000, but survival rates above $110,000 determine whether the trend is bullish or whether it will continue to give hints of structural debilitating. ”

Source: SwissBlock/X

Bitcoin was trading at $112,435 at the time of writing, and has risen slightly that day.

Generated Image: Dalle-3