Artificial intelligence (AI) tools suggest that despite Bitcoin (BTC)’s current bullish drive, it may be easier to think that assets could fall below $100,000 in the coming weeks.

According to Openai’s ChatGpt, Bitcoin, which currently costs around $117,000, is approaching critical support at $116,000. Breakdowns below this level could potentially be sent to $105,000 and $108,000 by August or early September 2025 if support fails.

The AI model highlighted the key risks that could accelerate the sale of Bitcoin, including a wide range of slowing spot ETF inflows and US market corrections.

In particular, the inflow of Bitcoin ETFs is a key factor in asset momentum, contributing to record highs above $123,000. At the close of trading on June 25th, Spot Bitcoin ETFs saw an influx of $130 million.

At the same time, as reported by Finbold, Citi analysts will predict a $135,000 base case for Bitcoin by the end of 2025 if the inflow continues. However, the bank also warned that assets could crash to $64,000.

ChatGpt also noted that both scenarios could put additional pressure on Bitcoin prices, particularly as Cryptocurrency’s correlation with the S&P 500 has increased in recent months.

Furthermore, the drawbacks can be attributed to unpredictable events such as exchange hacks that historically caused panic sales and sudden repression of regulations.

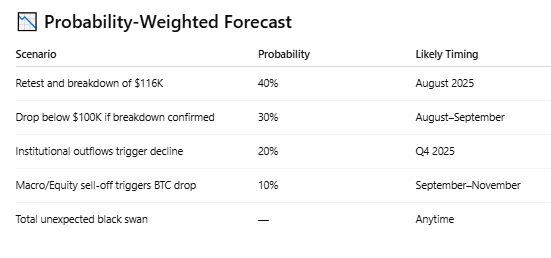

The AI model has emphasized that precise timing remains uncertain, but investors need to recognize the 30% to 40% chance that Bitcoin will fall below $100,000 by August to September 2025.

Important price levels to watch for Bitcoin

Meanwhile, cryptocurrency trading expert Michael Van de Poppe emphasized the importance of Bitcoin exceeding $116,000. In a July 26th X post, Poppe said the $116,800 level is an important battlefield for the Bulls.

His analysis shows that by maintaining support beyond this threshold, we can set a stage for next week’s push to a new all-time high.

In particular, there is strong liquidity below the $116,000 level that has been tested multiple times, suggesting that buyers are actively defending the zone. Therefore, if Bitcoin is able to establish a stable base of over $116,800, the market could target a resistance zone of $119,900.

However, if BTC drops, the $110,000 to $112,000 range is highlighted as the main accumulation zone, providing a potentially strong risk reward opportunity for long-term investors.

Bitcoin price analysis

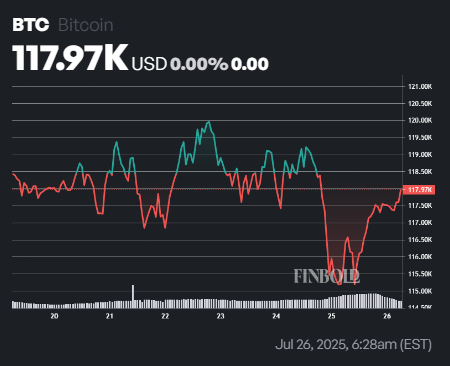

At the time of pressing, Bitcoin was trading at $117,970, earning around 1% in the last 24 hours. Over the past week, assets have fallen by 0.76%.

As things stand, it appears that Bitcoin is on track to regain its $120,000 mark after temporarily facing the threat of falling below $115,000 on July 25th.

Featured Images via ShutterStock