Important insights:

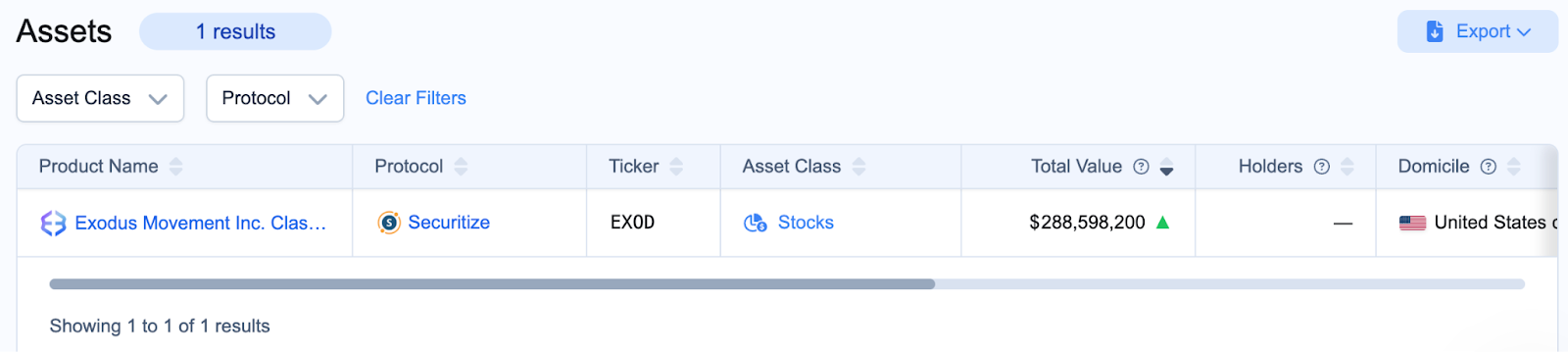

- Algorand manages more than 77% of the tokenized stock market thanks to one major asset. Exod.

- Ethereum, Base and Arbitrum are growing faster, with dozens of new assets being launched.

- If Algorand doesn’t diversify soon, it could fall behind in tokenized stock races.

Tokenized inventory is becoming one of the hottest newest trends in crypto. The chain is racing to bring traditional assets such as stocks and ETFs to the blockchain, ensuring faster trading and 24-hour access. And while Algorand was one of the first to win a lead, new data suggests that the lead may already be slipping.

Algorand’s big leads are built on a single asset

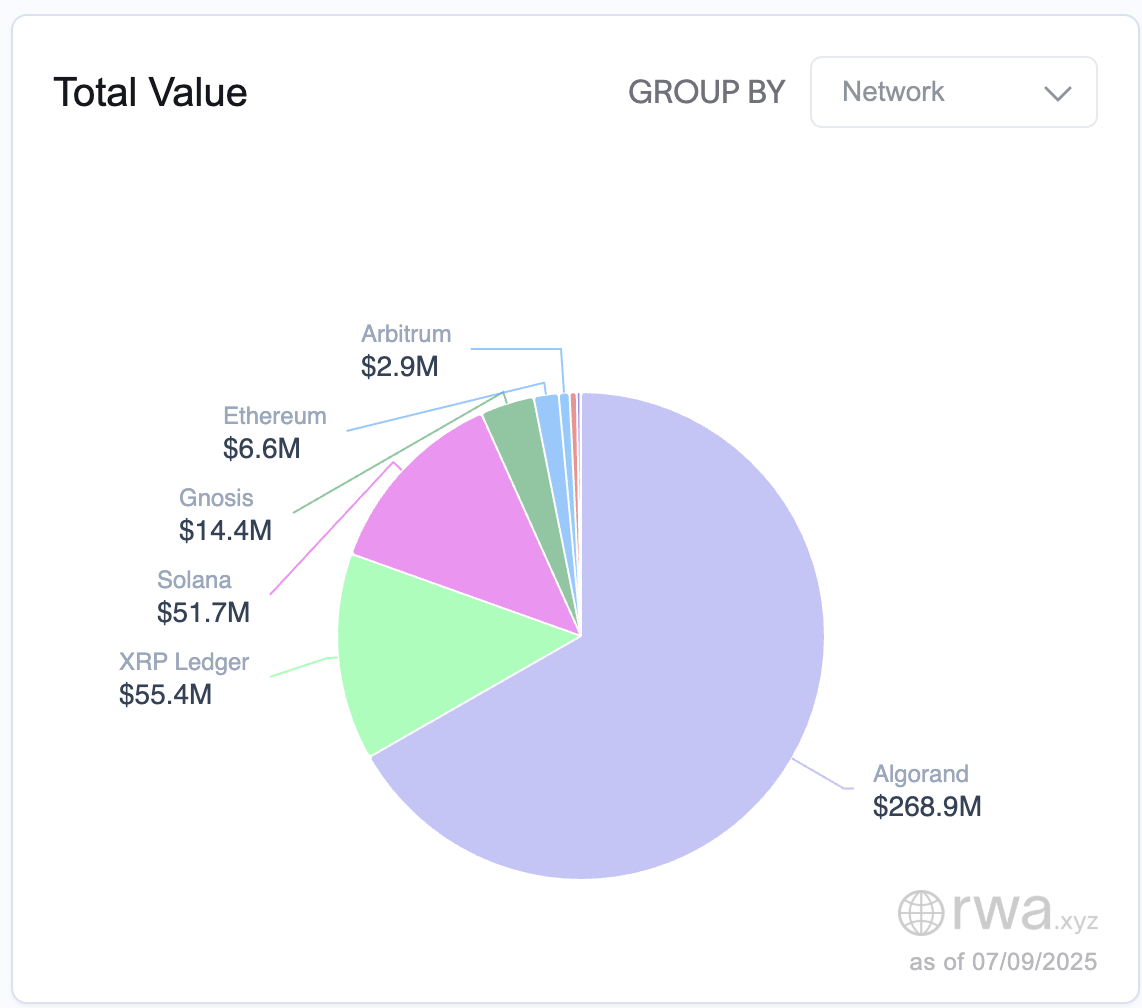

Algorand currently has the largest share of the tokenized stock market. Over 77% of the total value is hosted on the network, most of which are only one inventory. Exod is tokenized by Securitize from Exodus. This was one of the first major examples of tokenizing Tradfi into blockchain. This allowed Algorand to take the lead early in the Real World Asset (RWA) space.

Argondo of RWA Reed | Source: rw.xyz

But the problem is: Since its launch, no other tokenized stock has been added to the Algorand network.

For almost a year, it remained a one-tone chain. This makes the large market share look more like a pie snapshot than an actual lead.

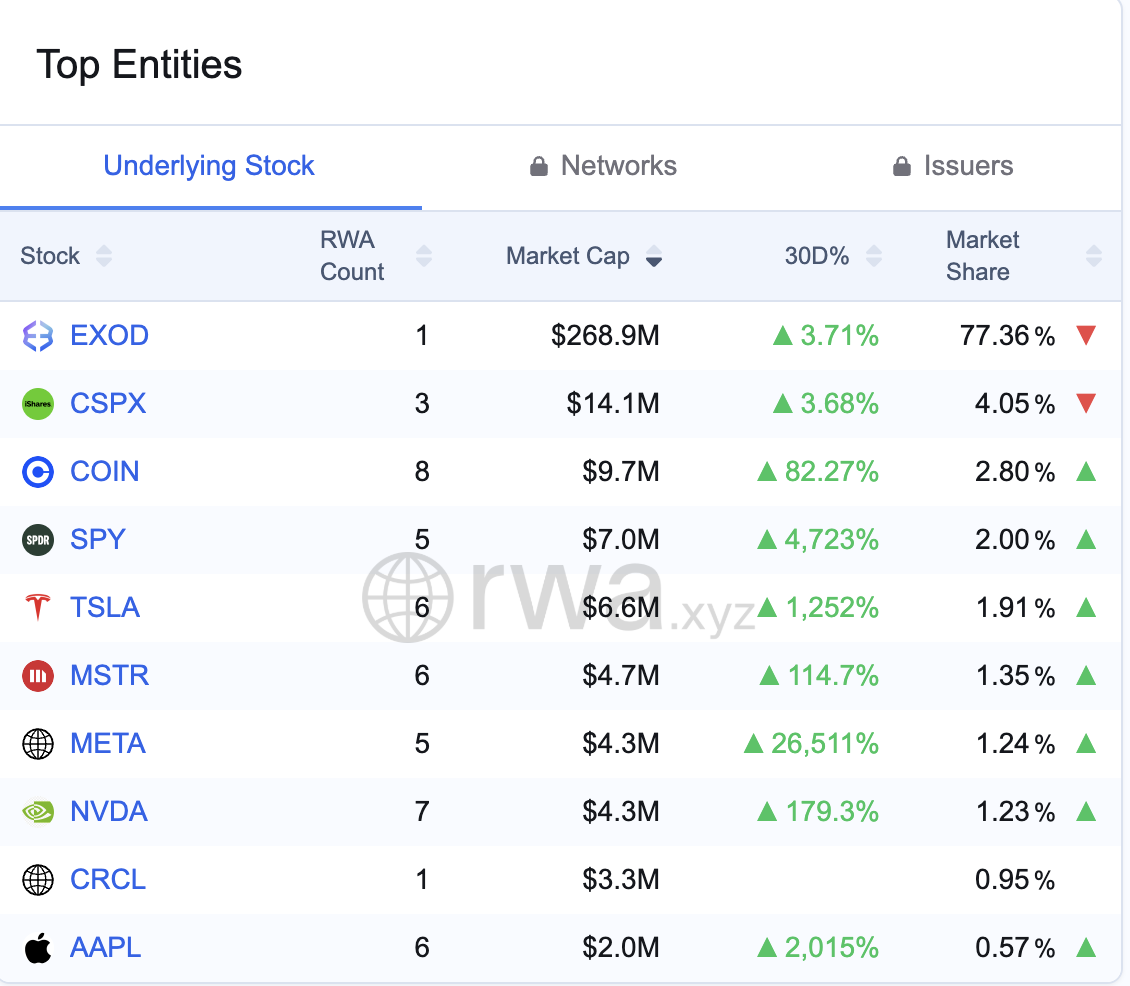

Only eliminate stock | Source: rwa.xyz

Tokenized inventory refers to a blockchain-based representation of traditional stocks such as Apple, Tesla or ETFs. They can be traded 24/7 and start global access to the stock market.

Ethereum and others are catching up quickly

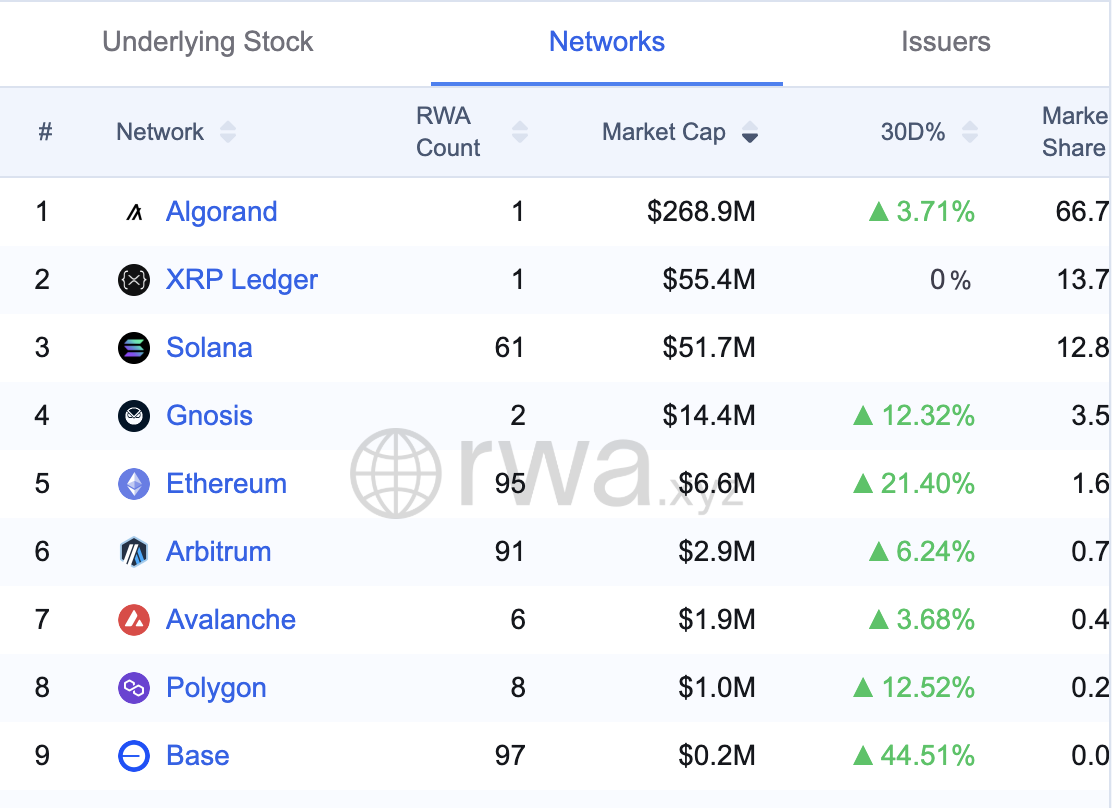

Algorand sits in one inventory, while the other networks are moving rapidly. Now, chains like Ethereum, Base, and arbitrum support dozens of tokenized assets. In some cases, it’s over 90.

Growth isn’t just about numbers. These networks onboard major players such as Robinhood, Coinbase and even Kraken.

Ethereum has over 90 assets | Source: rwa.xyz

For example, a new tokenized stock rollout in Robinhood uses Arbitrum as the payment layer. They listed over 200 stock tokens, including Apple, Nvidia and major ETFs. Meanwhile, Base and Ethereum have also become homes for these assets.

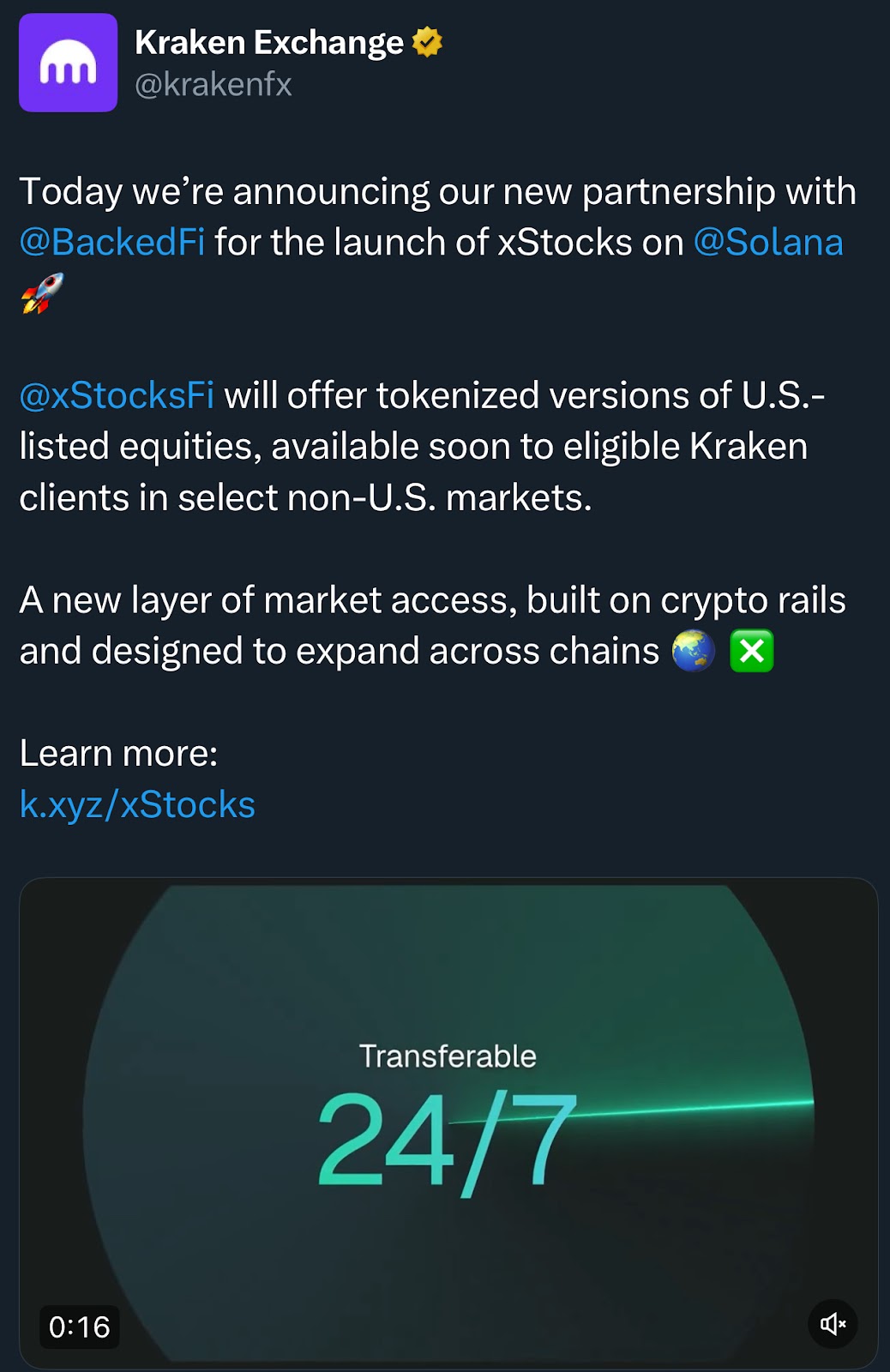

Kraken has launched its own tokenized product under the name Xstocks, hosted in Solana.

Provided by Kraken | Source: Kraken

The tokenized equity sector is expanding across multiple chains. And most of them add assets faster than Algorand, and have yet to add a second inventory.

Is the edge of Algorand sliding?

Despite the leading total value, data warns that Algorand is losing ground. That early advantage came from the beginning, but being the first is not the same as staying ahead.

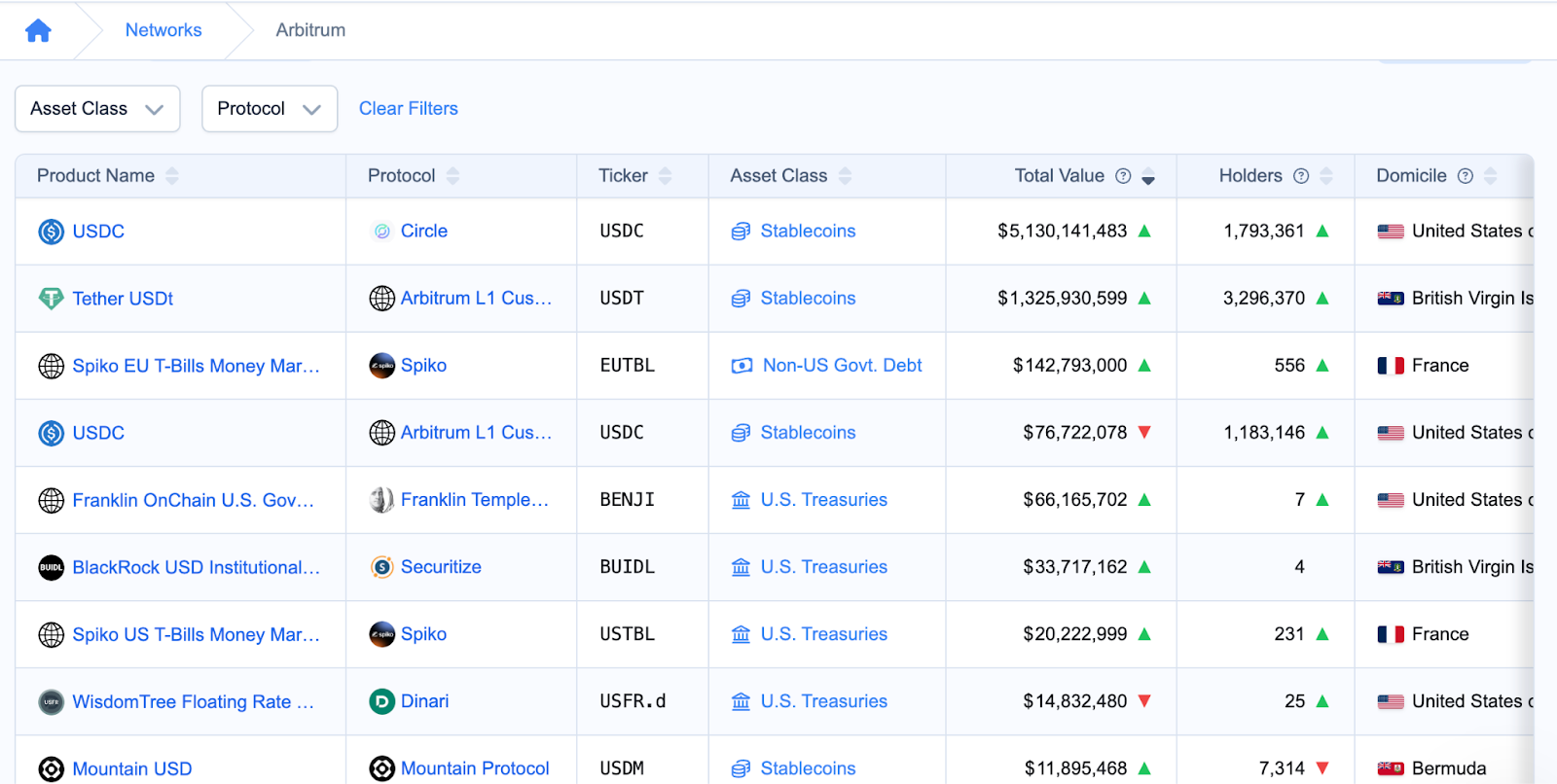

Arbiturum has RWA diversity | Source: of. xyz

Most institutions require multiple stocks. They want a wider platform, more diversity of assets, and proven liquidity. Currently, Ethereum and Arbitrum are checking these boxes.

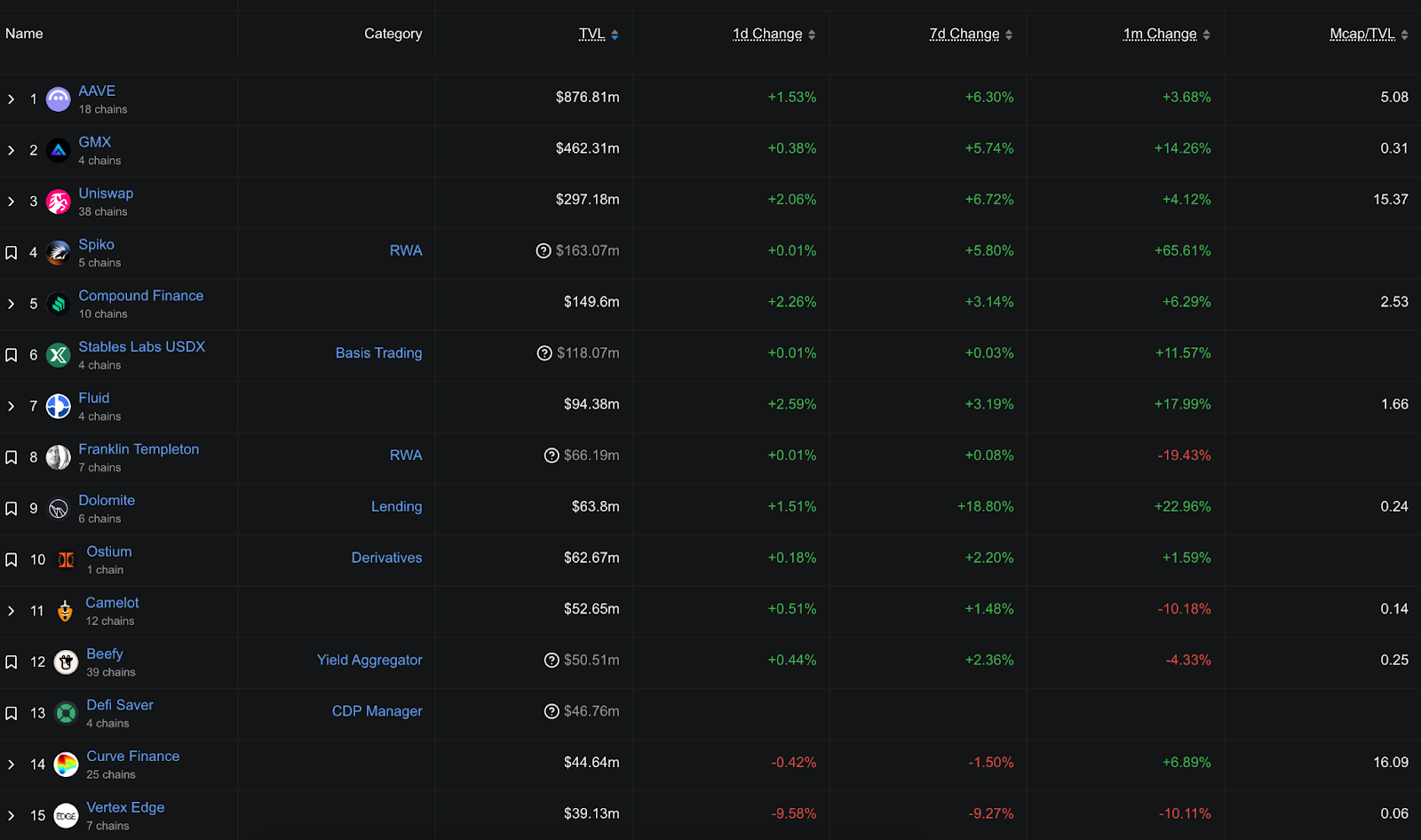

Arbitrum’s RWA TVL has skyrocketed | Source: Defillam

Arbitrum’s Real World Asset TVL spiked 32% last month thanks to tokenized inventory activity. By comparison, Algorand sees little traction beyond the Exod.

Algorand’s RWA stacks do not have variety | Source: of. xyz

The benefits of a first-mover are important. However, without follow-up development and asset expansion, it would turn into missed opportunities.

Can Algorand bounce back?

Algorand still has a strong foundation. It is known for being faster, low cost and more regulatory friendly than many other chains. These characteristics are suitable for institutional use cases such as tokenization of stocks. But now it needs to be taken action.

Important Algolan Characteristics | Source: NextGencrypto

To maintain the lead, Algorand must expand beyond a single inventory. Adding more tokenized stocks, as well as ETFs and bonds, will help you recover that edge. Otherwise, market share begins to shrink by 77% as other chains continue to launch new assets each month.

Tokenized stock lace is rapidly getting hot. The future may still be chained, but Algorand needs to prove that it is more than just an exodus.