The Solana Treasury season continues. Because another large Sol has passed through Falconx. DAT companies are considered relatively dangerous, but Sol offers additional passive income opportunities.

Sol’s unknown large buyers may be building a Ministry of Finance. Based on the Falconx transfer, the whale obtained 412,075 SOL, worth $98.4 million. The amount is close to the size of the purchase used by the finance company.

SOL was acquired at market rates as Falconx moved tokens from major exchanges, OKX, Coinbase and Bybit. Sol still went back to $233.86, allowing whales to buy the dip. Recent accumulation has increased the impact of Solana Data Company, which already owns. 2% As reported previously by Cryptopolitan, of SOL supply.

Sol purchases continued even after the forward industry completed a massive purchase Ministry of Finance. At the same time, some whales are using hype to leave the market. whale Send SOL worth $23 million to OKX.

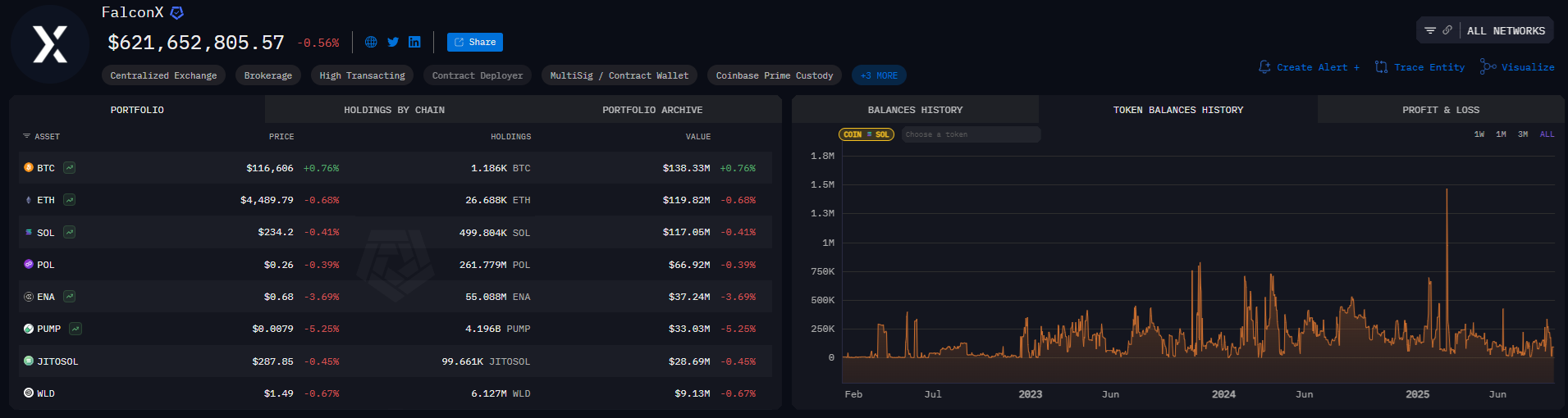

Falconx reflects the growing demand for SOL and is actively trading through public wallets. |Source: Arkham Intelligence.

Falconx still has around 449k of Sol and is worth over $117 million. At the current stage, a large Treasury locked in a 2m Sol holds less than 500k tokens.

Finance companies offset sales and unlocking and put pressure on SOL prices. Solana Treasuries still lag behind the accumulated reserves of BTC and ETH, but show strong growth and significant daily purchasing pressures.

Sol Treasuries show that most are above 1 MNAV ratio, indicating that inventory remains attractive. In the case of Mow, the forward industry is most aggressively trading, with Ford prices approaching a six-month peak $37.35.

Sol Treasuries boosts staking

Sol Treasuries are not passively held and send a substantial amount of tokens for staking and liquid staking. As of September 17th, Solana Treasuries holds an estimated 17.112 SOL, spreading across 17 entities of various sizes.

The total SOL of 7.4m is staked at an annual rate of 7.96. This means that the Treasury could receive an additional 589K sol as a reward for liquid staking. Despite price risk, the Treasury shows great demand for this type of profit. Sol Rewards is an automated expansion of the Treasury, further exacerbating the holdings of the largest entities.

Finance companies may also use value via liquid staking tokens rather than selling SOL. As a result, the locked Sol Ecosystem Value is close to a peak level near 12.35bb. Entities such as Jito, Jupiter, Binance Staked Sol, and even Bonk are competing to access the Ministry of Finance. In the past month alone, Binance Staked Sol has expanded its holdings to the new records listed above $2.88 billion.

Is Altcoin season the Solana season?

Sol Markes Capitalization has control at 3.2%, the highest in six months. The Solana Ecosystem contributes to the overall Altcoin season, adding a combination of new and old memes. However, Meme Coins is lagging behind with a market capitalization of just $12 billion and three assets above $1 billion.

The Solana Ecosystem has yet to recover from token-based hype since January. Currently, the network is switching to Defi, which includes lending and liquid staking. Solana also generates the most revenue from the app compared to all other chains and provides passive income to Sol Holders.

Sign up for Buybit now and get $50 free to trade crypto